Question: need help veifying Problem 7-37 (a) (Lo. 3, 5) Through a Type BI reorganization, Golden Corporation acquired 30% of DragonCo stock by September 25 of

need help veifying

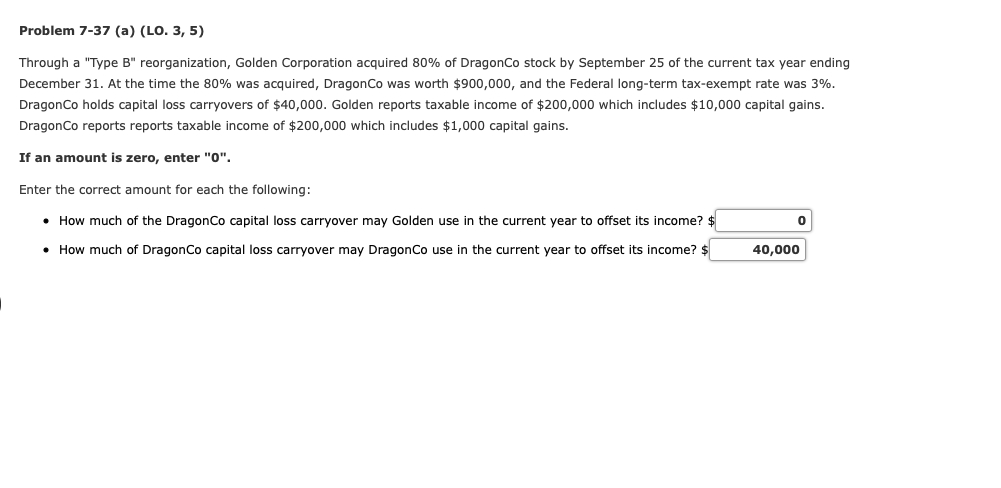

Problem 7-37 (a) (Lo. 3, 5) Through a "Type B"I reorganization, Golden Corporation acquired 30% of DragonCo stock by September 25 of the current tax year ending December 31. At the time the 80% was acquired, DragonCo was worth $900,000, and the Federal long-term tax-exempt rate was 3%. DragonCo holds capital loss carryovers of $40,000. Golden reports taxable income of $200,000 which. includes $10,000 capital gains. DragonCo reports reports taxable income of $200,000 which includes $1,000 capital gains. If an amount ls zero, enter "0". Enter the correct amount for each. the following: o How much ofthe DragonCo capital loss carryover may Golden use In the current year to offset Its Income? 0 How much of DragonCo capItaI loss carryover may DragonCo use In the current year to offset Its Income? $ 40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts