Question: need help pls USUUNHO Terrence Murphy opened a law office on January 1, 2018. During the first month of operations, the business completed the following

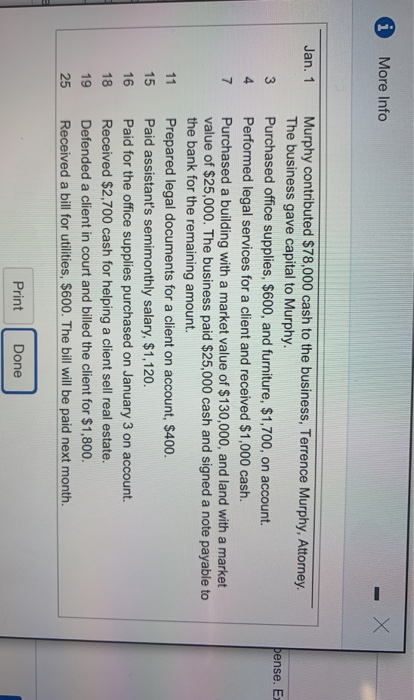

USUUNHO Terrence Murphy opened a law office on January 1, 2018. During the first month of operations, the business completed the following transactions: Click the icon to view the transactions.) Read the requirements Payable: Utilities Payable; Notes Payable: Murphy, Capital; Murphy, Withdrawals Service Revenue, Salaries Expense; Rent Expense, and Utilities Expense. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) Jan. 1: Murphy contributed $78,000 cash to the business, Terrence Murphy, Attorney. The business gave capital to Murphy. Date Accounts Debit Credit Jan. 1 i More Info Jan. 1 pense. E 3 4 7 Murphy contributed $78,000 cash to the business, Terrence Murphy, Attorney. The business gave capital to Murphy. Purchased office supplies, $600, and furniture, $1,700, on account. Performed legal services for a client and received $1,000 cash. Purchased a building with a market value of $130,000, and land with a market value of $25,000. The business paid $25,000 cash and signed a note payable to the bank for the remaining amount. Prepared legal documents for a client on account, $400. Paid assistant's semimonthly salary, $1,120. Paid for the office supplies purchased on January 3 on account. Received $2,700 cash for helping a client sell real estate. Defended a client in court and billed the client for $1,800. Received a bill for utilities, $600. The bill will be paid next month. 11 15 16 18 19 25 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts