Question: need help to solve this problem Sarah exchanges a building and land (used in its business) for Tyler's land and building and some equipment (used

need help to solve this problem

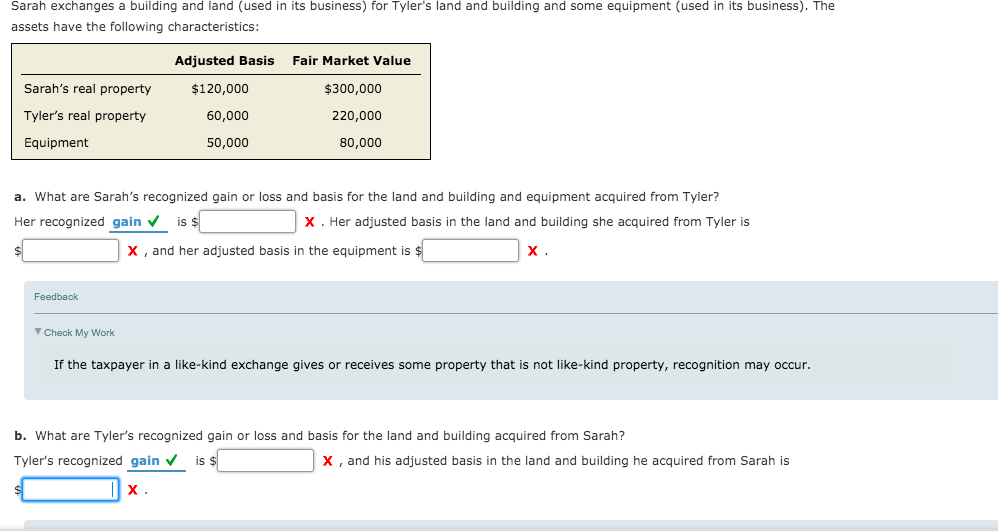

Sarah exchanges a building and land (used in its business) for Tyler's land and building and some equipment (used in its business). The assets have the following characteristics: Fair Market Value Sarah's real property Tyler's real property Equipment Adjusted Basis $120,000 60,000 50,000 $300,000 220,000 80,000 a. What are Sarah's recognized gain or loss and basis for the land and building and equipment acquired from Tyler? Her recognized gain is $ x. Her adjusted basis in the land and building she acquired from Tyler is x, and her adjusted basis in the equipment is $ Feedback Check My Work If the taxpayer in a like-kind exchange gives or receives some property that is not like-kind property, recognition may occur. b. What are Tyler's recognized gain or loss and basis for the land and building acquired from Sarah? Tyler's recognized gain is $ x, and his adjusted basis in the land and building he acquired from Sarah is x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts