Question: Need help please! Initial Oa my honor, I have completed this gart of the exam indepeodently (i.e., by myself). By providing initials you acknowledge compliance

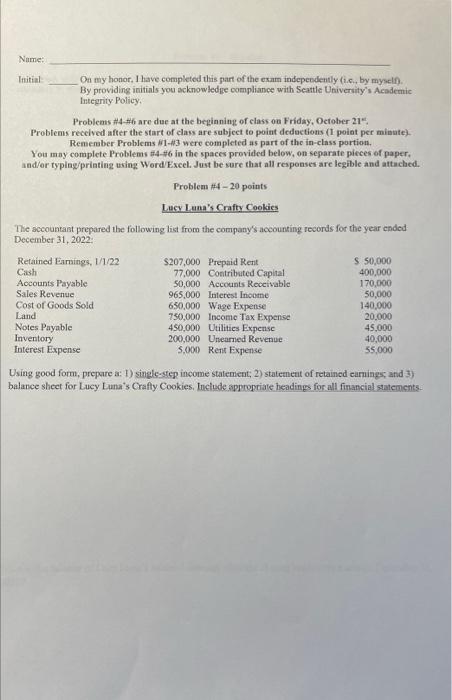

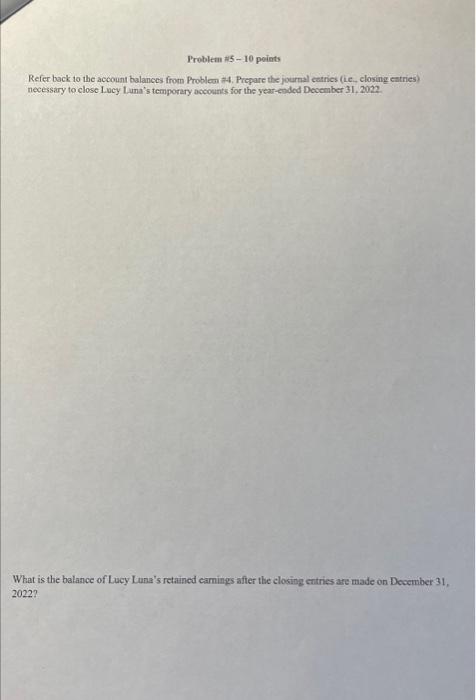

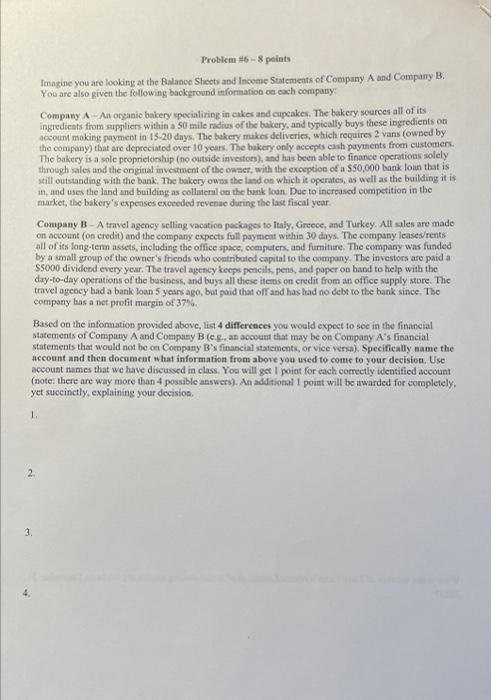

Initial Oa my honor, I have completed this gart of the exam indepeodently (i.e., by myself). By providing initials you acknowledge compliance with Seattle Univernity's Academic Integrity Policy. Probleas #446 are due at the beginning of class on Friday, Oetoher 21% Problems recelved after the start of class are subject to point dedections (1 poiat per minute). Remember Problems 1#3 were completed as part of the in-class portion. You may complete Problems #446 in the spaces provided below, on separate pieces of paper, and/er typingjprinting using Word Excel. Just be sure that all responses are legible and attached. Problem #4-20 points Lucy I una's Crafty Cookies The sccountant prepared the following list from the company's accounting records for the year ended December 31, 2022. Using good form, prepare a: 1) singlessfep income statement; 2) statennetit of retained earnings; and 3) balance sheet for Lucy Luma's Crafty Cookies. Inclode speropriate headings for all financial statements- Refer back to the account balances from Probleon #4. Prepare the journal eatries (Le., closinge eatries) necessary to close Lucy Luma's temporary accounts for the year-ended Decomber 31, 2022 What is the balance of Lucy Luna's retained camings after the closing entries are made on December 31, 20227 ProBem =68 points Imagine you are looking at the Balance Shect asd Incene Statemets of Company A and Company B. You are also given the following background information ce each company: Company AAn organic bakery specialiring in cakes and cupeakes. The bakery sourees all of its ingredicats from supplien within a 50 mile radius of the bakery, and typically bays these ingredients on account making payment in 15-20 days. The bukery makes deliveries, which requires 2 vans (owned by the company) that are depreciated over 10 years. The bakery only aceepts cash payments from customers. The bakery is a sole propnieloship (ne outside invettoen), and has been able to finance operations solely throegh sales and the onginal investment of the owser, with the exeeption of a 550.000 bank loan that is still outstanding with the bank. The bakery owzs the lasd on which it operates, as well as the building it is in, and wes the land and building as collaseral on the bunk loan. Due to increased competition in the market, the bakery' s expenses exceeded revenae daring the lact fiscal year. Company BA travel agency selling vacation pasiages to fealy, Girece, and Turkey. All ales are made on account (on credit) and the company expects full paymeat within 30 days. The company leasev/rents all of its long-term assets, inclading the office space, computers, and fumitire. The company was funded by a imall group of the owner's friends who contributed capital to the company. The investors are paid a $5000 dividend every year. The travel agency keeps pencily, pens, and paper on hand to help with the day-to-day operations of the basiness, and buys all these iterns on credit from an office supply store. The travel agency bad a bank loan 5 years ago, but poid that off and has had no debt to the bank since. The company bas a net protit margin of 37%. Based on the information provided above, list 4 differcaces you would expect to see in the financial statements of Consuaty A and Compasy B (e.g., an acoount that may be on Company A's financial statements that would not be on Coenpany B's financial statements, or vice versa). Specifically name the uccount and then document what information from above you used to come to your decision. Use account names that we have discussed in class. Yos will get 1 point for each correctly identified account (note: there are way more than 4 possible answers). An addational 1 poiat will be awarded for completely. yet succinctly, explaining your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts