Question: need help solving 6,7,8 please 6. You plan to buy a new piece of equipment costing $120,000. You can buy it outright, or the company

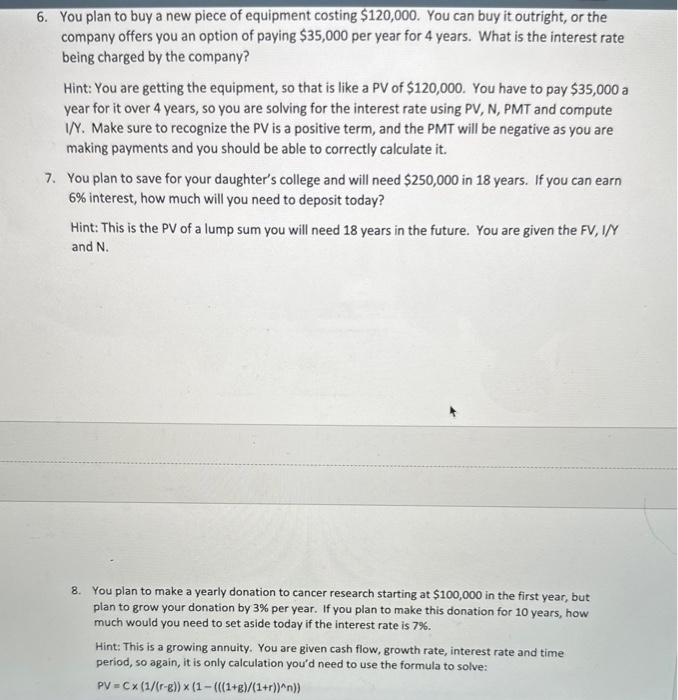

6. You plan to buy a new piece of equipment costing $120,000. You can buy it outright, or the company offers you an option of paying $35,000 per year for 4 years. What is the interest rate being charged by the company? Hint: You are getting the equipment, so that is like a PV of $120,000. You have to pay $35,000 a year for it over 4 years, so you are solving for the interest rate using PV, N, PMT and compute I/Y. Make sure to recognize the PV is a positive term, and the PMT will be negative as you are making payments and you should be able to correctly calculate it. 7. You plan to save for your daughter's college and will need $250,000 in 18 years. If you can earn 6% interest, how much will you need to deposit today? Hint: This is the PV of a lump sum you will need 18 years in the future. You are given the FV,I/Y and N. 8. You plan to make a yearly donation to cancer research starting at $100,000 in the first year, but plan to grow your donation by 3% per year. If you plan to make this donation for 10 years, how much would you need to set aside today if the interest rate is 7%. Hint: This is a growing annuity. You are given cash flow, growth rate, interest rate and time period, so again, it is only calculation you'd need to use the formula to solve: PV=C(1/(rg))(1(((1+g)/(1+r))n))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts