Question: Need help solving this zes/Exams D sample fir als , with sole X / D sample finalsdoopdf xpp.edu/bbcsweldav/pid 3899900-dt-content-rid-15953946 2/courses/18W CBA ACC2O7 0G/samplek20finalk.doospd ** Use

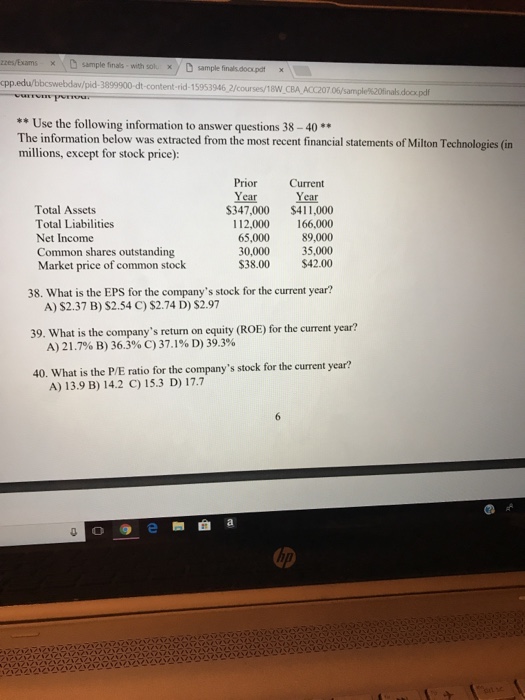

zes/Exams D sample fir als , with sole X / D sample finalsdoopdf xpp.edu/bbcsweldav/pid 3899900-dt-content-rid-15953946 2/courses/18W CBA ACC2O7 0G/samplek20finalk.doospd ** Use the following information to answer questions 38-40* The information below was extracted from the most recent financial statements of Milton Technologies (i millions, except for stock price): PriorCurrent Year Year $347,000 $411,000 Total Assets Total Liabilities Net Income Common shares outstanding Market price of common stock 112,000 166,000 65,000 89,000 30,000 35,000 $38.00 42.00 38. What is the EPS for the company's stock for the current year? A) S2.37 B) S2.54 C) S2.74 D) $2.97 39. What is the company's return on equity (ROE) for the current year? A) 21.7% B) 36.3% C) 37.1% D) 39.3% 40. What is the P/E ratio for the company's stock for the current year? A) 13.9 B) 14.2 C) 15.3 D) 17.7 o@e lip

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts