Question: Need help TRUE The portfolio's total standard deviation will always be less than the average of the standard deviations of the assets that comprise the

Need help

Need help

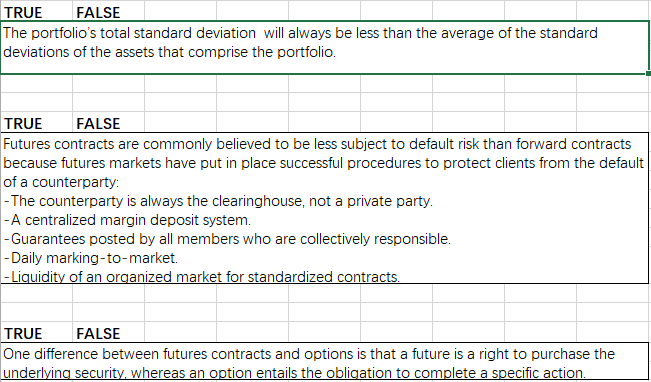

TRUE The portfolio's total standard deviation will always be less than the average of the standard deviations of the assets that comprise the portfolio FALSE TRUE Futures contracts are commonly believed to be less subject to default risk than forward contracts because futures markets have put in place successful procedures to protect clients from the default of a counterparty: The counterparty is always the clearinghouse, not a private party FALSE A centralized margin deposit system. -Guarantees posted by all members who are collectively responsible Daily marking-to-market. TRUE One difference between futures contracts and options is that a future is a right to purchase the underlying sec FALSE whereas an option entails the obligation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts