Question: Need help solving for the bad debt expense for the year 2. Receivables The Allowance for Uncollectible Accounts account was $32,500 at the beginning of

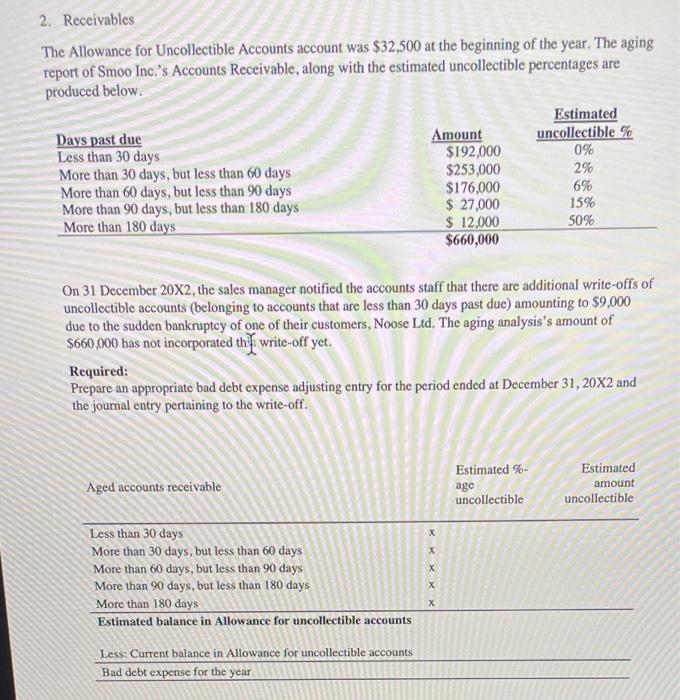

2. Receivables The Allowance for Uncollectible Accounts account was $32,500 at the beginning of the year. The aging report of Smoo Inc.'s Accounts Receivable, along with the estimated uncollectible percentages are produced below. Estimated Days past due Amount uncollectible % Less than 30 days $192,000 0% More than 30 days, but less than 60 days $253,000 2% More than 60 days, but less than 90 days $176,000 6% More than 90 days, but less than 180 days $ 27,000 15% More than 180 days $ 12,000 50% $660,000 On 31 December 20X2, the sales manager notified the accounts staff that there are additional write-offs of uncollectible accounts (belonging to accounts that are less than 30 days past due) amounting to $9,000 due to the sudden bankruptcy of one of their customers, Noose Ltd. The aging analysis's amount of $660,000 has not incorporated the write-off yet. Required: Prepare an appropriate bad debt expense adjusting entry for the period ended at December 31, 20X2 and the journal entry pertaining to the write-off. Aged accounts receivable Estimated %- age uncollectible Estimated amount uncollectible X X X Less than 30 days More than 30 days, but less than 60 days More than 60 days, but less than 90 days More than 90 days, but less than 180 days More than 180 days Estimated balance in Allowance for uncollectible accounts X Less: Current balance in Allowance for uncollectible accounts Bad debt expense for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts