Question: Need help to solve this problem by tomorrow Thank you Unit sales Sales price Variable cost per unit Fixed operating costs except depreciation Accelerated depreciation

Need help to solve this problem by tomorrow

Thank you

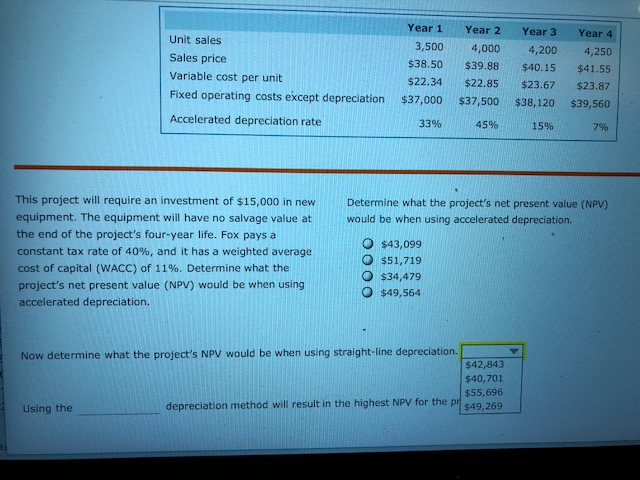

Unit sales Sales price Variable cost per unit Fixed operating costs except depreciation Accelerated depreciation rate Year 1 3,500 $38.50 $22.34 $37,000 33% Year 2 4,000 $39.88 $22.85 $37,500 45% Year 3 4,200 $40.15 $23.67 $38,120 15% Year 4 4,250 $41.55 $23.87 $39,560 This project will require an investment of $15,000 in new equipment. The equipment will have no salvage value at the end of the project's four-year life. Fox pays a constant tax rate of 40%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be when using accelerated depreciation. Determine what the project's net present value (NPV) would be when using accelerated depreciation. O $43,099 O $51,719 O $34,479 O $49,564 Now determine what the project's NPV would be when using straight-line depreciation. E $42,843 $40,701 $55,696 Using the depreciation method will result in the highest NPV for the pr dag 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts