Question: Need help solving for the balance that should be $0 at the end. Please show how to calculate with excel with a function. North West

Need help solving for the balance that should be $0 at the end. Please show how to calculate with excel with a function.

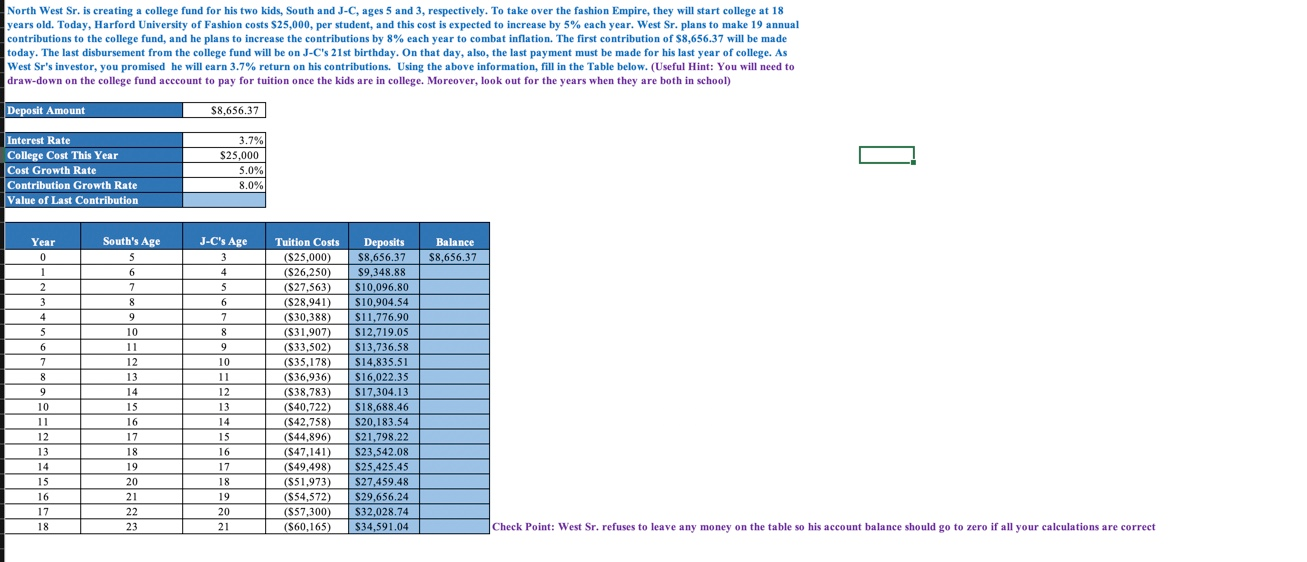

North West Sr. is creating a college fund for his two kids, South and J-C, ages 5 and 3, respectively. To take over the fashion Empire, they will start college at 18 years old. Today, Harford University of Fashion costs $25,000, per student, and this cost is expected to increase by 5% each year. West Sr. plans to make 19 annual contributions to the college fund, and he plans to increase the contributions by 8% each year to combat inflation. The first contribution of $8,656.37 will be made today. The last disbursement from the college fund will be on J-C's 21st birthday. On that day, also, the last payment must be made for his last year of college. As West Sr's investor, you promised he will earn 3.7% return on his contributio ns. Using the above information, fill in the Table below. (Useful Hint: You will need to draw-down on the college fund acccount to pay for tuition once the kids are in college. Moreover, look out for the years when they are both in school) Deposit Amount $8,656.37 Interest Rate 3.7% College Cost This Year $25,000 Cost Growth Rate 5.0% Contribution Growth Rate 8.0% Value of Last Contribution South's Age J-C's Age Deposits S8,656.37 Year Tuition Costs Balance 0 ($25,000) $8,656.37 1 6 4 ($26,250) ($27,563) $9,348,88 2 7 5 $10,096,80 3 8 6 ($28,941) $10,904.54 4 q 7 (S30,388) $11,776.90 10 8 (S31,907) $12,719.05 (S33,502) $13,736.58 6 11 9 7 12 10 (S35,178 $14,835.51 8 13 11 (S36,936) $16,022.35 (S38,783) 14 12 $17,304.13 $18,688.46 $20,183.54 10 15 13 (S40,722) 11 16 14 (S42,758) ($44,896) 12 17 15 $21,798.22 (S47,141) ($49,498) ($51,973) 13 18 16 $23,542.08 $25,425.45 $27,459.48 $29,656.24 14 19 17 15 20 18 ($54,572) 16 21 19 (S57,300) ($60,165 $32,028.74 17 22 20 Check Point: West Sr. refuses to leave any money on the table so his account balance should go to zero if all your calculations are correct $34,591.04 18 23 21 North West Sr. is creating a college fund for his two kids, South and J-C, ages 5 and 3, respectively. To take over the fashion Empire, they will start college at 18 years old. Today, Harford University of Fashion costs $25,000, per student, and this cost is expected to increase by 5% each year. West Sr. plans to make 19 annual contributions to the college fund, and he plans to increase the contributions by 8% each year to combat inflation. The first contribution of $8,656.37 will be made today. The last disbursement from the college fund will be on J-C's 21st birthday. On that day, also, the last payment must be made for his last year of college. As West Sr's investor, you promised he will earn 3.7% return on his contributio ns. Using the above information, fill in the Table below. (Useful Hint: You will need to draw-down on the college fund acccount to pay for tuition once the kids are in college. Moreover, look out for the years when they are both in school) Deposit Amount $8,656.37 Interest Rate 3.7% College Cost This Year $25,000 Cost Growth Rate 5.0% Contribution Growth Rate 8.0% Value of Last Contribution South's Age J-C's Age Deposits S8,656.37 Year Tuition Costs Balance 0 ($25,000) $8,656.37 1 6 4 ($26,250) ($27,563) $9,348,88 2 7 5 $10,096,80 3 8 6 ($28,941) $10,904.54 4 q 7 (S30,388) $11,776.90 10 8 (S31,907) $12,719.05 (S33,502) $13,736.58 6 11 9 7 12 10 (S35,178 $14,835.51 8 13 11 (S36,936) $16,022.35 (S38,783) 14 12 $17,304.13 $18,688.46 $20,183.54 10 15 13 (S40,722) 11 16 14 (S42,758) ($44,896) 12 17 15 $21,798.22 (S47,141) ($49,498) ($51,973) 13 18 16 $23,542.08 $25,425.45 $27,459.48 $29,656.24 14 19 17 15 20 18 ($54,572) 16 21 19 (S57,300) ($60,165 $32,028.74 17 22 20 Check Point: West Sr. refuses to leave any money on the table so his account balance should go to zero if all your calculations are correct $34,591.04 18 23 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts