Question: Need help solving this with explanations on how problem was solved omework.aspx?homeworkid=551616959&questionld=11&flushed=false&cld=5794703&back=DoAssignments.aspx Apps Web Slice Gallery Search Xf XFINITY by Comcas... Other bookmarks FIN-320-R3711 Principles

Need help solving this with explanations on how problem was solved

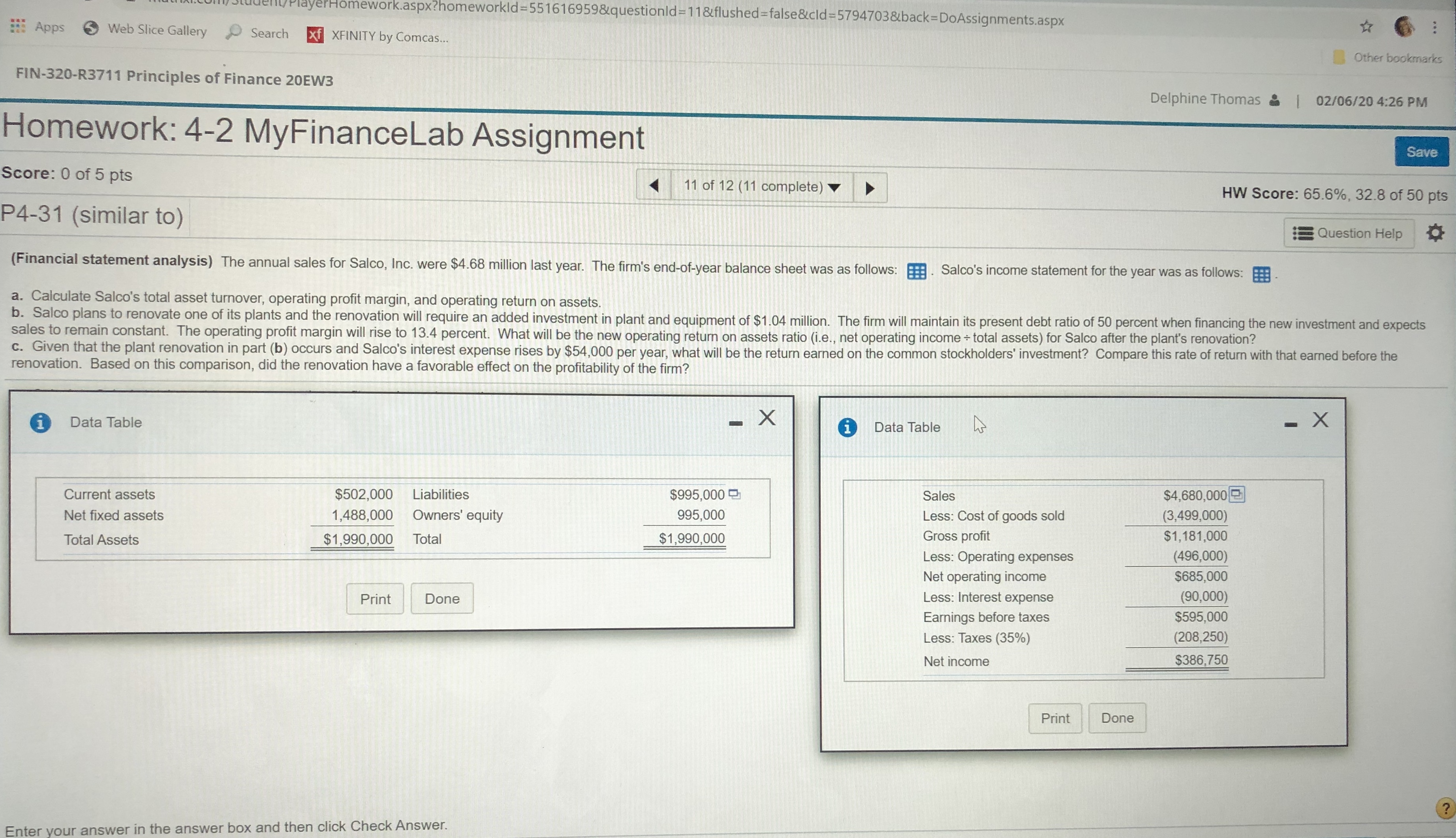

omework.aspx?homeworkid=551616959&questionld=11&flushed=false&cld=5794703&back=DoAssignments.aspx Apps Web Slice Gallery Search Xf XFINITY by Comcas... Other bookmarks FIN-320-R3711 Principles of Finance 20EW3 Delphine Thomas |02/06/20 4:26 PM Homework: 4-2 MyFinanceLab Assignment Save Score: 0 of 5 pts 11 of 12 (11 complete) HW Score: 65.6%, 32.8 of 50 pts P4-31 (similar to) Question Help (Financial statement analysis) The annual sales for Salco, Inc. were $4.68 million last year. The firm's end-of-year balance sheet was as follows: . Salco's income statement for the year was as follows: a. Calculate Salco's total asset turnover, operating profit margin, and operating return on assets. b. Salco plans to renovate one of its plants and the renovation will require an added investment in plant and equipment of $1.04 million. The firm will maintain its present debt ratio of 50 percent when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13.4 percent. What will be the new operating return on assets ratio (i.e., net operating income + total assets) for Salco after the plant's renovation? c. Given that the plant renovation in part (b) occurs and Salco's interest expense rises by $54,000 per year, what will be the return earned on the common stockholders' investment? Compare this rate of return with that earned before the renovation. Based on this comparison, did the renovation have a favorable effect on the profitability of the firm? i Data Table -X i Data Table - X Current assets $502,000 Liabilities $995,000 Sales $4,680,000 Net fixed assets 1,488,000 Owners' equity 995,000 Less: Cost of goods sold (3,499,000) Total Assets $1,990,000 Total $1,990,000 Gross profit $1, 181,000 Less: Operating expenses (496,000) Net operating income $685,000 Print Done Less: Interest expense (90,000) Earnings before taxes $595,000 Less: Taxes (35%) (208,250) Net income $386,750 Print Done Enter your answer in the answer box and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts