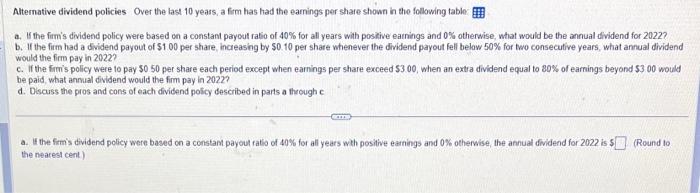

Question: need help solving part A,B,C,D Alternative dividend policies Over the last 10 years, a firm has had the earnings per share shown in the following

Alternative dividend policies Over the last 10 years, a firm has had the earnings per share shown in the following table: a. If the firm's dividend policy were based on a constant paryout ratio of 40% for all years with positive earnings and 0% otherwise, what would be the annual dividend for 2022 ? b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for two consecutive years, what annual dividend would the firm pay in 2022 ? c. If the firm's policy were to pay 50.50 per share each period except when eamings per share exceed 53.00 , when an extra dividend equal to 80% of earnings beyond 53 . 00 would be paid, what anmial dividend would the firm pay in 2022 ? d. Discuss the pros and cons of each dividend policy described in parts a through c a. It the firm's dividend policy were based on a constam payoul fatio of 40% for all years wth positive eamings and 0% otherwise, the annual dividend for 2022 is : (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts