Question: Need help, thanks in advance Suppose that JB Cos, has a capital structure of 75 percent equity, 25 percent debt, and that its before-tax cost

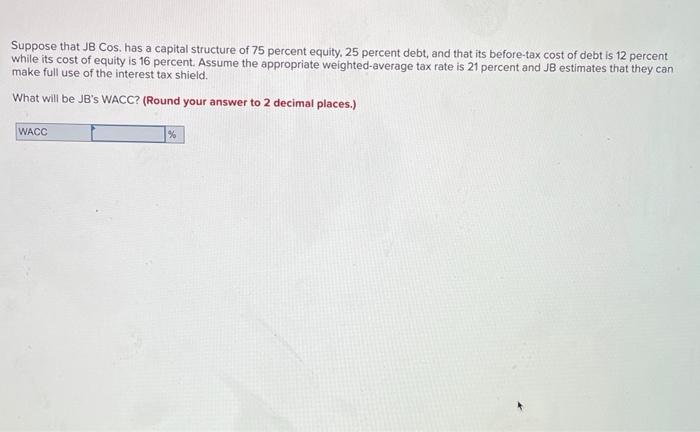

Suppose that JB Cos, has a capital structure of 75 percent equity, 25 percent debt, and that its before-tax cost of debt is 12 percent while its cost of equity is 16 percent. Assume the appropriate weighted-average tax rate is 21 percent and JB estimates that they can make full use of the interest tax shield. What will be JB's WACC? (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts