Question: need help Present value with periodic rates. Sam Hinds, a local dentist, is going to remodel the dental reception area and add two new workstations.

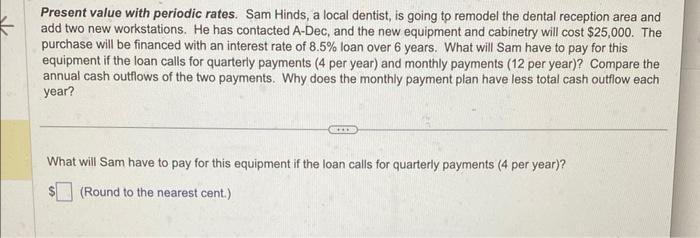

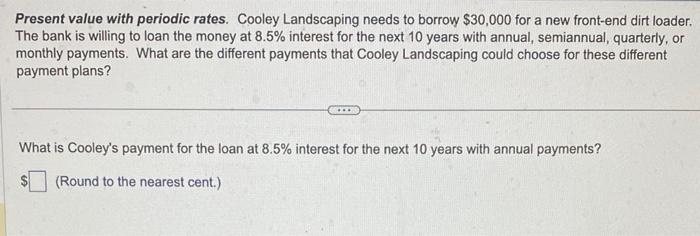

Present value with periodic rates. Sam Hinds, a local dentist, is going to remodel the dental reception area and add two new workstations. He has contacted A-Dec, and the new equipment and cabinetry will cost $25,000. The purchase will be financed with an interest rate of 8.5% loan over 6 years. What will Sam have to pay for this equipment if the loan calls for quarterly payments ( 4 per year) and monthly payments ( 12 per year)? Compare the annual cash outflows of the two payments. Why does the monthly payment plan have less total cash outflow each year? What will Sam have to pay for this equipment if the loan calls for quarterly payments ( 4 per year)? (Round to the nearest cent.) Present value with periodic rates. Cooley Landscaping needs to borrow $30,000 for a new front-end dirt loader. The bank is willing to loan the money at 8.5% interest for the next 10 years with annual, semiannual, quarterly, or monthly payments. What are the different payments that Cooley Landscaping could choose for these different payment plans? What is Cooley's payment for the loan at 8.5% interest for the next 10 years with annual payments? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts