Question: need help please. Rolfe Compainy (a US. based comparmy has a subsidiary in Nogeris where the local currency unit is the 2019, the subsidiary had

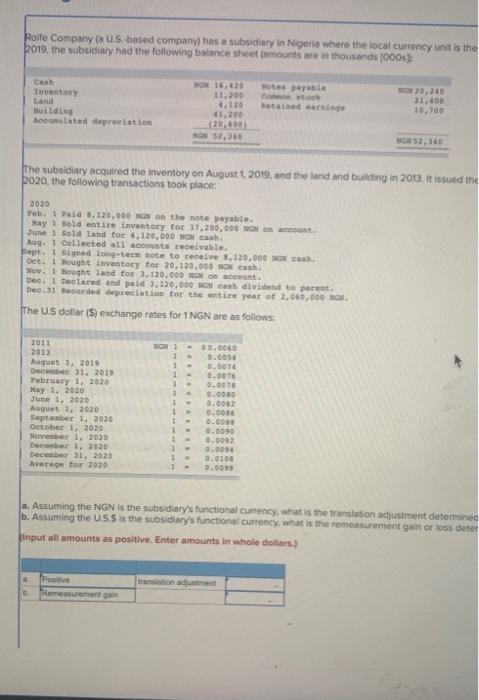

Rolfe Compainy (a US. based comparmy has a subsidiary in Nogeris where the local currency unit is the 2019, the subsidiary had the following batance sheet (emounts are in thousands (000s): The subsidiary acquired the irventory on August 1, 2019, and the land and bullding in 2013. It issued the 2020 , the following transactions took place: 2020 Feb. I Fald 1,120,000 noti on the note peyable. Nay 1 sold entire inventory tor 17,250,000 - Mok an aceoest. tune 1 sold land for 6,120,000 with canh. Aag, 1 collected all acoounts recelvable. hept. 1 Aignnd long-tern note to receive 8,120,000 man cash. oot. I hought inventory for 20,120 , jot mcar casb. Hov, 1 Bought land for 3,120,060 Nck on acevunt. Doc. I Deelared and paid 3,120,000 not each dividend to parent. Dee.31 mecorded depreelation tor the entire year of 2, 260, 000 smu. The U.S doliar (\$) exchange rates for 1 NGN are as follows: a. Assuming the NGN is the subsidiary's functionat currency, what is the translation adjustment determined b. Assuming the USS is the subsidiary/s functional currency, what is the remeasurement gain or loss deter (Input afl amounts as positive: Enter amounts in whole dollars.) Rolfe Compainy (a US. based comparmy has a subsidiary in Nogeris where the local currency unit is the 2019, the subsidiary had the following batance sheet (emounts are in thousands (000s): The subsidiary acquired the irventory on August 1, 2019, and the land and bullding in 2013. It issued the 2020 , the following transactions took place: 2020 Feb. I Fald 1,120,000 noti on the note peyable. Nay 1 sold entire inventory tor 17,250,000 - Mok an aceoest. tune 1 sold land for 6,120,000 with canh. Aag, 1 collected all acoounts recelvable. hept. 1 Aignnd long-tern note to receive 8,120,000 man cash. oot. I hought inventory for 20,120 , jot mcar casb. Hov, 1 Bought land for 3,120,060 Nck on acevunt. Doc. I Deelared and paid 3,120,000 not each dividend to parent. Dee.31 mecorded depreelation tor the entire year of 2, 260, 000 smu. The U.S doliar (\$) exchange rates for 1 NGN are as follows: a. Assuming the NGN is the subsidiary's functionat currency, what is the translation adjustment determined b. Assuming the USS is the subsidiary/s functional currency, what is the remeasurement gain or loss deter (Input afl amounts as positive: Enter amounts in whole dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts