Question: need help please.. QUESTION 3 1. My crystal ball predicts the one year rates will be: 6.930% today 5.180% in one year 8.020% in two

need help please..

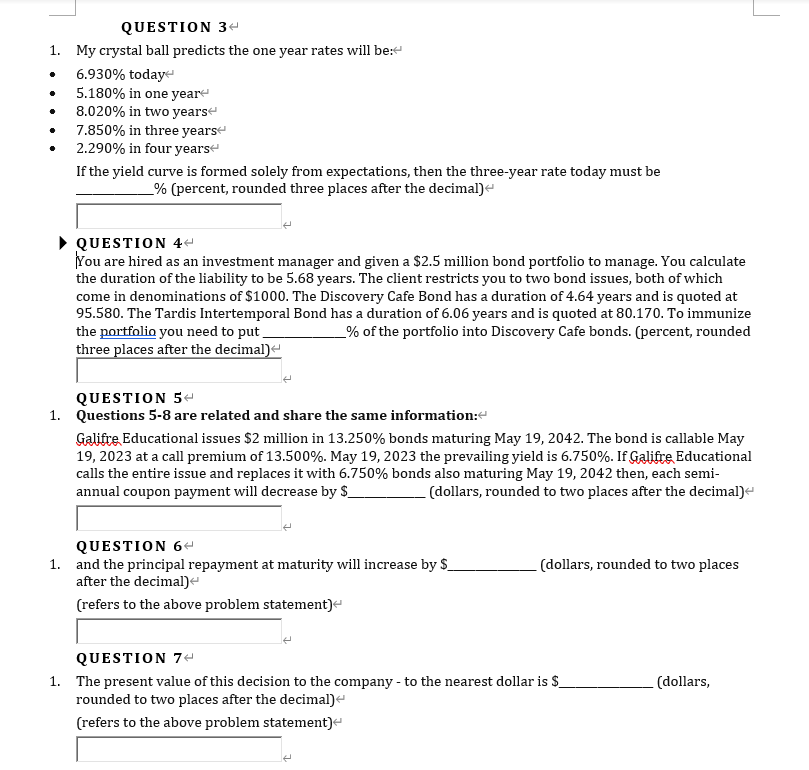

QUESTION 3 1. My crystal ball predicts the one year rates will be: 6.930% today 5.180% in one year 8.020% in two years 7.850% in three years 2.290% in four years If the yield curve is formed solely from expectations, then the three-year rate today must be % (percent, rounded three places after the decimal) QUESTION 4+ You are hired as an investment manager and given a $2.5 million bond portfolio to manage. You calculate the duration of the liability to be 5.68 years. The client restricts you to two bond issues, both of which come in denominations of $1000. The Discovery Cafe Bond has a duration of 4.64 years and is quoted at 95.580. The Tardis Intertemporal Bond has a duration of 6.06 years and is quoted at 80.170. To immunize the portfolio you need to put _% of the portfolio into Discovery Cafe bonds. (percent, rounded three places after the decimal) QUESTION 54 1. Questions 5-8 are related and share the same information: Galifre Educational issues $2 million in 13.250% bonds maturing May 19, 2042. The bond is callable May 19, 2023 at a call premium of 13.500%. May 19, 2023 the prevailing yield is 6.750%. If Galifre Educational calls the entire issue and replaces it with 6.750% bonds also maturing May 19, 2042 then, each semi- annual coupon payment will decrease by $_ (dollars, rounded to two places after the decimal) (dollars, rounded to two places QUESTION 6 1. and the principal repayment at maturity will increase by $ after the decimal) (refers to the above problem statement) QUESTION 7 1. The present value of this decision to the company - to the nearest dollar is $ rounded to two places after the decimal) (refers to the above problem statement) (dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts