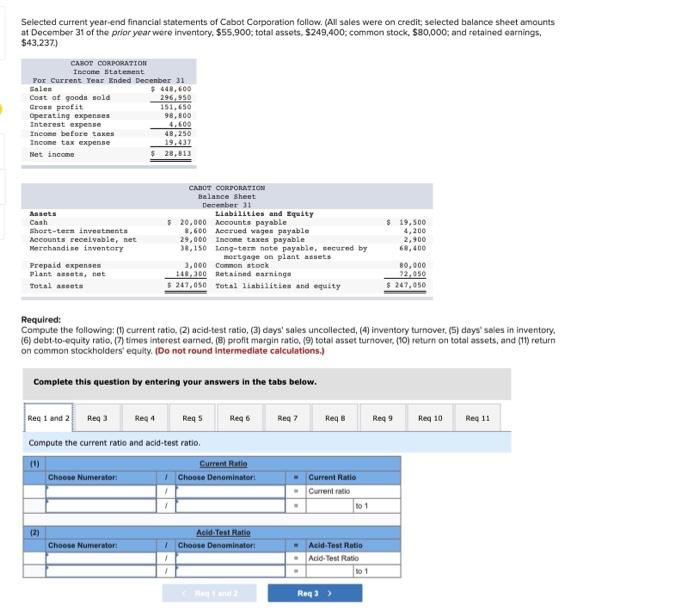

Question: Need help! please help asap. its the same question with multiple parts Selected current year-end financial statements of Cabot Corporation follow. (All sales were on

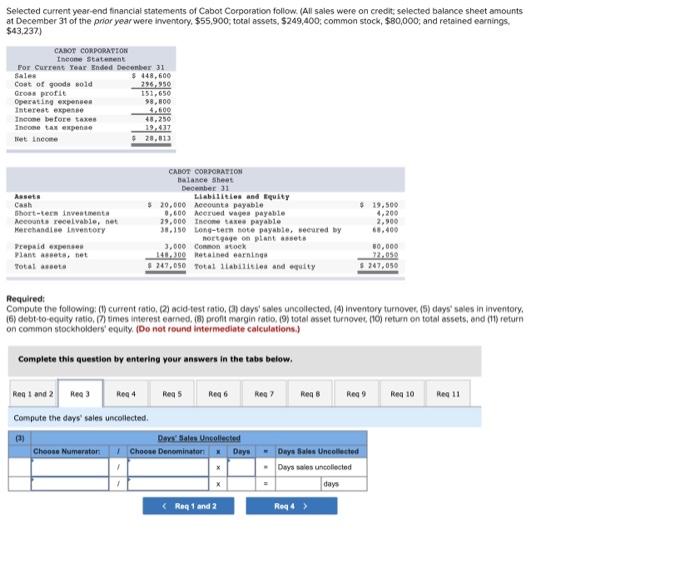

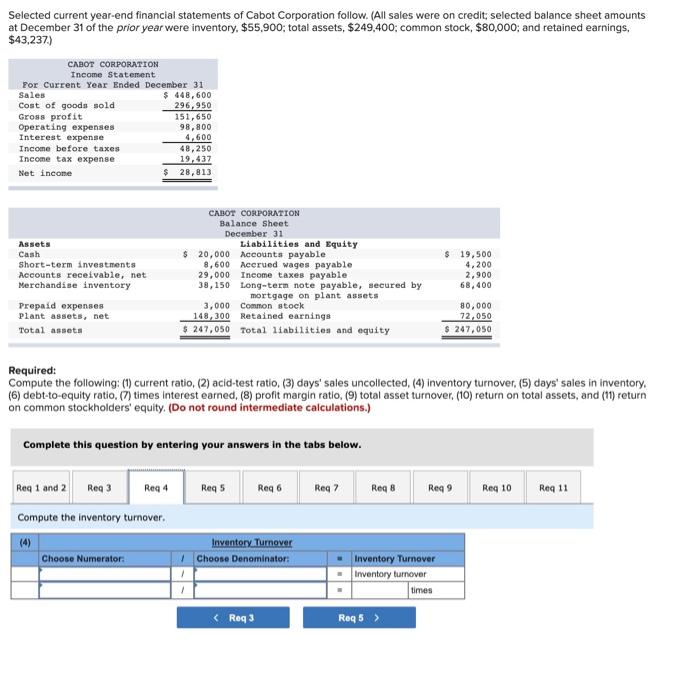

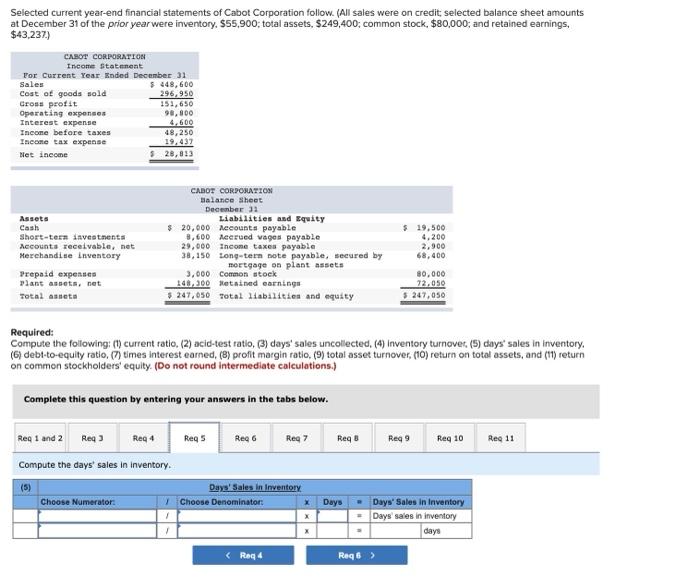

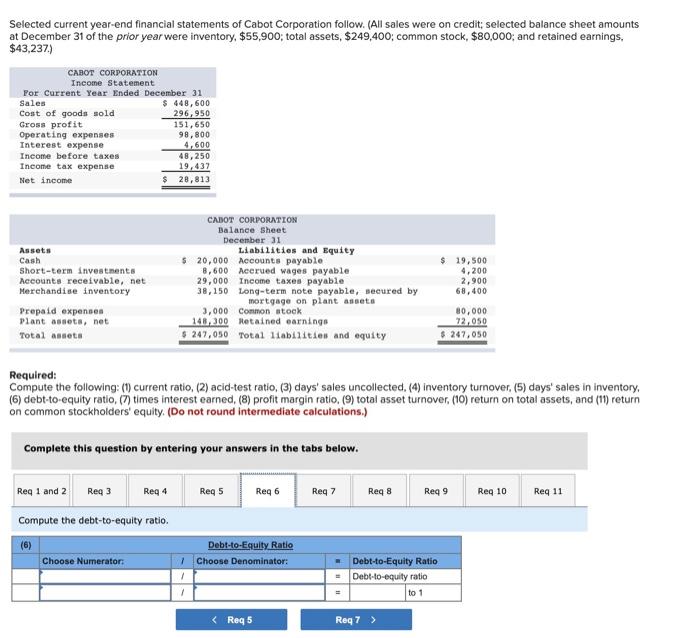

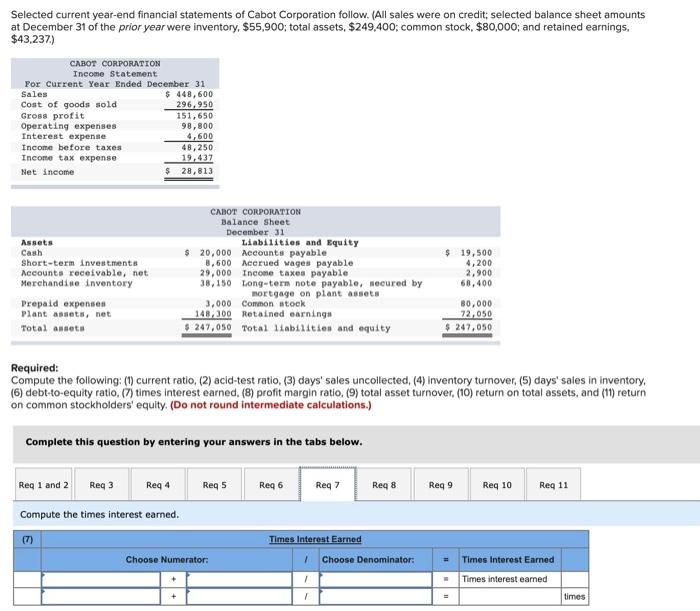

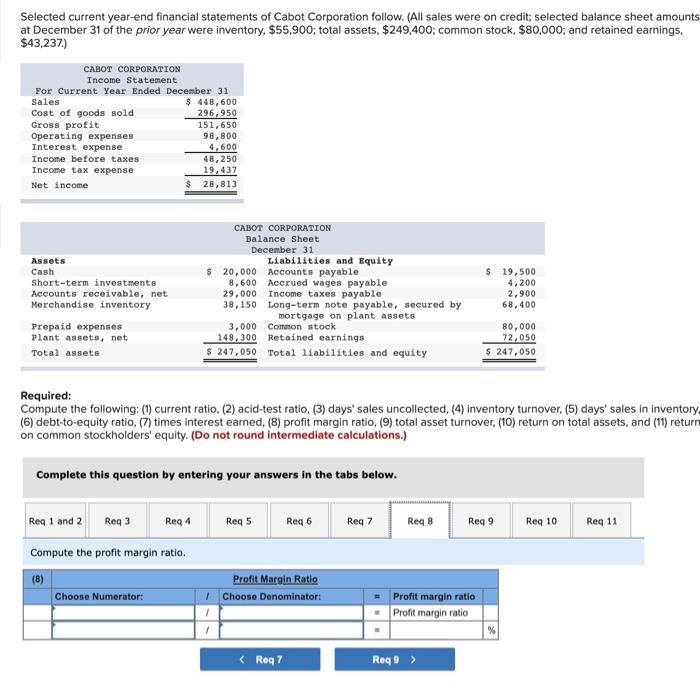

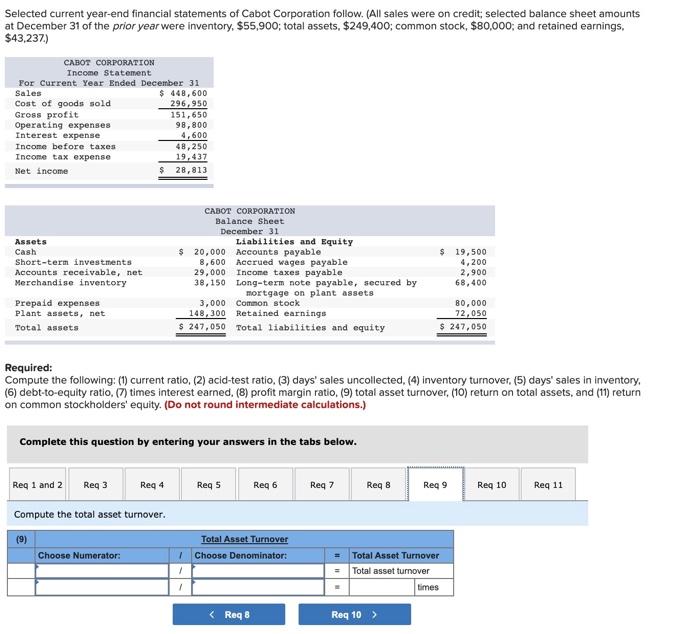

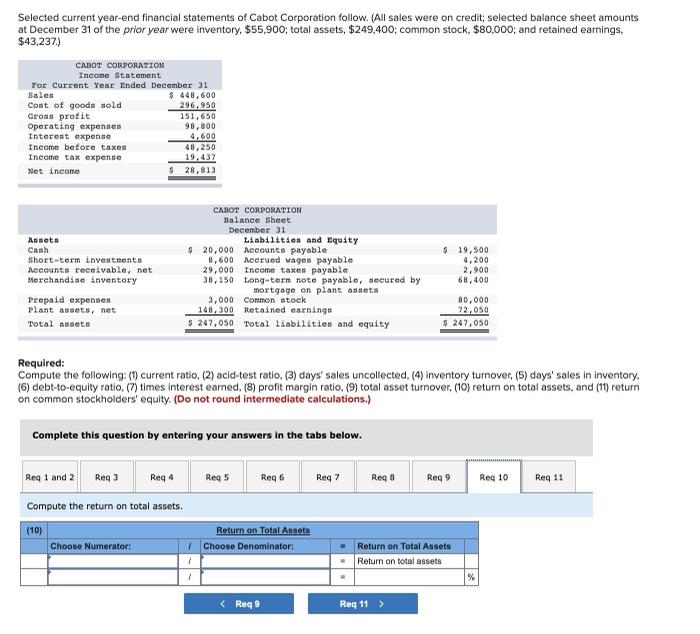

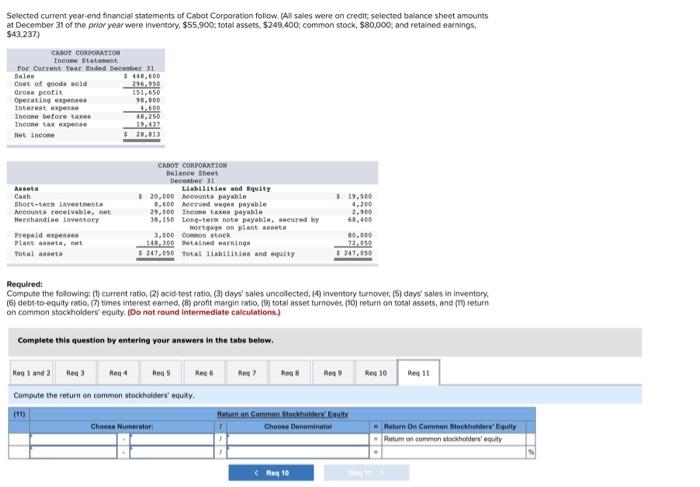

Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory. $55.900: total assets. $249.400.common stock, $80,000; and retained earnings, $43.237.) CABOT CORPORATION Tescorte Statement For Current Year Ended December 31 Sales $448.000 Cost of goods sold 296,950 Gross profit 151.650 Operating expenses 98.800 Interest expense 4.600 Income before taxes 48,250 Income tax expense Net income $ 28,813 Assets Cash Short te investments Mccounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total aceste CANOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Acerved wages pay 29,000 Incone taxes payable 38,150 Long-term nate payable, secured by mortgage on plant assets 3,000 Common stock 340,100 Retained earning $ 249,050 Total limbilities and equity $ 19,500 4,200 2,900 68,400 80,000 72,050 $247,050 Required: Compute the following: (1) current ratio (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio. (7) times interest earned. (8) profit margin ratio. (9) total asset turnover. (10) return on total assets, and (11) return on common stockholders equity. (Do not round Intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reqs Req4 Reqs Req Req? Req Req9 Reg 10 Reg 11 Compute the current ratio and acid-test ratio. 10) Current Ratio 1 Choose Denominatori Choose Numerator: Current Ratio Current ratio 101 1 - (2) Acid Test Ratio Choose Denominator: Choose Numerator 1 1 1 - Acid-Test Ratio Add-Test Ratio - 101 Reg 3 > Selected current year-end financial statements of Cabot Corporation follow. (All sales were on Credit: selected balance sheet amounts at December 31 of the prior year were inventory. $55.900; total assets. $249,400, common stock, $80,000, and retained earnings. $43.237) CABO CORPORATION Incone Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expened 98,800 Interest expense 4.600 Income before taxes 48,250 Income tax expen 19,417 Net Income 28.013 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total asset CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity 20,000 Accounts payable 0,600 Acerved vages payable 29.000 Income tax payable 38.150 Long-term note payable, secured by nortgage on plant assets 3,000 Common tok 140.300 Retained earning 247,050 Total abilities and equity $19.500 4,200 2,900 68.400 10,000 72.959 $ 247,050 Required: Compute the following: (t) current ratio, (2) acid-test ratio, (l) days Sales uncollected (4) Inventory turnover. (5) days' sales in inventory. 16) debt-to-equity ratio, 7) times interest earned, (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req? Rea B Red Reg 10 Reg 11 Red 1 and 2 Red Roe 4 Reqs Red Compute the days' sales uncollected. (3) Days Sales Uncollected Choose Numerator 1 Choose Denominatori Days Days Sales Uncollected Days was uncollected 1 days Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $249,400; common stock, $80,000; and retained earnings, $43,237.) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expenses 98,800 Interest expense 4,600 Income before taxes 48,250 Income tax expense 19.437 Net income $ 28,813 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Accrued wages payable 29,000 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 148,300 Retained earnings $ 247,050 Total liabilities and equity $ 19,500 4,200 2,900 68,400 Prepaid expenses Plant assets, net Total assets 80,000 72,050 $ 247,050 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Reqs Reg 6 Req? Reg 8 Req9 Reg 10 Req11 Compute the inventory turnover. (4) Choose Numerator Inventory Turnover Choose Denominator: - Inventory Turnover Inventory turnover times Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit selected balance sheet amounts at December 31 of the prior year were inventory, 555,900; total assets, 5249,400, common stock, $80,000; and retained earnings, $43,237) CABOT CORPORATION Income Statement For Current Year Inded December 31 Sales $ 448,600 Cost of goods sold 296,950 Cross profit 151,650 Operating expenses 98,800 Interest expense 4.600 Income before taxes 48,250 Income tax expense 19,437 Net income 28,833 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total asset CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Mecounts payable 3,600 Accrued vages payable 29,000 Incone taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 143,200 Netained earning $ 249,050 Total abilities and equity $ 19,500 4,200 2,900 68,400 80,000 22.050 247,050 Required: Compute the following: (1) current ratio. (2) acid-test ratio, (3) days' sales uncollected (4) Inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio. (7) times interest earned. (8) profit margin ratio, (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Regs Reg 6 Reg 7 Req Reg 9 Reg 10 Reg 11 Reg 1 and 2 Req Reg 4 Compute the days' sales in Inventory (5) Choose Numerator: Days' Sales In Inventory 1 Choose Denominator x Days Days' Sales In Inventory + Days sales in inventory 1 x days Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $249,400; common stock, $80,000; and retained earnings, $43,237) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expenses 98,800 Interest expense 4,600 Income before taxes 48,250 Income tax expense 19,437 Net income $ 28,813 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Acerved wages payable 29,000 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 143,200 Retained earnings 247,050 Total liabilities and equity $ 19,500 4,200 2,900 68,400 Prepaid expenses Plant assets, net Total assets 80,000 72,050 $ 247,050 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover (5) days' sales in inventory (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 5 Reg 6 Req7 Req8 Req9 Req 10 Req 11 Req 1 and 2 Req3 Reg 4 Compute the debt-to-equity ratio. (6) Choose Numerator. Debt-to-Equity Ratio 1 Choose Denominator: 1 Debt-to-Equity Ratio = Debt-to-equity ratio = to 1 1 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit: selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $249.400; common stock, $80,000; and retained earnings. $43,237) CABOT CORPORATION Income Statement Por Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expenses 98,800 Interest expense 4,600 Income before taxes 48,250 Income tax expense 19,437 Net income $ 28,813 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total aseta CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Neerued wages payable 29,000 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 148,300 Retained earningu 5 247,050 Total liabilities and equity $19,500 4,200 2.900 68,400 80,000 72,050 $ 247,050 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected (4) Inventory turnover. (5) days' sales in inventory, (6) debt-to-equity ratio (7) times interest earned, (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Reg 4 Reg 5 Reg 6 Req7 Req8 Reg 9 Req 10 Reg 11 Compute the times interest eamed. (7) Times Interest Earned Choose Numerator: Choose Denominator: 11 Times Interest Earned Times interest eamed times Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $249,400; common stock, $80,000; and retained earnings, $43,237) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expenses 98,800 Interest expense 4,600 Income before taxes 48,250 Income tax expense 19,437 Net income $ 28,813 Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Accrued wages payable 29,000 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 148,300 Retained earnings $ 247,050 Total liabilities and equity $ 19,500 4,200 2,900 68,400 80,000 72,050 $ 247,050 Required: Compute the following: (1) current ratio. (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover (5) days' sales in inventory (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio, (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Req 3 Reg 4 Reg 5 Reg 6 Reg 7 Reg 8 Reg 9 Req 10 Reg 11 Compute the profit margin ratio. (8) Choose Numerator: Profit Margin Ratio Choose Denominator: Profit margin ratio Profit margin ratio % Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory, $55,900; total assets, $249,400; common stock, $80,000, and retained earnings, $43,237) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 Cost of goods sold 296,950 Gross profit 151,650 Operating expenses 98,800 Interest expense 4,600 Income before taxes 48,250 Income tax expense 19,437 Net income $ 28,813 $ Assets Cash Short-term investments Accounts receivable, net Merchandise inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 20,000 Accounts payable 8,600 Acerued wages payable 29,000 Income taxes payable 38,150 Long-term note payable, secured by mortgage on plant assets 3,000 Common stock 148,300 Retained earnings S 247,050 Total liabilities and equity 19,500 4,200 2,900 68.400 Prepaid expenses Plant assets, net Total assets 80,000 72,050 $ 247,050 Required: Compute the following: (1) current ratio, (2) acid-test ratio. (3) days' sales uncollected. (4) inventory turnover, (5) days' sales in inventory (6) debt-to-equity ratio, (7) times interest earned. (8) profit margin ratio. (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Reg 5 Reg 6 Req7 Req8 Reg 9 Req 10 Reg 11 Compute the total asset turnover. (9) Choose Numerator Total Asset Turnover 1 Choose Denominator: / 1 = Total Asset Turnover Total asset turnover times Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory $55,900 total assets, $249,400, common stock, $80,000 and retained earnings. $43.237) CAROT CORPORATION Income Statement Tor Current Year Ended December 31 Sales $ 448.600 cost of goods sold 296.950 Grose proti 151,650 Operating expenses 33.800 Interest expense 4.600 Incone before taxe 18,256 Income tax exe 12.491 Net Income $ 20.01) Neos CADOT CORPORATION Balance Sheet December Liabilities and Equity $ 20,000 payable 3.600 Acerond wage payable 29,000 Income taxes payable 38,150 Long-ter note payable, wered by more on piantas 3,000 con stock 148.300 et earning 247,050 Total Habilities and pity Assets Cash short-term investments Accounts receivable.net Merchandise inventory Prepaid expenses Plant assets.net Total anset 19,500 4,200 2,700 80,000 22/09 1 247.030 Required: Compute the following: (1) current ratio. (2) acid test ratio, (3) days sales uncollected, (4) inventory turnover (5) days' sales in Inventory (6) debt-to-equity ratio (7) times interest earned, (B) profit margin ratio (9) total asset turnover (10) return on total assets, and (1) return on common stockholders' equity (Do not round Intermediate calculations.) Complete this question by entering your answers in the tabs below. Ite 1 and 2 Reg Reqs Heg 6 Ree Rego Reg Reg 10 Res 11 Compute the return on common stockholders' equity. (11) Choone Numerator Reumer Commen Stachelde out Choose Denominator - Return On Common Stockholders' Equity Retuin en common stockholders' equity Reg 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts