Question: need help solving this with work shown What conclusion do you draw from studying the behavior of these common money market base rates for business

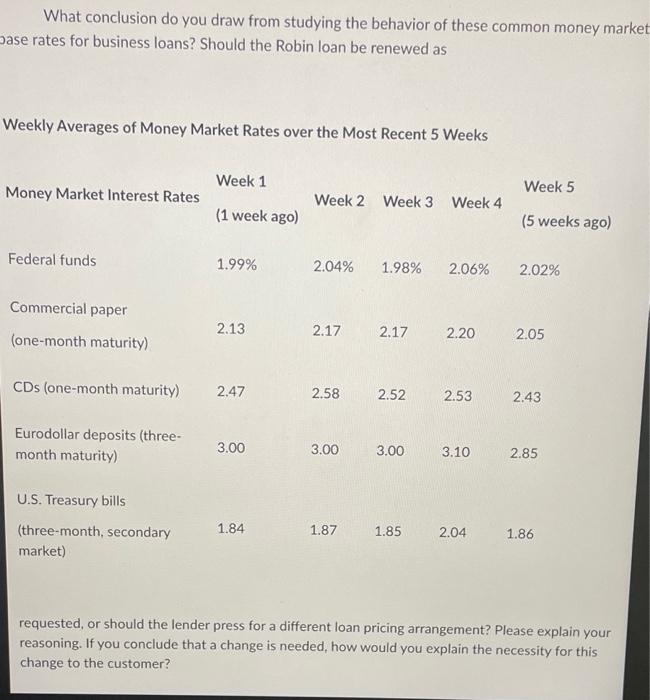

What conclusion do you draw from studying the behavior of these common money market base rates for business loans? Should the Robin loan be renewed as Weekly Averages of Money Market Rates over the Most Recent 5 Weeks Week 1 Week 5 Money Market Interest Rates Week 2 Week 3 Week 4 (1 week ago) (5 weeks ago) Federal funds 1.99% 2.04% 1.98% 2.06% 2.02% Commercial paper 2.13 2.17 2.17 2.20 2.05 (one-month maturity) CDs (one-month maturity) 2.47 2.58 2.52 2.53 2.43 Eurodollar deposits (three- 3.00 3.00 3.00 3.10 2.85 month maturity) U.S. Treasury bills 1.84 1.87 1.85 2.04 1.86 (three-month, secondary market) requested, or should the lender press for a different loan pricing arrangement? Please explain your reasoning. If you conclude that a change is needed, how would you explain the necessity for this change to the customer? What conclusion do you draw from studying the behavior of these common money market base rates for business loans? Should the Robin loan be renewed as Weekly Averages of Money Market Rates over the Most Recent 5 Weeks Week 1 Week 5 Money Market Interest Rates Week 2 Week 3 Week 4 (1 week ago) (5 weeks ago) Federal funds 1.99% 2.04% 1.98% 2.06% 2.02% Commercial paper 2.13 2.17 2.17 2.20 2.05 (one-month maturity) CDs (one-month maturity) 2.47 2.58 2.52 2.53 2.43 Eurodollar deposits (three- 3.00 3.00 3.00 3.10 2.85 month maturity) U.S. Treasury bills 1.84 1.87 1.85 2.04 1.86 (three-month, secondary market) requested, or should the lender press for a different loan pricing arrangement? Please explain your reasoning. If you conclude that a change is needed, how would you explain the necessity for this change to the customer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts