Question: Need help solving 10-1 through 10-4 using step by step. . The company's growth rate d. Investors become more risk averse. 04 ockpr -1 How

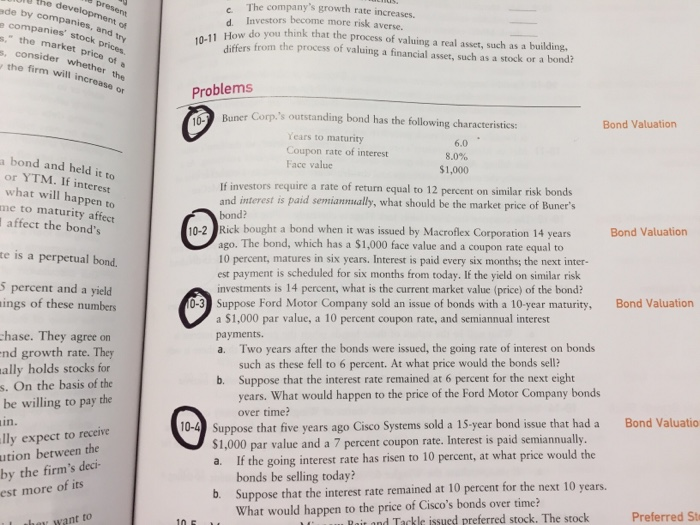

. The company's growth rate d. Investors become more risk averse. 04 ockpr -1 How do you think that the process of valuing a real asst, such as a building. differs from the process of valuing a financial asset, such as a stock or a bond? of the firm will Problems 0 Buner Corp.'s outstanding bond has the following characteristics: Bond Valuation Years to maturity Coupon rate of interest Face value 6.0 8.0% $1,000 a bond and held it to If i what will h me to maturity affect affect the bond's If investors require a rate of return equal to 12 percent on similar risk bonds and interest is paid semiannually, what should be the market price of Buner's bond? 10-2 Rick bought a bond when it was issued by Macroflex Corporation 14 years Bond Valuation ago. The bond, which has a $1,000 face value and a coupon rate equal to 10 percent, matures in six years. Interest is paid every six months; the next inter- est payment is scheduled for six months from today. If the yield on similar risk investments is 14 percent, what is the current market value (price) of the bond? te is a perpetual bond. 5 percent and a yield ings of these numbers 0-3 Suppose Ford Motor Company sold an issue of bonds with a 10-year maturity, Bond Valuation hase. They agree on nd growth rate. They ally holds stocks for a $1,000 par value, a 10 percent coupon rate, and semiannual interest payments a. Two years after the bonds were issued, the going rate of interest on bonds such as these fell to 6 percent. At what price would the bonds sell? Suppose that the interest rate remained at 6 percent for the next eight years. What would happen to the price of the Ford Motor Company bonds over time? b. On the basis of the be willing to pay the in. s. 10-4 Suppose that five years ago Cisco Systems sold a 15-year bond issue that had a Bond Valuatio $1,000 par value and a 7 percent coupon rate. Interest is paid semiannually. a. If the going interest rate has risen to 10 percent, at what price would the y expect to receive between the by the firm's deci- ution bonds be selling today? Suppose that the interest rate remained at 10 percent for the next 10 years. est more of its b. What would happen to the price of Cisco's bonds over time? Preferred St Rait and Tackle issued preferred stock. The stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts