Question: Need Help solving this problem from Advanced Accounting Twelfth Edition Joe B. Hoyle Ch.8 Segment and Interim Reporting. what journal entry to be

Need Help solving this problem from"Advanced Accounting Twelfth Edition Joe B. Hoyle" Ch.8Segment and

Interim Reporting.

what journal entry to be recorded on 15 March & 31 March

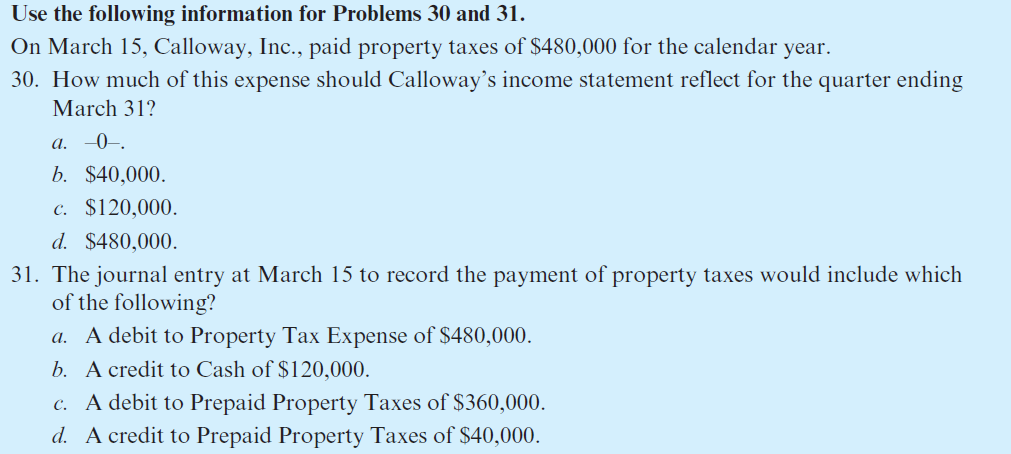

Use the following information for Problems 30 and 31. On March 15, Calloway, Inc., paid property taxes of $480,000 for the calendar year. 30. How much of this expense should lGalloway's income statement reect for the quarter ending March 31? a. 0. b. $40,000. 6. $120,000. d. $480,000. 3]. The journal entry at March 15 to record the payment of property taxes would include which of the following? a. A debit to Property Tax Expense of $480,000. 5. A credit to Cash of $120,000. 6. A debit to Prepaid Property Taxes of $360,000. d. A credit to Prepaid Property Taxes of $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts