Question: need help quick, will like! Grommit Engineering expects to have net income next year of $20.75 million and free cash flow of $22.15 million Grommit's

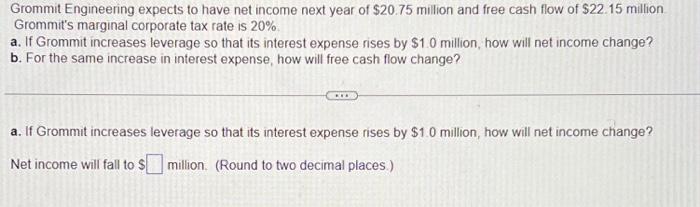

Grommit Engineering expects to have net income next year of $20.75 million and free cash flow of $22.15 million Grommit's marginal corporate tax rate is 20% a. If Grommit increases leverage so that its interest expense rises by $1.0 million, how will net income change? b. For the same increase in interest expense, how will free cash flow change? a. If Grommit increases leverage so that its interest expense rises by $1.0 million, how will net income change? Net income will fall to $ million. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts