Question: Need help to see if I am doing this correctly. The following data refers to Huron Corporation for the year 20x2. Sales revenue Raw-material inventory,

Need help to see if I am doing this correctly.

Need help to see if I am doing this correctly.

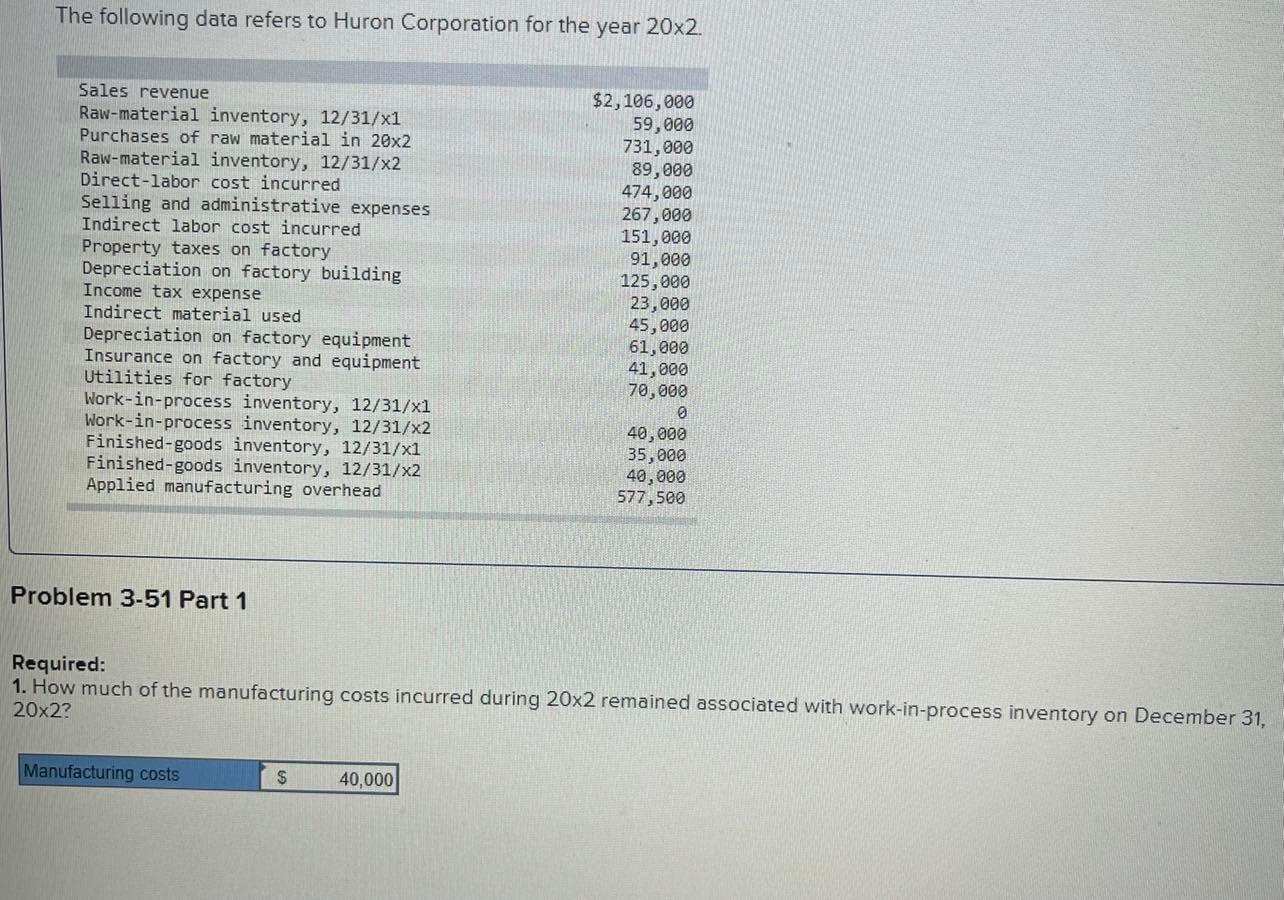

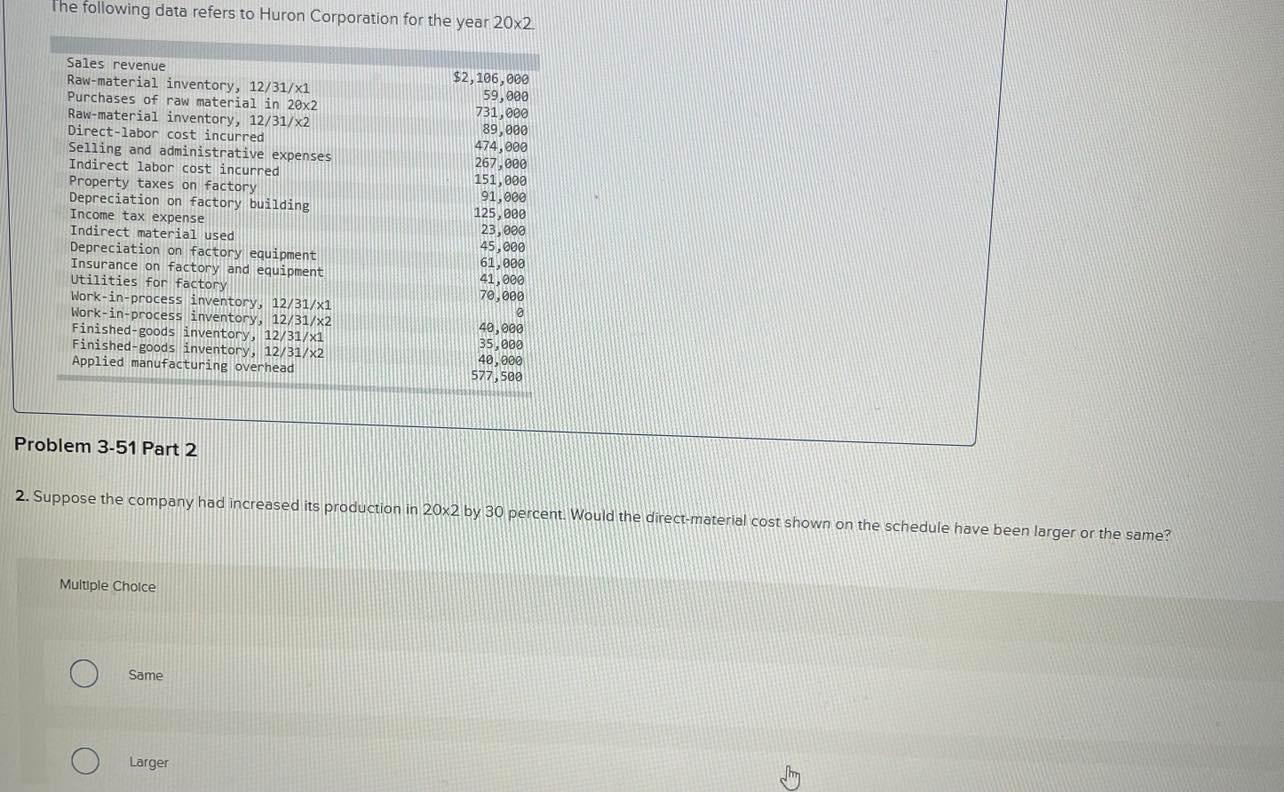

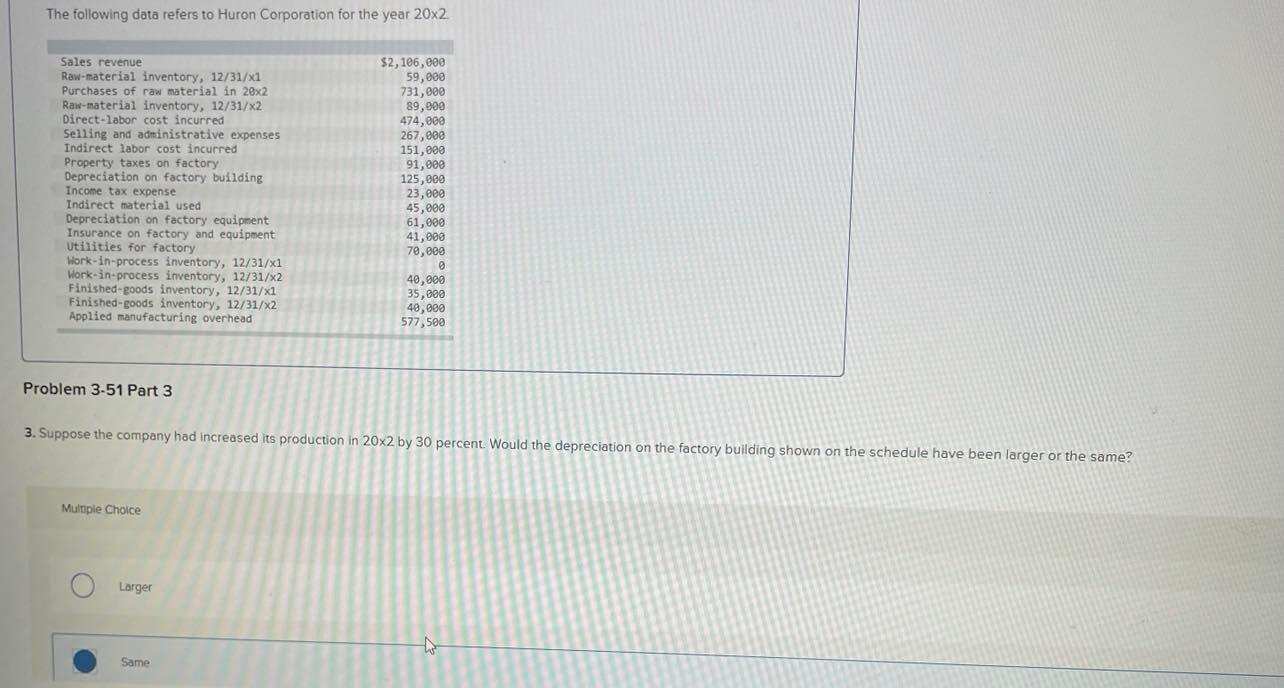

The following data refers to Huron Corporation for the year 20x2. Sales revenue Raw-material inventory, 12/31/x1 Purchases of raw material in 20x2 Raw-material inventory, 12/31/x2 Direct-labor cost incurred Selling and administrative expenses Indirect labor cost incurred Property taxes on factory Depreciation on factory building Income tax expense Indirect material used Depreciation on factory equipment Insurance on factory and equipment Utilities for factory Work-in-process inventory, 12/31/x1 Work-in-process inventory, 12/31/x2 Finished-goods inventory, 12/31/x1 Finished-goods inventory, 12/31/X2 Applied manufacturing overhead $2,106,000 59,000 731,000 89,000 474,000 267,000 151,000 91,000 125,000 23,000 45,000 61,000 41,000 70,000 40,000 35,000 40,000 577,500 Problem 3-51 Part 1 Required: 1. How much of the manufacturing costs incurred during 20x2 remained associated with work-in-process inventory on December 31, 20x2? Manufacturing costs $ 40,000 The following data refers to Huron Corporation for the year 20x2 Sales revenue Raw-material inventory, 12/31/xi Purchases of raw material in 20x2 Raw-material inventory, 12/31/X2 Direct-labor cost incurred Selling and administrative expenses Indirect labor cost incurred Property taxes on factory Depreciation on factory building Income tax expense Indirect material used Depreciation on factory equipment Insurance on factory and equipment Utilities for factory Work-in-process inventory, 12/31/x1 TH Work-in-process inventory, 12/31/X2 Finished-goods inventory, 12/31/X1 Finished-goods inventory, 12/31/X2 Applied manufacturing overhead $2,106,000 59,000 731,000 89,000 474,000 267,000 151,000 91,000 125,000 23,000 45,000 61,800 41,000 70,000 a 40,000 35,000 40,000 577,500 Problem 3-51 Part 2 2. Suppose the company had increased its production in 20x2 by 30 percent. Would the direct-material cost shown on the schedule have been larger or the same? Multiple Choice Same Larger thg The following data refers to Huron Corporation for the year 20x2 Sales revenue Raw-material inventory, 12/31/X1 Purchases of raw material in 20x2 Raw-material inventory, 12/31/x2 Direct-labor cost incurred Selling and administrative expenses Indirect labor cost incurred Property taxes on factory Depreciation on factory building Income tax expense Indirect material used Depreciation on factory equipment Insurance on factory and equipment Utilities for factory Work-in-process inventory, 12/31/1 Vork-in-process inventory, 12/31/X2 Finished-goods inventory, 12/31/x1 Finished-goods inventory, 12/31/X2 Applied manufacturing overhead $2,106,000 59,000 731,000 89,000 474,000 267,000 151,000 91,000 125,000 23,000 45,000 61,000 41,000 70,000 40,000 35,000 40,000 577,500 Problem 3-51 Part 3 3. Suppose the company had increased its production in 20x2 by 30 percent. Would the depreciation on the factory building shown on the schedule have been larger or the same? Multiple Choice Larger Same

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts