Question: Need help solving for problem 24 #23-24 are based on the following information: On April 1, 2020, City Corporation issued $300,000 (300 units of $1,000

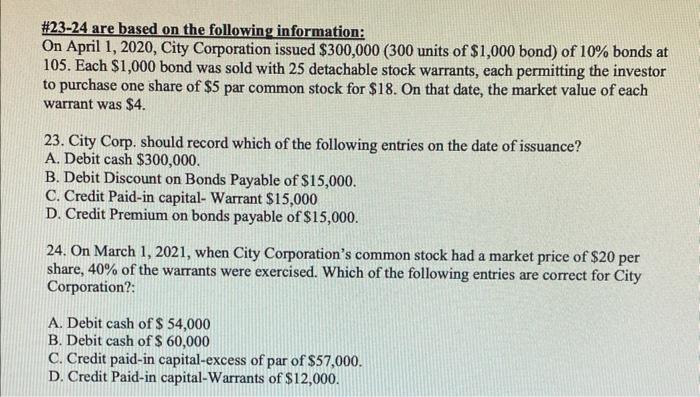

\#23-24 are based on the following information: On April 1, 2020, City Corporation issued $300,000 (300 units of $1,000 bond) of 10% bonds at 105. Each $1,000 bond was sold with 25 detachable stock warrants, each permitting the investor to purchase one share of $5 par common stock for $18. On that date, the market value of each warrant was $4. 23. City Corp. should record which of the following entries on the date of issuance? A. Debit cash $300,000. B. Debit Discount on Bonds Payable of $15,000. C. Credit Paid-in capital- Warrant $15,000 D. Credit Premium on bonds payable of $15,000. 24. On March 1, 2021, when City Corporation's common stock had a market price of \$20 per share, 40% of the warrants were exercised. Which of the following entries are correct for City Corporation?: A. Debit cash of $54,000 B. Debit cash of $60,000 C. Credit paid-in capital-excess of par of $57,000. D. Credit Paid-in capital-Warrants of $12,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts