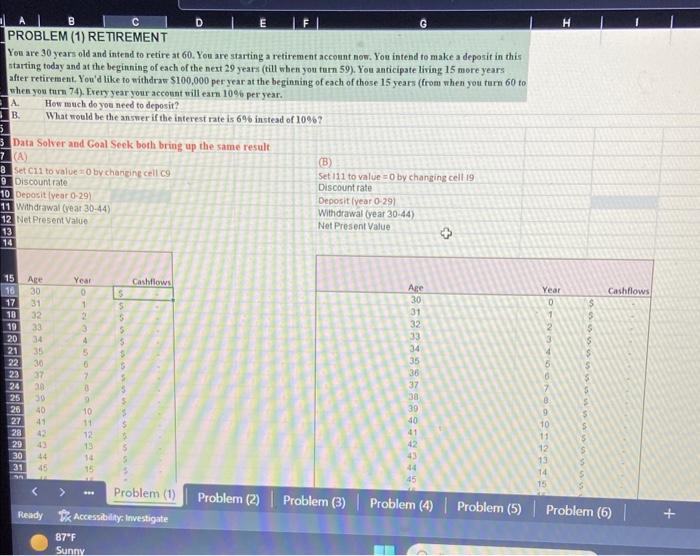

Question: need help!! PROBLEM (1) RETIREMENT You are 30 years old and intend to retire at 60 . You are starting a retirement account now. You

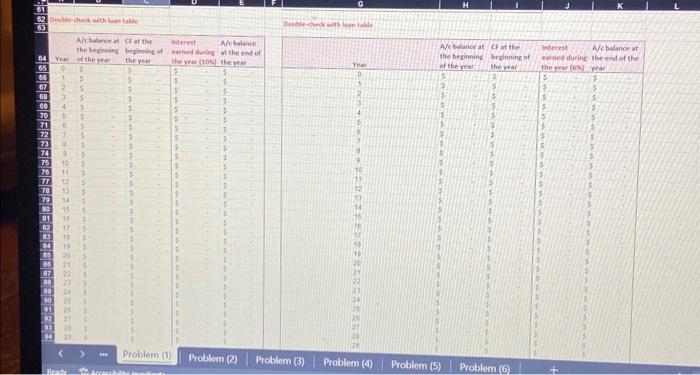

PROBLEM (1) RETIREMENT You are 30 years old and intend to retire at 60 . You are starting a retirement account now. You intend to make a deposit in this starting today and at the beginning of each of the next 29 years (till wben you furn 59). You anticipate living 15 more years after retirement. You'd like to withdraw $100,000 per year at the beginning of each of those 15 years (from when you turn 60 to when you turn 74). Exery year your account will eam 10%6 per year. A. How much do yoe need to deposit? B. What would be the answer if the interest rate is 6% instead of 10%6 ? \begin{tabular}{|c|c|c|c|c|c|} \hline 64 & Year & Nobulereratthebeconineoftheyrar & Cratthebecinningoftheyear & & Actulanceottheondofthevea. \\ \hline 65 & 0 & & 5 & 5 & 13 \\ \hline es & 1 & = & 7 & 3 & is \\ \hline 67 & 2 & 4 & \pm & 5 & is \\ \hline 69 & 3 & = & 2= & & 5 \\ \hline ea & 4 & 4 & 5 & 5 & 5 \\ \hline 70 & 5 & . & = & 5 & 5 \\ \hline 71 & 6 & - & = & 5 & 5 \\ \hline 72 & 7. & - & & 3 & is \\ \hline 73 & 8 & = & = & 5 & 5 \\ \hline 74 & 9 & = & 3 & $ & 5 \\ \hline 75 & 10 & 5 & 5 & 3 & 1 \\ \hline 76 & 11 & = & 3 & 3 & 5 \\ \hline 77 & 12 & 3 & 3 & 5 & 5 \\ \hline 7a & 12 & 5 & 3 & 15 & 5 \\ \hline 79 & 14 & 3 & 1 & 5 & 2 \\ \hline 8 & 15 & 1 & 3 & 13 & 5 \\ \hline Di & 16 & 3 & & 1 & $ \\ \hline B? & 17 & 5 & s & is & 5 \\ \hline (193) & tir & 1 & 1 & is & 5 \\ \hline 8 & 13 & 3 & & 5 & 1 \\ \hline Bs & 2n & 5 & 3 & 5 & 1 \\ \hline 85 & 21 & 5 & 4 & 5 & 3 \\ \hline & 22 & 3 & 1 & 1 & 1 \\ \hline Din & 27 & 3 & t2 & 1 & \\ \hline 79 & 24 & 3 & 1 & 1 & 1 \\ \hline & 25 & 1 & 3 & 3 & I \\ \hline 91 & 76 & 1 & + & 1 & 1 \\ \hline 92 & 27 & 3 & & 1 & \& \\ \hline ar] & 71 & 1 & = & 3 & 1 \\ \hline 84 & 27 & 1 & 2 & 13 & t \\ \hline \end{tabular} PROBLEM (1) RETIREMENT You are 30 years old and intend to retire at 60 . You are starting a retirement account now. You intend to make a deposit in this starting today and at the beginning of each of the next 29 years (till wben you furn 59). You anticipate living 15 more years after retirement. You'd like to withdraw $100,000 per year at the beginning of each of those 15 years (from when you turn 60 to when you turn 74). Exery year your account will eam 10%6 per year. A. How much do yoe need to deposit? B. What would be the answer if the interest rate is 6% instead of 10%6 ? \begin{tabular}{|c|c|c|c|c|c|} \hline 64 & Year & Nobulereratthebeconineoftheyrar & Cratthebecinningoftheyear & & Actulanceottheondofthevea. \\ \hline 65 & 0 & & 5 & 5 & 13 \\ \hline es & 1 & = & 7 & 3 & is \\ \hline 67 & 2 & 4 & \pm & 5 & is \\ \hline 69 & 3 & = & 2= & & 5 \\ \hline ea & 4 & 4 & 5 & 5 & 5 \\ \hline 70 & 5 & . & = & 5 & 5 \\ \hline 71 & 6 & - & = & 5 & 5 \\ \hline 72 & 7. & - & & 3 & is \\ \hline 73 & 8 & = & = & 5 & 5 \\ \hline 74 & 9 & = & 3 & $ & 5 \\ \hline 75 & 10 & 5 & 5 & 3 & 1 \\ \hline 76 & 11 & = & 3 & 3 & 5 \\ \hline 77 & 12 & 3 & 3 & 5 & 5 \\ \hline 7a & 12 & 5 & 3 & 15 & 5 \\ \hline 79 & 14 & 3 & 1 & 5 & 2 \\ \hline 8 & 15 & 1 & 3 & 13 & 5 \\ \hline Di & 16 & 3 & & 1 & $ \\ \hline B? & 17 & 5 & s & is & 5 \\ \hline (193) & tir & 1 & 1 & is & 5 \\ \hline 8 & 13 & 3 & & 5 & 1 \\ \hline Bs & 2n & 5 & 3 & 5 & 1 \\ \hline 85 & 21 & 5 & 4 & 5 & 3 \\ \hline & 22 & 3 & 1 & 1 & 1 \\ \hline Din & 27 & 3 & t2 & 1 & \\ \hline 79 & 24 & 3 & 1 & 1 & 1 \\ \hline & 25 & 1 & 3 & 3 & I \\ \hline 91 & 76 & 1 & + & 1 & 1 \\ \hline 92 & 27 & 3 & & 1 & \& \\ \hline ar] & 71 & 1 & = & 3 & 1 \\ \hline 84 & 27 & 1 & 2 & 13 & t \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts