Question: Need help please On May 1, 2016, Meta Computer, Inc., enters into a contract to sell 5,500 units of Comfort Office Keyboard to one of

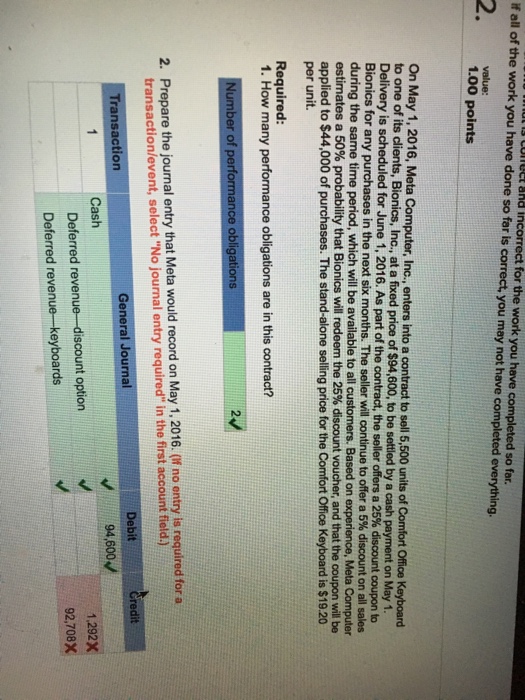

On May 1, 2016, Meta Computer, Inc., enters into a contract to sell 5,500 units of Comfort Office Keyboard to one of its clients, Bionics, Inc., at a fixed price of $94,600, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 2016. As part of the contract, the seller offers a 25% discount coupon to Bionics for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Meta Computer estimates a 50% probability that Bionics will redeem the 25% discount voucher, and that the coupon will be applied to $44,000 of purchase. The stand-alone selling price for the Comfort Office Keyboard is $19.20 per unit. How many performance obligations are in this correct? Prepare the journal entry that Meta would record on May 1, 2016. (If no entry is required for transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts