Question: need help solving e) f) and g) using the following information posted below 1) Write summary journal entries for Superior Company for the following transactions

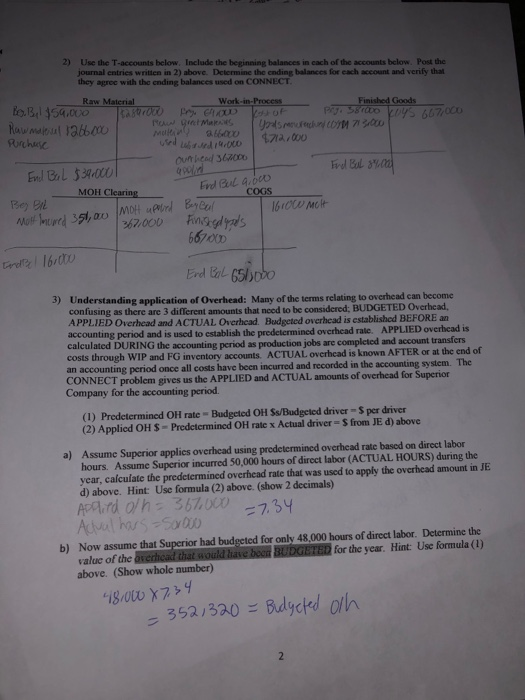

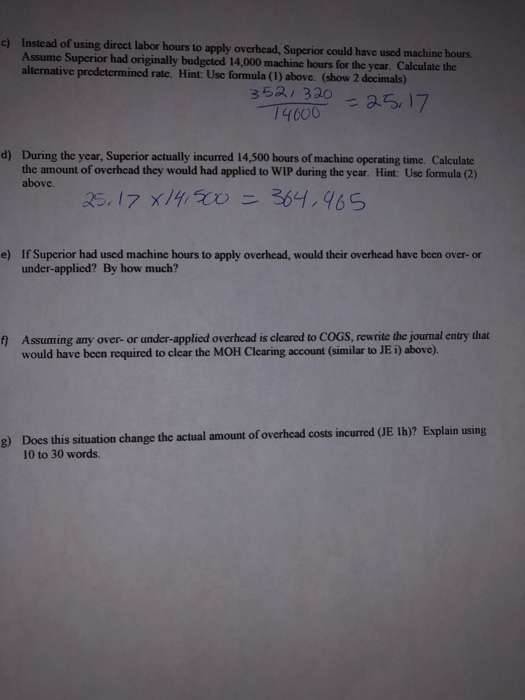

1) Write summary journal entries for Superior Company for the following transactions for the period as calculated/given in the problem on CONNECT. Use the Review Problem at the end of Chapter 2 on page 119 as a reference. a) Purchase of raw material Ruw 266.000 Accont payubie 266,000 b) Transfer of Raw material to Work-in-Process 367,000 CR c) Application of Direct Labor to Work-in-Process WIP 14.000 14,000 Factory muges PR CR d) Application of Manufacturing Overhead to Work-in-Process WIP 367.000 Mot applied to WIP DR e) Transfer of Work-in-Process to Finished Goods Finished goods 212.000 CR DR worku Places 700.000 f) Revenue for the sale of goods manufactured ACC Receivsle 1064,000 sales 1,064,000 CR BP g) Cost of goods sold COLS 6670w Finished Goods 667.000 PR CR h) The incurrence of the actual overhead costs (use " various to represent multiple accounts) Molt Selling & administrative 351100 351.600 DR i) Clear the Overhead account. Accounts paygle CR Manufactory overveco 16.000 DR cost of goal solds 16,000 CR 1 2) Use the T-accounts below. Include the beginning balances in cach of the accounts below. Post the journal entries written in 2) above. Determine the ending balances for each account and verify that they agree with the ending balances used on CONNECT Raw Material Work-in-Process Finished Goods Beg Bel $59.000 Trasa rowo pry Glow prgi 581wo yoys 667,000 w gol MARA Raw Tablo Mulling Yodechowo 713.000 8.16 Purchase 4712.000 Outled 3600 End But 87.000 Enl Bal 534.000 MOH Clearing COGS Beg Bil lbrow me Finished gols 667000 Frd Bul 4.000 Most moured 351, au Mot upored Bey Bail 267.000 Ende 16.000 End Bal 65100bo 3) Understanding application of Overhead: Many of the terms relating to overhead can become confusing as there are 3 different amounts that need to be considered: BUDGETED Overhead, APPLIED Overhead and ACTUAL Overhead. Budgeted overhead is established BEFORE an accounting period and is used to establish the predetermined overhead rate. APPLIED overhead is calculated DURING the accounting period as production jobs are completed and account transfers costs through WIP and FG inventory accounts. ACTUAL overhead is known AFTER or at the end of an accounting period once all costs have been incurred and recorded in the accounting system. The CONNECT problem gives us the APPLIED and ACTUAL amounts of overhead for Superior Company for the accounting period. (1) Predetermined OH rate - Budgeted OH Ss/Budgeted driver - Sper driver (2) Applied OH $ - Predetermined OH rate x Actual driver = S from JE d) above a) Assume Superior applies overhead using predetermined overhead rate based on direct labor hours. Assume Superior incurred 50,000 hours of direct labor (ACTUAL HOURS) during the year, calculate the predetermined overhead rate that was used to apply the overhead amount in JE d) above. Hint: Use formula (2) above. (show 2 decimals) Apdild on 367.000 Adual hars-sorow b) Now assume that Superior had budgeted for only 48,000 hours of direct labor. Determine the value of the overhead that would have book BUDGETED for the year. Hint: Use formula (1) above. (Show whole number) =7.34 "18,000 X734 352,320 = Budgeted on 2 c) Instead of using direct labor hours to apply overhead, Superior could have used machine hours. Assume Superior had originally budgeted 14,000 machine hours for the year. Calculate the alternative predetermined rate. Hint: Use formula (1) above. (show 2 decimals) 3521320 = 25,17 T4000 d) During the year, Superior actually incurred 14,500 hours of machine operating time. Calculate the amount of overhead they would had applied to WIP during the year. Hint: Use formula (2) above, 25.17X14,500 = 364,465 e) If Superior had used machine hours to apply overhead, would their overhead have been over-or under-applied? By how much? f} Assuming any over- or under-applied overhead is cleared to COGS, rewrite the journal entry that would have been required to clear the MOH Clearing account (similar to JEI) above). g) Does this situation change the actual amount of overhead costs incurred (JE 1h)? Explain using 10 to 30 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts