Question: Need help solving problem Condensed balance sheet and income statement data for Sheffield Corporation are presented here. Question 12 of 12 SHEFFIELD CORPORATION Income Statements

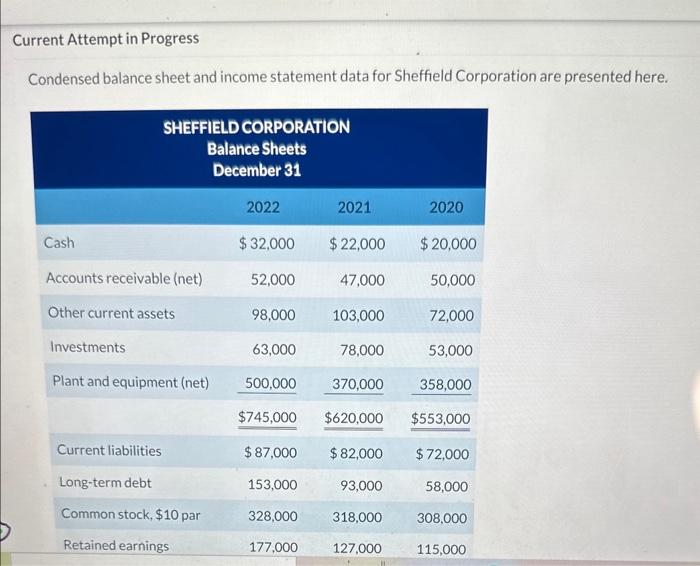

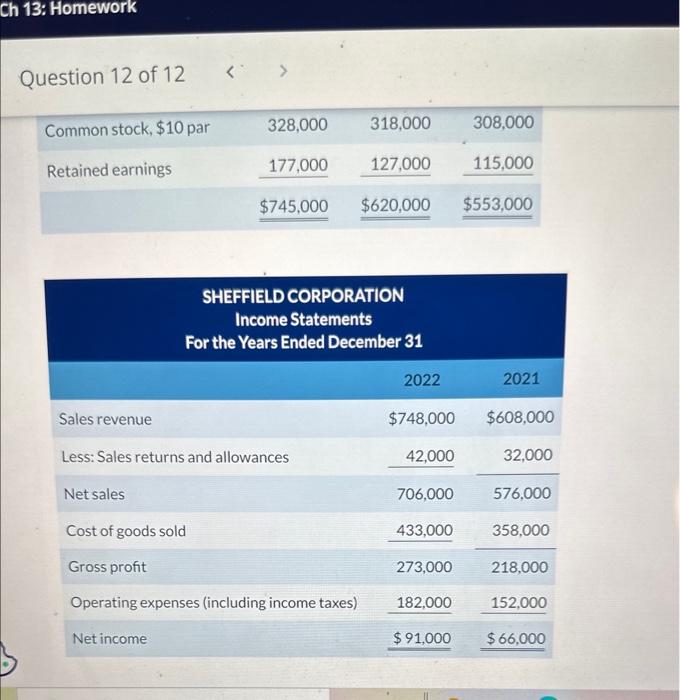

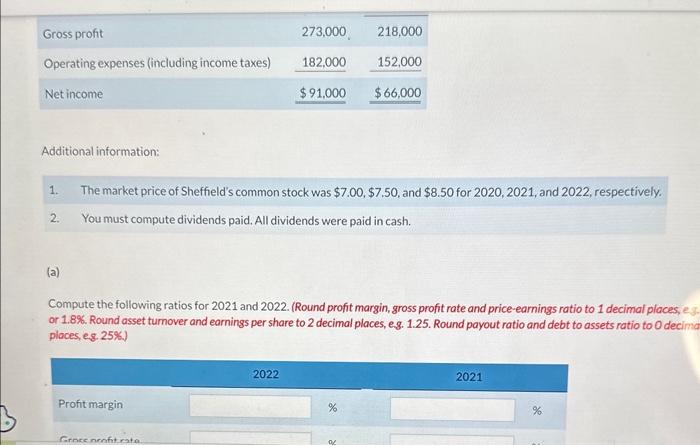

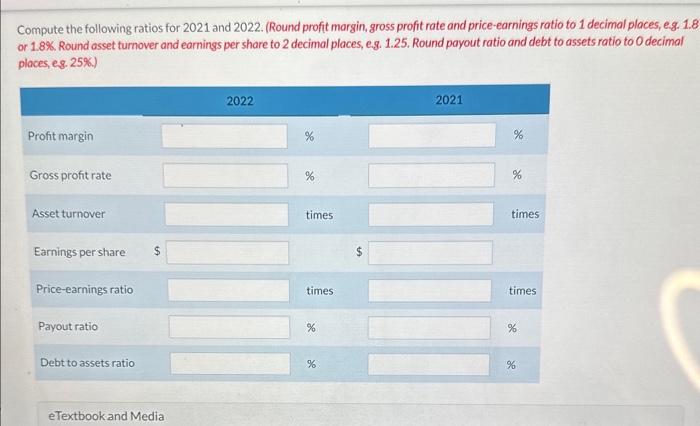

Condensed balance sheet and income statement data for Sheffield Corporation are presented here. Question 12 of 12 SHEFFIELD CORPORATION Income Statements For the Years Ended December 31 Additional information: 1. The market price of Sheffield's common stock was $7.00,$7.50, and $8.50 for 2020,2021 , and 2022 , respectively. 2. You must compute dividends paid. All dividends were paid in cash. (a) Compute the following ratios for 2021 and 2022. (Round profit margin, gross profit rate and price-earnings ratio to 1 decimal places, es or 1.8\%. Round asset turnover and earnings per share to 2 decimal places, e. . 1.25. Round payout ratio and debt to assets ratio to 0 decimg places, eg. 25\%.) Compute the following ratios for 2021 and 2022. (Round profit margin, gross profit rate and price-earnings ratio to 1 decimal places, e.g. 1.8 or 1.8%. Round osset turnover and earnings per share to 2 decimal places, e.g. 1.25. Round payout ratio and debt to assets ratio to 0 decimal places, eg. 25\%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts