Question: need help solving P10-17 Project Evaluation [LO1 Your firm is contemplating the purchase of a new $610,500 computer-based order entry system. The system will be

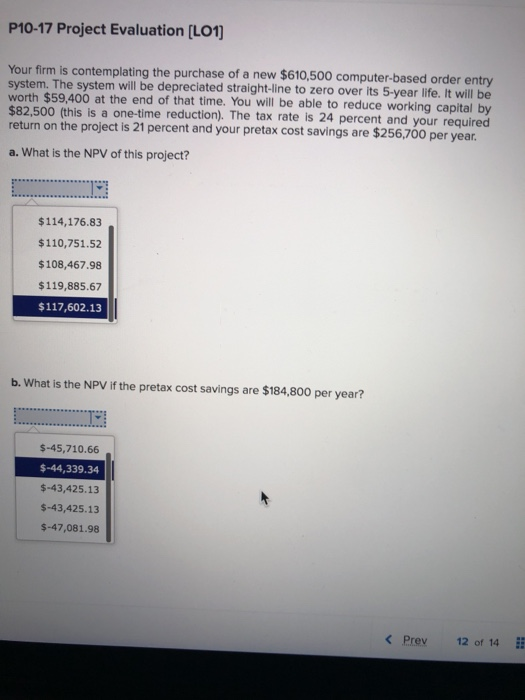

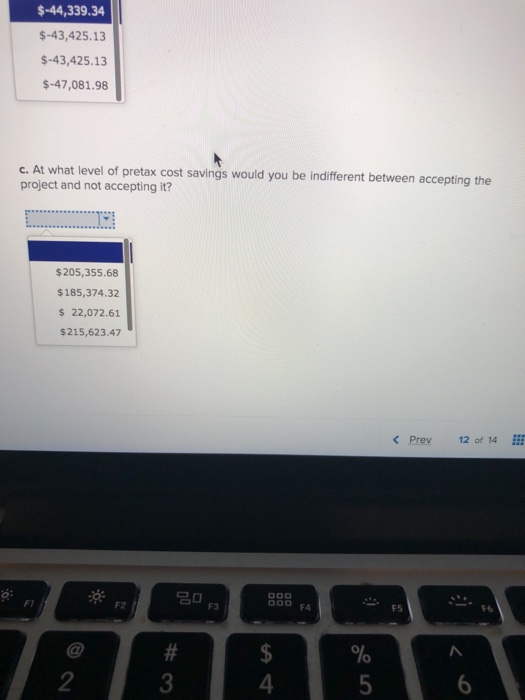

P10-17 Project Evaluation [LO1 Your firm is contemplating the purchase of a new $610,500 computer-based order entry system. The system will be depreciated straight-line to zero over its 5-year life. It will be worth $59,400 at the end of that time. You will be able to reduce working capital by $82,500 (this is a one-time reduction). The tax rate is 24 percent and your required return on the project is 21 percent and your pretax cost savings are $256,700 per year. a. What is the NPV of this project? $114,176.83 $110,751.52 $108,467.98 $119,885.67 $117,602.13 b. What is the NPV if the pretax cost savings are $184,800 per year? $-45,710.66 $-44,339.34 $-43,425.13 $-43,425.13 $-47,081.98 K Prev12 of 14 $-44,339.34 $-43,425.13 $-43,425.13 $-47,081.98 c. At what level of pretax cost savings would you be indifferent between accepting the project and not accepting it? $205,355.68 185,374.32 s 22,072.61 $215,623.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts