Question: need help solve all blanks/mess ups Selected transactions for Bridgeport, an interior decorator corporation, in its first month of business, are as follows. 1. Issued

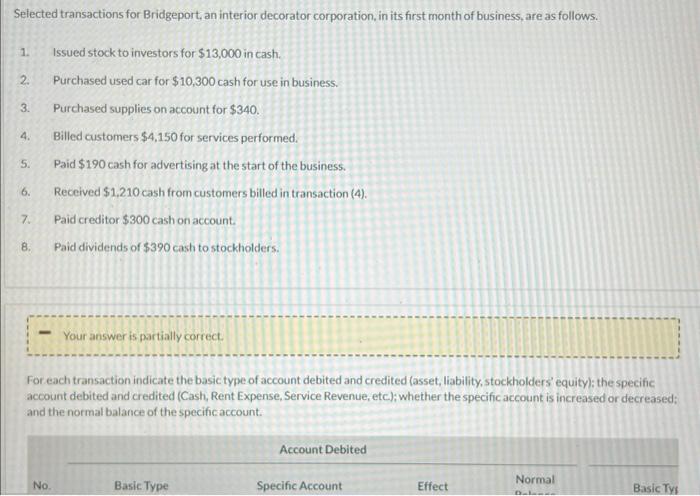

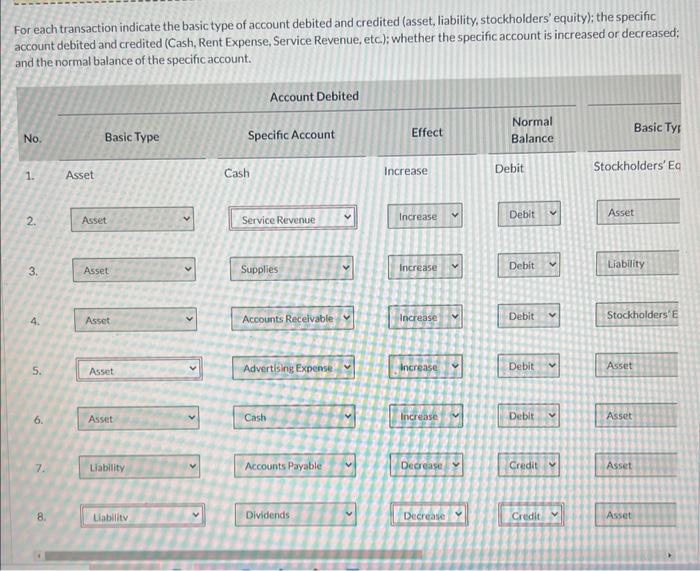

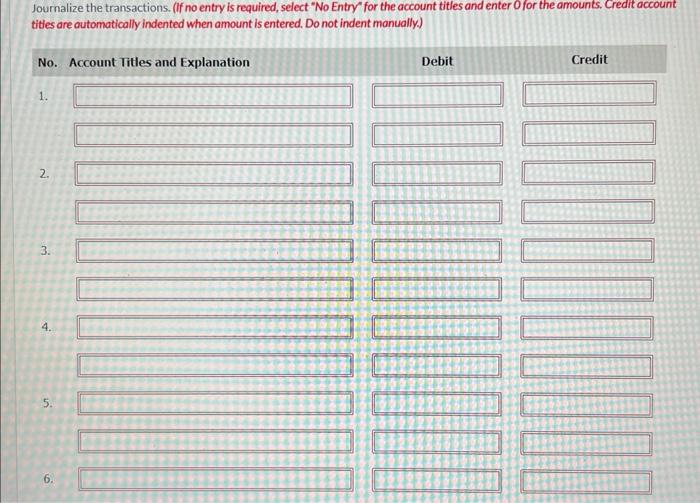

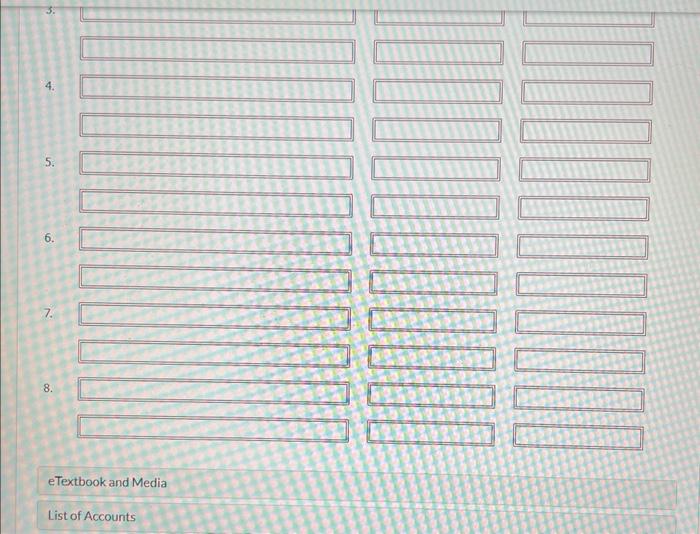

Selected transactions for Bridgeport, an interior decorator corporation, in its first month of business, are as follows. 1. Issued stock to investors for $13,000 in cash. 2. Purchased used car for $10,300 cash for use in business. 3. Purchased supplies on account for $340. 4. Billed customers $4,150 for services performed. 5. Paid $190 cash for advertising at the start of the business. 6. Received $1,210 cash from customers billed in transaction (4). 7. Paid creditor $300 cash on account. 8. Paid dividends of $390 cash to stockholders. Your answer is partially correct. For each transaction indicate the basic type of account debited and credited (asset, liability, stockholders' equity): the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc); whether the specific account is increased or decreased; and the normal balance of the specific account. For each transaction indicate the basic type of account debited and credited (asset, liability, stockholders' equity): the specific account debited and credited (Cash, Rent Expense. Service Revenue, etc); whether the specific account is increased or decreased; and the normal balance of the specific account. Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter Ofor the amounts. Credit account titles are outomatically indented when amount is entered. Do not indent manually.) 4. 5. 6. 7. 8. eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts