Question: Need help to solve this question 1, together with some explanation.. thank you QUESTION 1 Handicraft Advance Bhd is a company incorporated in Malaysia. Its

Need help to solve this question 1, together with some explanation.. thank you

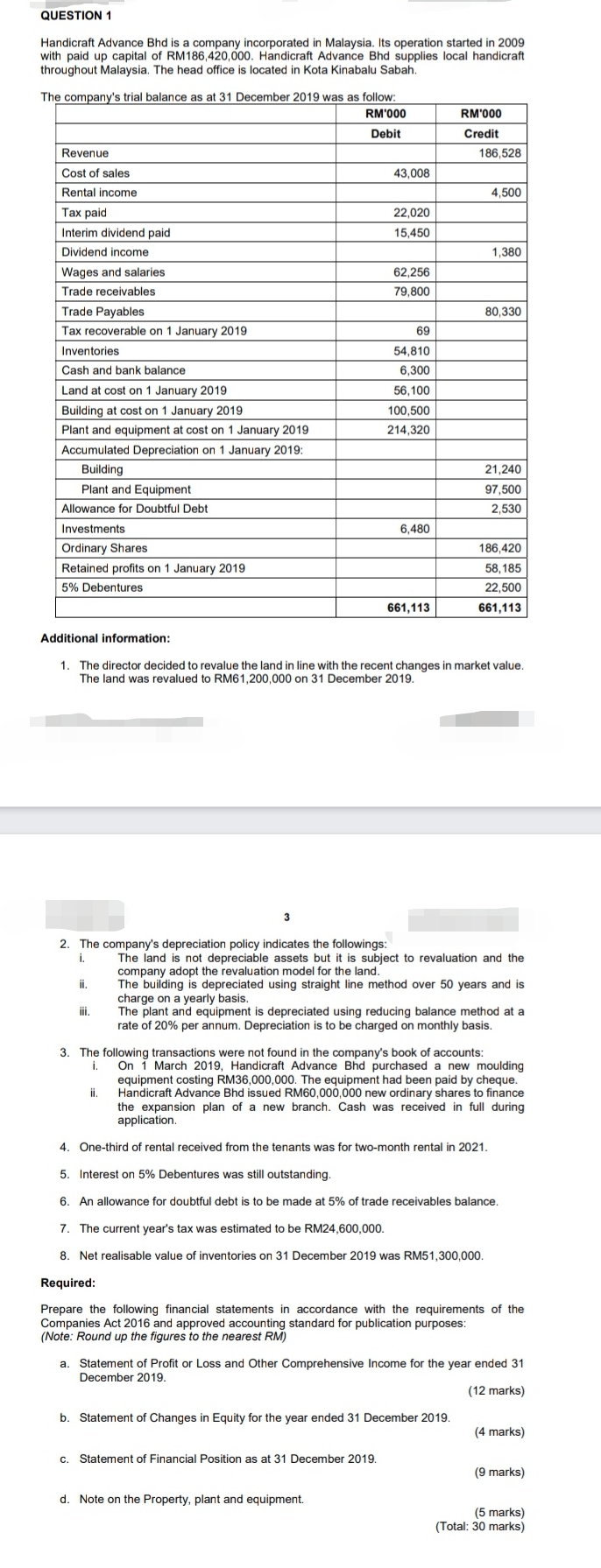

QUESTION 1 Handicraft Advance Bhd is a company incorporated in Malaysia. Its operation started in 2009 with paid up capital of RM186,420,000. Handicraft Advance Bhd supplies local handicraft throughout Malaysia. The head office is located in Kota Kinabalu Sabah. The company's trial balance as at 31 December 2019 was as follow: RM'000 RM'000 Debit Credit Revenue 186,528 Cost of sales 43,008 Rental income 4,500 Tax paid 22,020 Interim dividend paid 15,450 Dividend income 1,380 s and sal 52,256 Trade receivables 79,800 Trade Payables 80,330 Tax recoverable on 1 January 2019 69 Inventories 54,810 Cash and bank balance 6,300 Land at cost on 1 January 2019 56,100 Building at cost on 1 January 2019 100,500 Plant and equipment at cost on 1 January 2019 214,320 Accumulated Depreciation on 1 January 2019: Building 21,240 Plant and Equipment 97,500 Allowance for Doubtful Debt 2,530 Investments 6,480 Ordinary Shares 186,420 Retained profits on 1 January 2019 58,185 5% Debentures 22,500 661,113 661,113 Additional information: 1. The director decided to revalue the land in line with the recent changes in market value. The land was revalued to RM61,200,000 on 31 December 2019. 2. The company's depreciation policy indicates the followings: The land is not depreciable assets but it is subject to revaluation and the company adopt the revaluation model for the land. The building is depreciated using straight line method over 50 years and is charge on a yearly basis. ii The plant and equipment is depreciated using reducing balance method at a rate of 20% per annum. Depreciation is to be charged on monthly basis. 3. The following transactions were not found in the company's book of accounts: i. On 1 March 2019, Handicraft Advance Bhd purchased a new moulding equipment costing RM36,000,000. The equipment had been paid by cheque. ii. Handicraft Advance Bhd issued RM60,000,000 new ordinary shares to finance the expansion plan of a new branch. Cash was received in full during application. 4. One-third of rental received from the tenants was for two-month rental in 2021. 5. Interest on 5% Debentures was still outstanding 6. An allowance for doubtful debt is to be made at 5% of trade receivables balance. 7. The current year's tax was estimated to be RM24,600,000. 8. Net realisable value of inventories on 31 December 2019 was RM51,300,000. Required: Prepare the following financial statements in accordance with the requirements of the Companies Act 2016 and approved accounting standard for publication purposes: (Note: Round up the figures to the nearest RM) a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019. (12 marks) b. Statement of Changes in Equity for the year ended 31 December 2019. (4 marks) C. Statement of Financial Position as at 31 December 2019. (9 marks) d. Note on the Property, plant and equipment. (5 marks) (Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts