Question: need help!!! thank you Question 9 3.34 pts Below is balance sheet information for the year 2020 and 2019 of United Manufacturing Co. 2020 2019

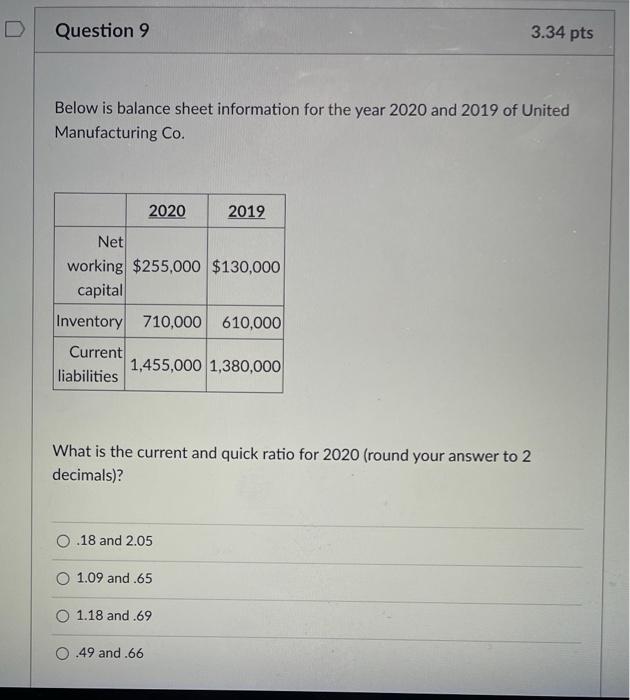

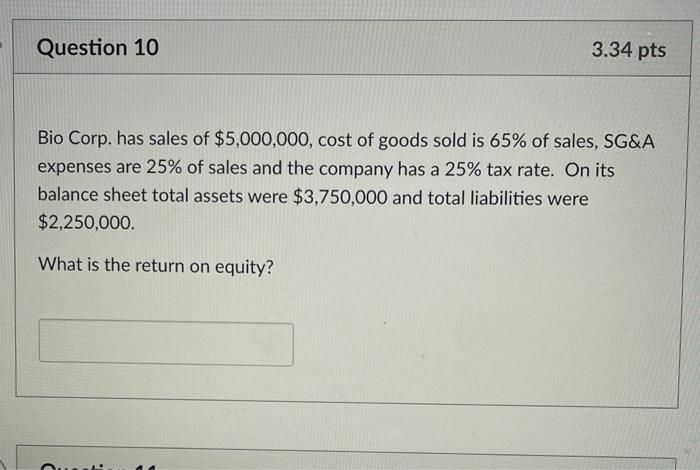

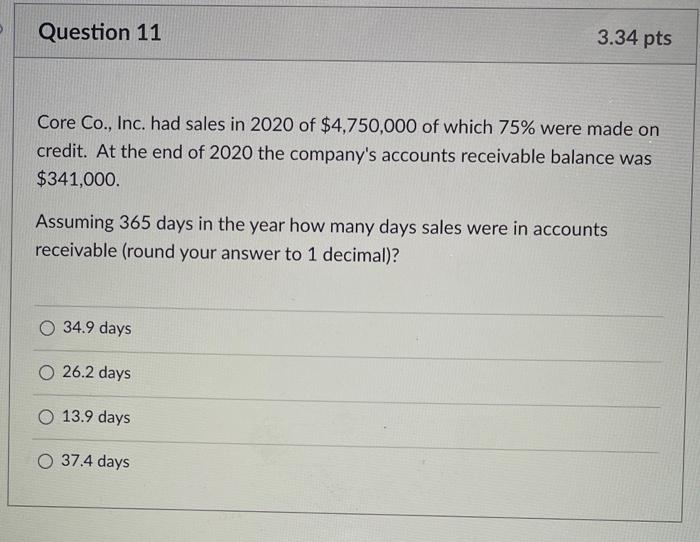

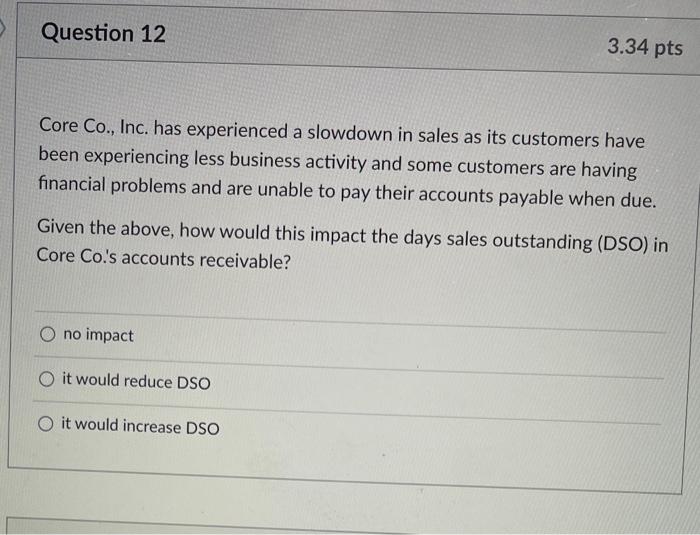

Question 9 3.34 pts Below is balance sheet information for the year 2020 and 2019 of United Manufacturing Co. 2020 2019 Net working $255,000 $130,000 capital Inventory 710,000 610,000 Current 1,455,000 1,380,000 liabilities What is the current and quick ratio for 2020 (round your answer to 2 decimals)? 0.18 and 2.05 O 1.09 and .65 1.18 and .69 O.49 and .66 Question 10 3.34 pts Bio Corp. has sales of $5,000,000, cost of goods sold is 65% of sales, SG&A expenses are 25% of sales and the company has a 25% tax rate. On its balance sheet total assets were $3,750,000 and total liabilities were $2,250,000. What is the return on equity? Question 11 3.34 pts Core Co., Inc. had sales in 2020 of $4,750,000 of which 75% were made on credit. At the end of 2020 the company's accounts receivable balance was $341,000. Assuming 365 days in the year how many days sales were in accounts receivable (round your answer to 1 decimal)? 34.9 days O 26.2 days O 13.9 days O 37.4 days Question 12 3.34 pts Core Co., Inc. has experienced a slowdown in sales as its customers have been experiencing less business activity and some customers are having financial problems and are unable to pay their accounts payable when due. Given the above, how would this impact the days sales outstanding (DSO) in Core Co.'s accounts receivable? no impact O it would reduce DSO O it would increase DSO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts