Question: NEED HELP QUICKLY Exercise 6.31 a-b (Part Level Submission) An investment banker is analyzing two companies that specialize in the production and sale of candied

NEED HELP QUICKLY

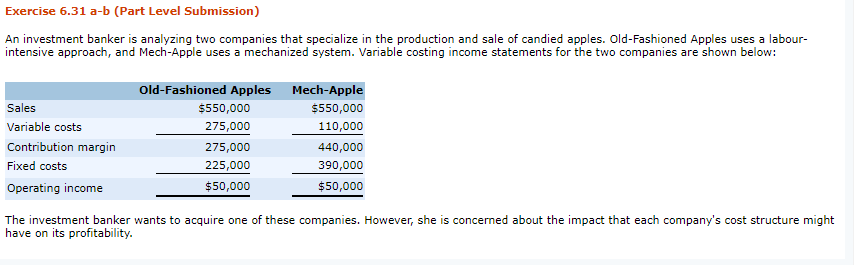

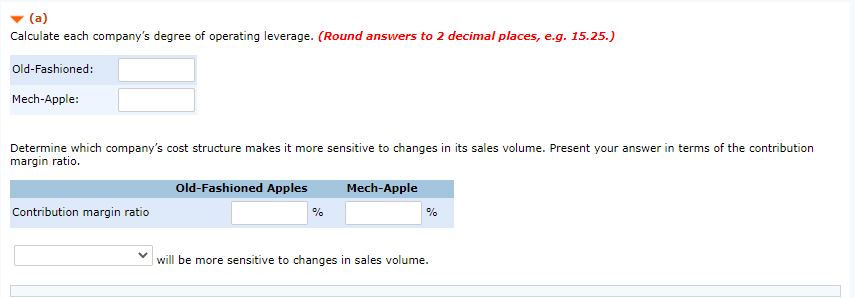

Exercise 6.31 a-b (Part Level Submission) An investment banker is analyzing two companies that specialize in the production and sale of candied apples. Old-Fashioned Apples uses a labour- intensive approach, and Mech-Apple uses a mechanized system. Variable costing income statements for the two companies are shown below: Old-Fashioned Apples Mech-Apple Sales $550,000 $550,000 Variable costs 275,000 110,000 Contribution margin 275,000 440,000 Fixed costs 225,000 390,000 Operating income $50,000 $50,000 The investment banker wants to acquire one of these companies. However, she is concerned about the impact that each company's cost structure might have on its profitability. (a) Calculate each company's degree of operating leverage. (Round answers to 2 decimal places, e.g. 15.25.) Old-Fashioned: Mech-Apple: Determine which company's cost structure makes it more sensitive to changes in its sales volume. Present your answer in terms of the contribution margin ratio. Old-Fashioned Apples Mech-Apple Contribution margin ratio % % will be more sensitive to changes in sales volume

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts