Question: NEED HELP.. This is a question that was downloaded and already printed on the excel sheet if anyone is wondering where the excel sheet may

NEED HELP.. This is a question that was downloaded and already printed on the excel sheet if anyone is wondering where the excel sheet may be.

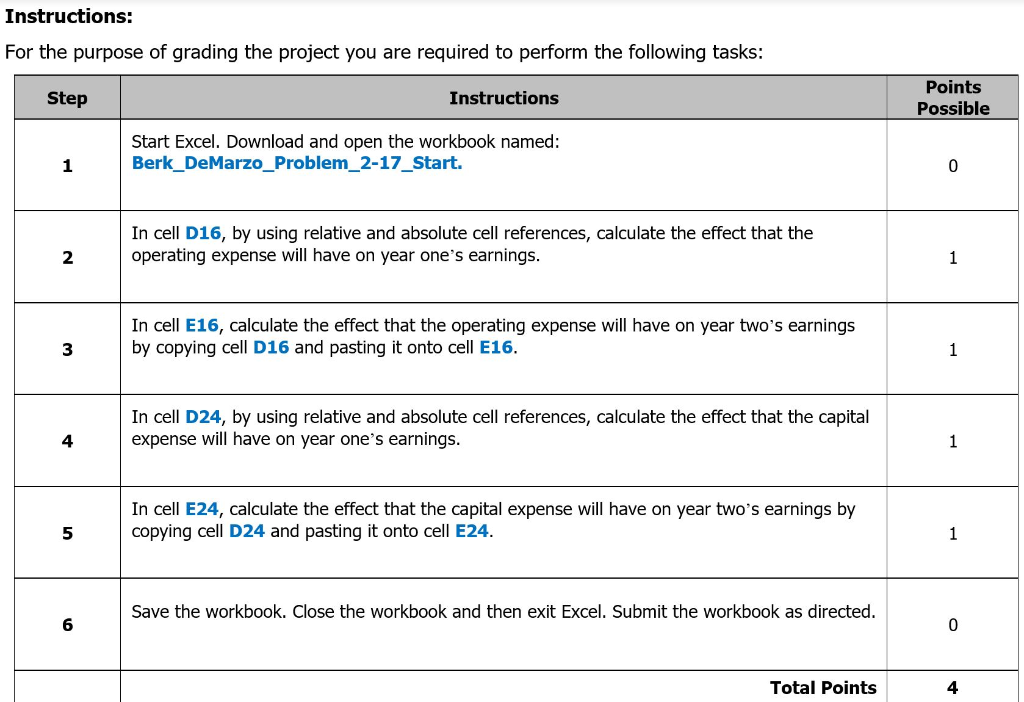

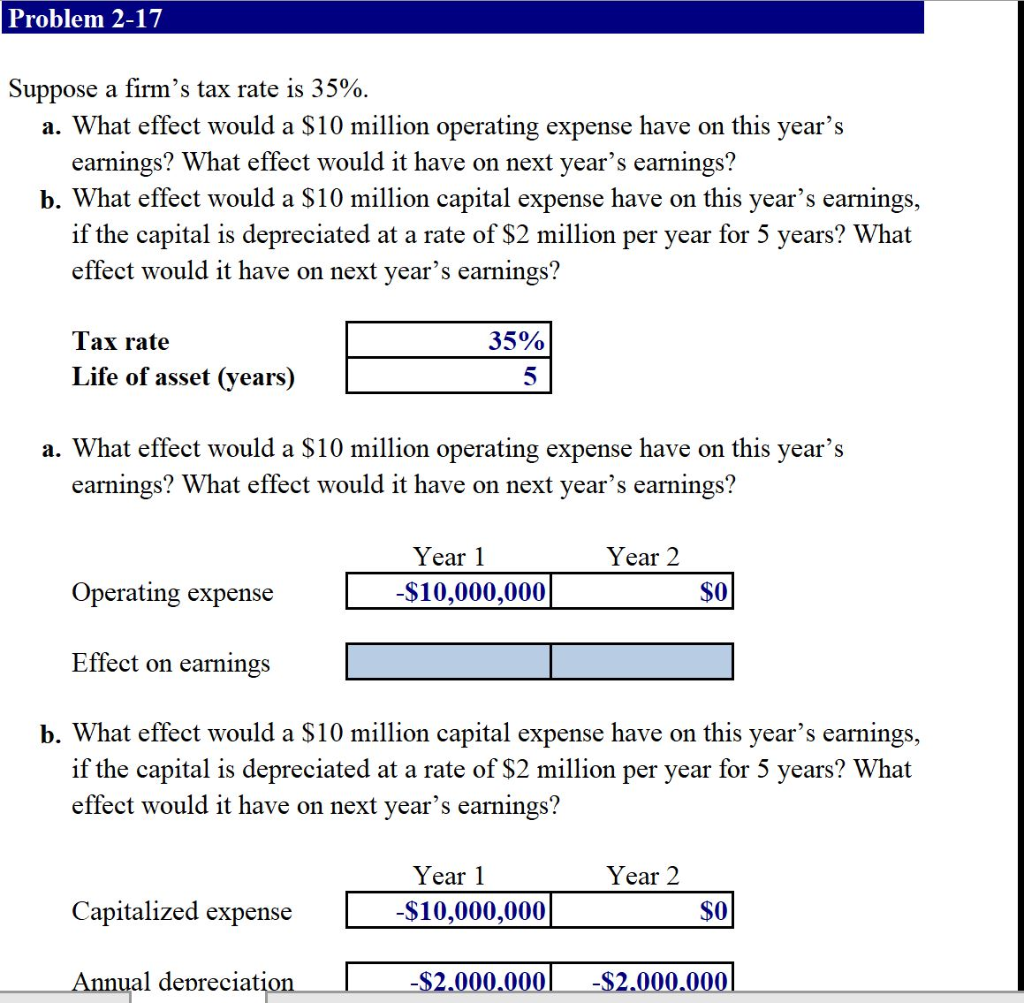

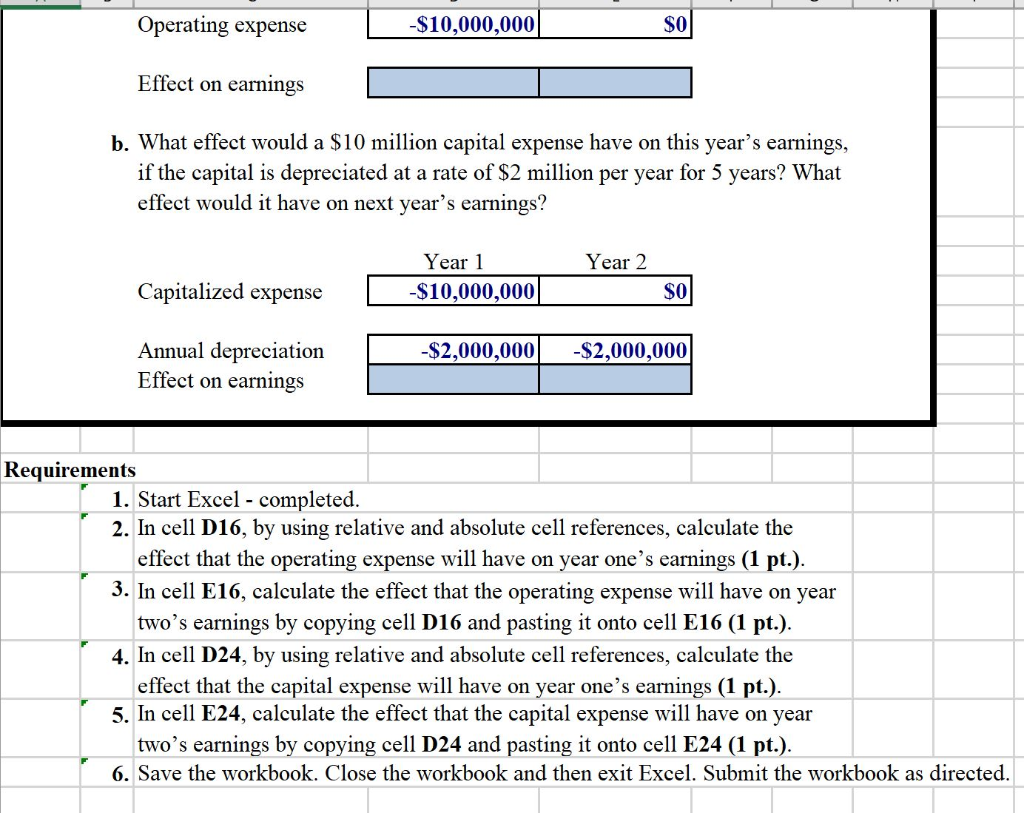

Instructions: For the purpose of grading the project you are required to perform the following tasks: Points Possible Step Instructions Start Excel. Download and open the workbook named: 1 Berk_ DeMarzo_Problem_2-17_Start. 0 In cell D16, by using relative and absolute cell references, calculate the effect that the 2operating expense will have on year one's earnings. 2 In cell E16, calculate the effect that the operating expense will have on year two's earnings 3 by copying cell D16 and pasting it onto cell E16. In cell D24, by using relative and absolute cell references, calculate the effect that the capital expense will have on year one's earnings 4 In cell E24, calculate the effect that the capital expense will have on year two's earnings by 5 copying cell D24 and pasting it onto cell E24. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. 6 0 Total Points 4 Problem 2-17 Suppose a firm's tax rate is 35% a. What effect would a $10 million operating expense have on this year's earnings? What effect would it have on next year's earnings? b. What effect would a $10 million capital expense have on this year's earnings, if the capital is depreciated at a rate of $2 million per year for 5 years? What effect would it have on next vear's earnings? 35% Tax rate Life of asset (years) a. What effect would a S10 million operating expense have on this year's earnings? What effect would it have on next vear's earnings? Year 1 Year 2 SO Operating expense -$10,000,000 Effect on earnings b. What effect would a $10 million capital expense have on this year's earnings, if the capital is depreciated at a rate of $2 million per year for 5 years? What effect would it have on next vear's earnings? Year 1 Year 2 Capitalized expense S0 -$10,000,000 al deoreciati Operating expense -$10,000,000 SO Effect on earnings b. What effect would a $10 million capital expense have on this year's earnings, if the capital is depreciated at a rate of $2 million per year for 5 years? What effect would it have on next vear's earnings? ear 1 ear 2 Capitalized expense -$10,000,000 SO Annual depreciation Effect on earnings -$2,000,000-$2,000,000 Requirements 1. Start Excel - completed 2. In cell D16, by using relative and absolute cell references, calculate the effect that the operating expense will have on year one's earnings (1 pt.) 3. In cell E16, calculate the effect that the operating expense will have on year two's earnings by copying cell D16 and pasting it onto cell E16 (1 pt.) 4. In cell D24, by using relative and absolute cell references, calculate the effect that the capital expense will have on year one's earnings (1 pt 5. In cell E24, calculate the effect that the capital expense will have on year two's earnings by copying cell D24 and pasting it onto cell E24 (1 pt.) 6. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed .)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts