Question: Need help! Problem 2, 24pts ) Cottage Co. deposits all cash receipts on the day when they are received and it makes all cash payments

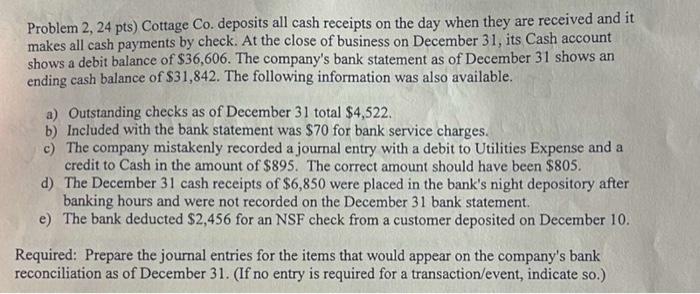

Problem 2, 24pts ) Cottage Co. deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on December 31 , its Cash account shows a debit balance of $36,606. The company's bank statement as of December 31 shows an ending cash balance of $31,842. The following information was also available. a) Outstanding checks as of December 31 total $4,522. b) Included with the bank statement was $70 for bank service charges. c) The company mistakenly recorded a journal entry with a debit to Utilities Expense and a credit to Cash in the amount of $895. The correct amount should have been $805. d) The December 31 cash receipts of $6,850 were placed in the bank's night depository after banking hours and were not recorded on the December 31 bank statement. e) The bank deducted $2,456 for an NSF check from a customer deposited on December 10 . Required: Prepare the journal entries for the items that would appear on the company's bank reconciliation as of December 31. (If no entry is required for a transaction/event, indicate so.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts