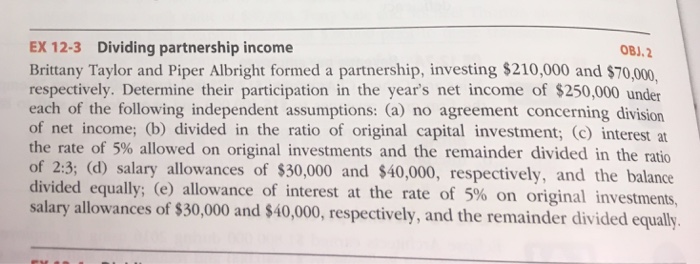

Question: Need help to solve this problem please... Brittany Taylor and Piper Albright formed a partnership, investing $210,000 and $70,000. respectively. Determine their participation in the

Brittany Taylor and Piper Albright formed a partnership, investing $210,000 and $70,000. respectively. Determine their participation in the year's net income of $250,000 under each of the following independent assumptions: (a) no agreement concerning division of net income: (b) divided in the ratio of original capital investment: (c) interest at the rate of 5% allowed on original investments and the remainder divided in the ratio of 2: 3: (d) salary allowances of $30,000 and $40,000, respectively, and the balance divided equally: (e) allowance of interest at the rate of 5% on original investments salary allowances of $30,000 and $40,000, respectively, and the remainder divided equally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts