Question: Need help solving 4-1, 4-2, 4-3 (just part A), 4-4, 4-5, 4-7, and 4-8: capital ~mayest / FIN3300/ Files/ ch12.ppifbreak+eventanalysis+and+ leveragedhl=en&gl= us&ct=clnk&cd=1 es the pis

Need help solving 4-1, 4-2, 4-3 (just part A), 4-4, 4-5, 4-7, and 4-8:

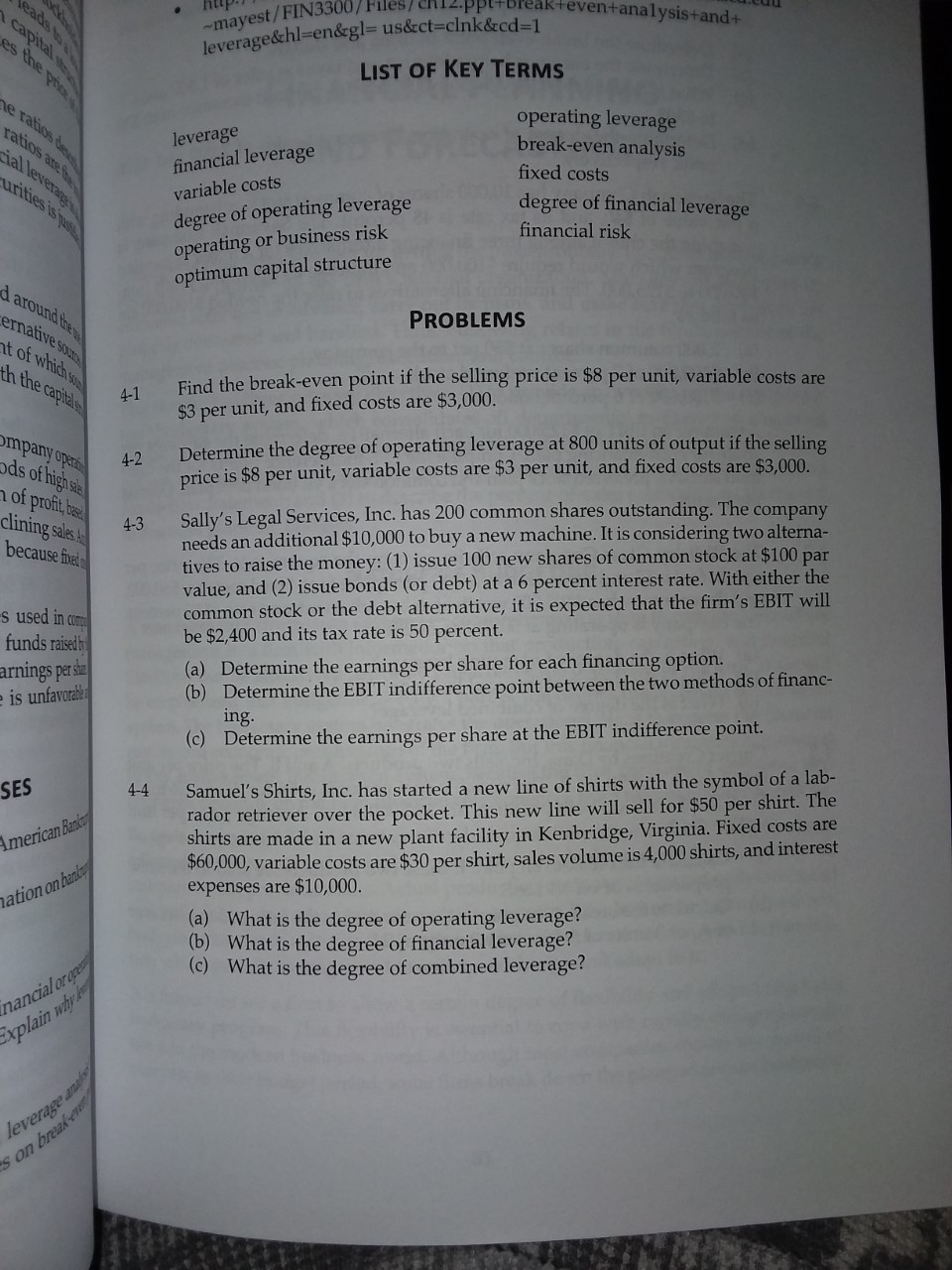

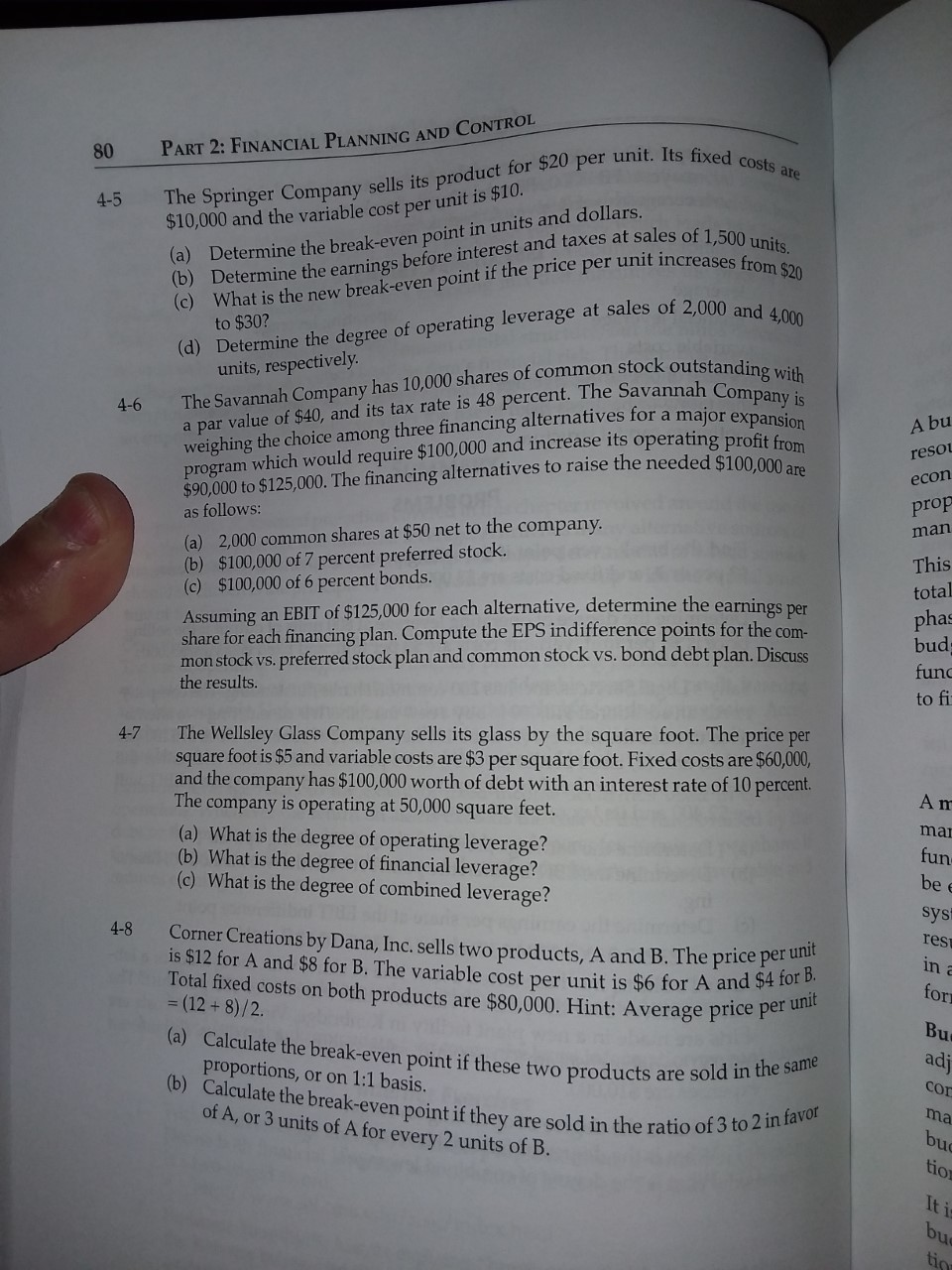

capital ~mayest / FIN3300/ Files/ ch12.ppifbreak+eventanalysis+and+ leveragedhl=en&gl= us&ct=clnk&cd=1 es the pis LIST OF KEY TERMS he ratios desk leverage operating leverage ratios are to break-even analysis ial leverage financial leverage urities is just variable costs fixed costs degree of operating leverage degree of financial leverage operating or business risk financial risk optimum capital structure d around the was ernative sour PROBLEMS it of which sore th the capitals 4-1 Find the break-even point if the selling price is $8 per unit, variable costs are $3 per unit, and fixed costs are $3,000. mpany operate ds of high sales 4-2 Determine the degree of operating leverage at 800 units of output if the selling price is $8 per unit, variable costs are $3 per unit, and fixed costs are $3,000. of profit, based clining sales. At 4-3 Sally's Legal Services, Inc. has 200 common shares outstanding. The company because fixed needs an additional $10,000 to buy a new machine. It is considering two alterna- tives to raise the money: (1) issue 100 new shares of common stock at $100 par value, and (2) issue bonds (or debt) at a 6 percent interest rate. With either the s used in compu common stock or the debt alternative, it is expected that the firm's EBIT will funds raised by be $2,400 and its tax rate is 50 percent. arnings per she (a) Determine the earnings per share for each financing option. is unfavorable (b) Determine the EBIT indifference point between the two methods of financ ing. (c) Determine the earnings per share at the EBIT indifference point. SES 4-4 Samuel's Shirts, Inc. has started a new line of shirts with the symbol of a lab- American Banks rador retriever over the pocket. This new line will sell for $50 per shirt. The shirts are made in a new plant facility in Kenbridge, Virginia. Fixed costs are ation on banks $60,000, variable costs are $30 per shirt, sales volume is 4,000 shirts, and interest expenses are $10,000. (a) What is the degree of operating leverage? ( C ) b) What is the degree of financial leverage? nancial or oper What is the degree of combined leverage? Explain why lev leverage analy s on break-ever80 PART 2: FINANCIAL PLANNING AND CONTROL 4-5 The Springer Company sells its product for $20 per unit. Its fixed costs are $10,000 and the variable cost per unit is $10. (a) Determine the break-even point in units and dollars. (b) Determine the earnings before interest and taxes at sales of 1,500 units (C) What is the new break-even point if the price per unit increases from $20 to $30? (d) Determine the degree of operating leverage at sales of 2,000 and 4,000 units, respectively. 4-6 The Savannah Company has 10,000 shares of common stock outstanding with a par value of $40, and its tax rate is 48 percent. The Savannah Company is weighing the choice among three financing alternatives for a major expansion program which would require $100,000 and increase its operating profit from A bu $90,000 to $125,000. The financing alternatives to raise the needed $100,000 are reso econ as follows: pro (a) 2,000 common shares at $50 net to the company. man (b) $100,000 of 7 percent preferred stock. (C ) $100,000 of 6 percent bonds. This Assuming an EBIT of $125,000 for each alternative, determine the earnings per total share for each financing plan. Compute the EPS indifference points for the com- pha bud the results. mon stock vs. preferred stock plan and common stock vs. bond debt plan. Discuss fund to fi 4-7 The Wellsley Glass Company sells its glass by the square foot. The price per square foot is $5 and variable costs are $3 per square foot. Fixed costs are $60,000, and the company has $100,000 worth of debt with an interest rate of 10 percent. The company is operating at 50,000 square feet. An (a) What is the degree of operating leverage? ma (b) What is the degree of financial leverage? fun (c) What is the degree of combined leverage? be 4-8 sys Corner Creations by Dana, Inc. sells two products, A and B. The price per unit is $12 for A and $8 for B. The variable cost per unit is $6 for A and $4 for B. res Total fixed costs on both products are $80,000. Hint: Average price per unit in = (12 + 8) / 2. for (a) Calculate the break-even point if these two products are sold in the same Bu proportions, or on 1:1 basis. adi (b) Calculate the break-even point if they are sold in the ratio of 3 to 2 in favor cor of A, or 3 units of A for every 2 units of B. ma bu tio It i bu tio