Question: need help please someone help really urgent Show Attempt History Current Attempt in Progress OCloud Corporation's suite of software products and services provides secure and

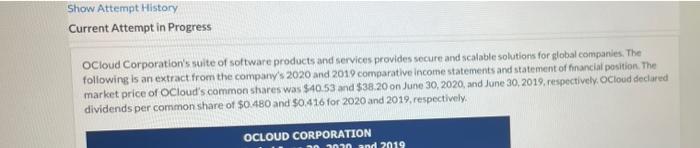

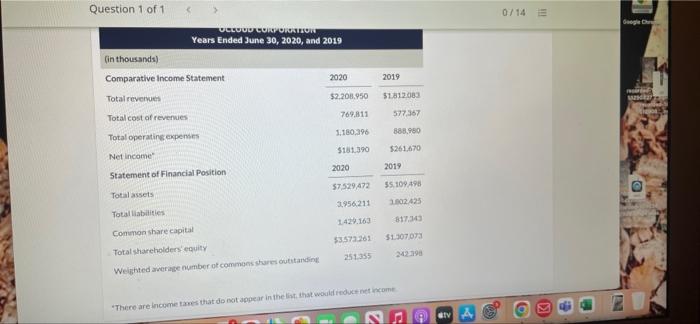

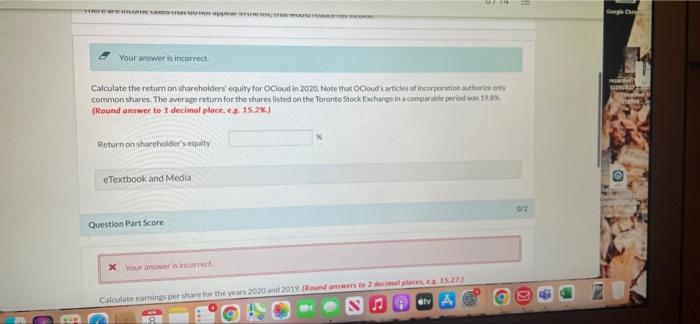

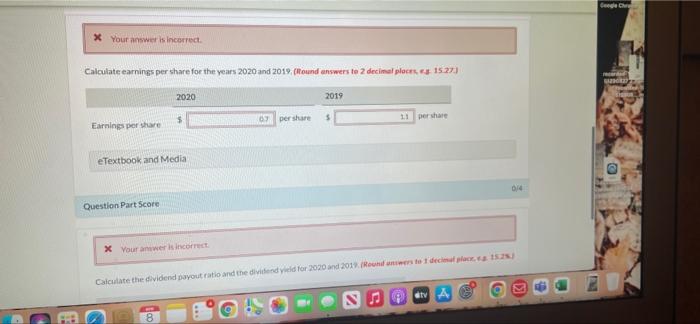

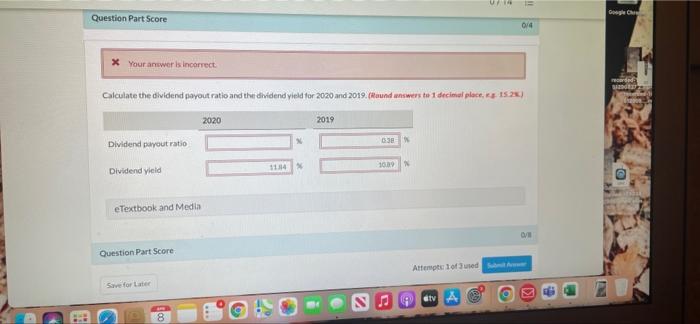

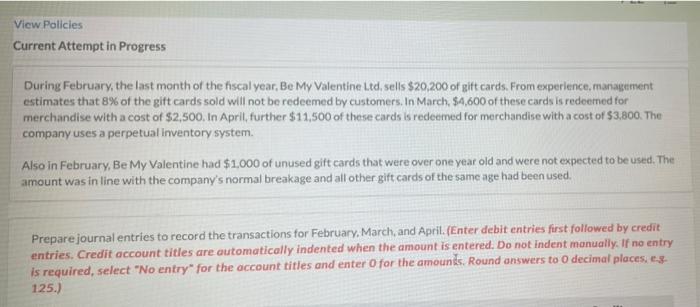

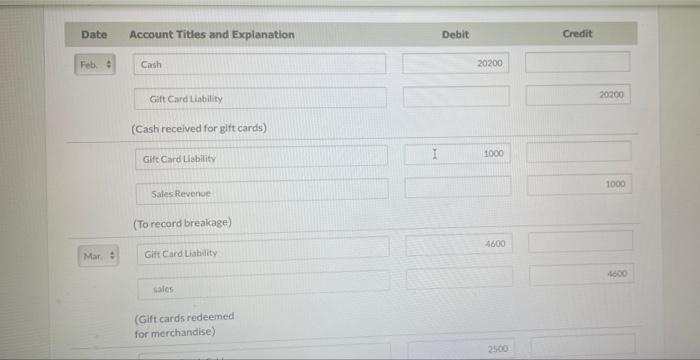

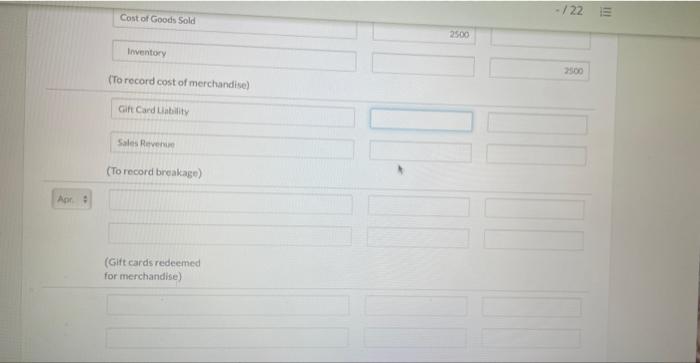

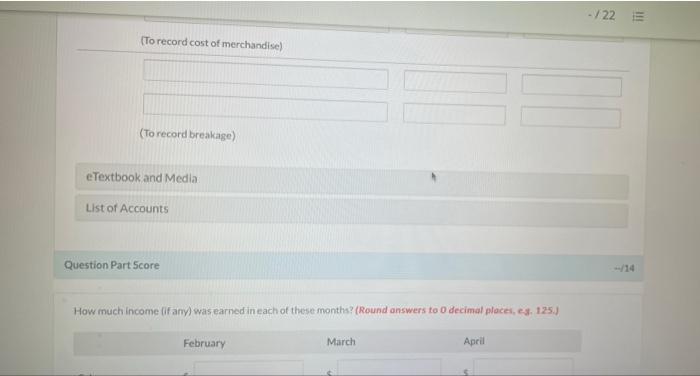

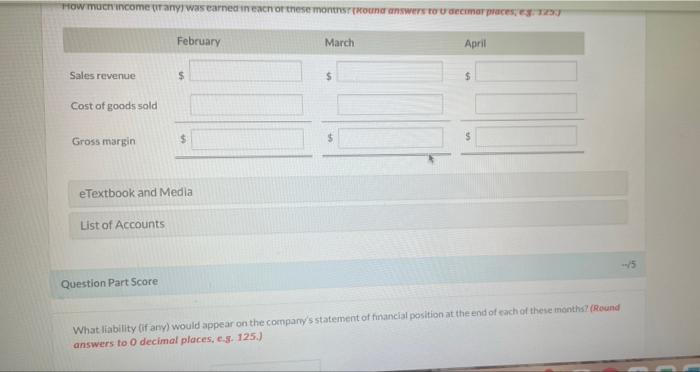

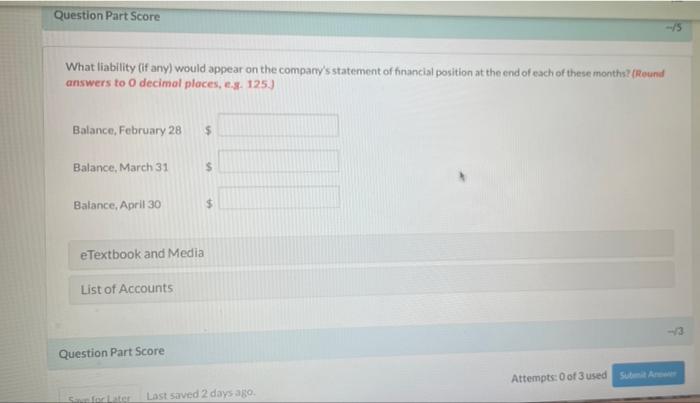

Show Attempt History Current Attempt in Progress OCloud Corporation's suite of software products and services provides secure and scalable solutions for global companies. The following is an extract from the company's 2020 and 2019 comparative Income statements and statement of financial position. The market price of OCloud's common shares was $40.53 and $38.20 on June 30, 2020, and June 30, 2019, respectively. Ocloud declared dividends per common share of $0.480 and $0.416 for 2020 and 2019, respectively, OCLOUD CORPORATION ann and 2019 Question 1 of 1 0714 E Google 2019 51.813083 wa 577367 888980 UCLU CORPORATION Years Ended June 30, 2020, and 2019 in thousands) Comparative Income Statement 2020 Total revenue $2,205.950 Total cost of revenues 769,811 Total operating expenses 1.180.396 Net income $181390 Statement of Financial Position 2020 Total assets 57529472 Total abilities 3.956.211 142.163 Common share capital 33.573,261 Total shareholders equity 251355 Weighted average number of common shares outstanding $261.670 2019 55 10998 102425 817,34 51307073 There are income taxes that do not appear in the list that would reducere income E MORE Google Cloud Your answer is incorrect Calculate the return on shareholders equity for Cloud in 2020. Note that oCloudsartides of incorporation authorie only common shares. The average return for the shares listed on the Toronto Stock Exchange in a comparable period w 19% (Round answer to 1 decimal place, s. 15.2 Return on shareholder's equality e Textbook and Media Question Part Score x Your awes incorrect Calculate carines per share for the years 2020 and 2019. Round answers to 2 decimo 1523 Gtv A Gengler X Your answer is incorrect Calculate earnings per share for the years 2020 and 2019. Cound answers to 2 decimal places 1527 2020 2019 $ 6 per share 11 per share Earnings per she e Textbook and Media o Question Part Score * Your answer is incorrect Calculate the dividend payout ratio and the dividend yield for 2020 and 2017. Hounds to deci, 152 G A 8 U | couple Question Part Score 014 * Your answer is incorrect Calculate the dividend payout ratio and the dividend yield for 2020 and 2019. raund answers to 1 decimal place, s 152x) 2020 2019 638 Dividend payout ratio 11 1009 Dividend yield e Textbook and Media Question Part Score Attempt 1 of used Save for at a otv View Policies Current Attempt in Progress During February, the last month of the fiscal year, Be My Valentine Ltd, sells $20,200 of gift cards. From experience management estimates that 8% of the gift cards sold will not be redeemed by customers. In March, $4,600 of these cards is redeemed for merchandise with a cost of $2,500. In April further $11,500 of these cards is redeemed for marchandise with a cost of $3,800. The company uses a perpetual inventory system. Also in February, Be My Valentine had $1,000 of unused gift cards that were over one year old and were not expected to be used. The amount was in line with the company's normal breakage and all other gift cards of the same age had been used. Prepare journal entries to record the transactions for February, March, and April (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter for the amounts. Round answers to decimal places, es 125.) Date Account Titles and Explanation Debit Credit Feb Cash 20200 20000 Gift Card Liability (Cash received for gift cards) Gift Card Liability 1000 1000 Sales Revenue (To record breakage) 1600 Mar Gift Card Labdity 00 sales (Gift cards redeemed for merchandise) -/22 Cost of Goods Sold 2500 Inventory (To record cost of merchandise) Gift Card Liability Sales Revenue L. (To record breakage) Anr: (Gift cards redeemed for merchandise -/22 (To record cost of merchandise) (To record breakage) e Textbook and Media List of Accounts Question Part Score How much Income (if any) was earned in each of these months? (Round answers to 0 decimal places, s. 125.) February March April Tow Much income in any was earned in each of these montre round answers to more February March April Sales revenue $ $ Cost of goods sold Gross margin $ eTextbook and Media List of Accounts Question Part Score What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to O decimal places, eg. 125.) Question Part Score What liability (if any) would appear on the company's statement of financial position at the end of each of these months? (Round answers to 0 decimal places, e. 125.) Balance, February 28 $ Balance, March 31 $ Balance, April 30 $ e Textbook and Media List of Accounts Question Part Score Attempts: 0 of 3 used SA soft Last saved 2 days ago

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts