Question: need help w 7-2, 7-4 & 7-9 please EMC Corporation's current free cash flow is $400,000 and is expected to grow at a constant rate

need help w 7-2, 7-4 & 7-9 please

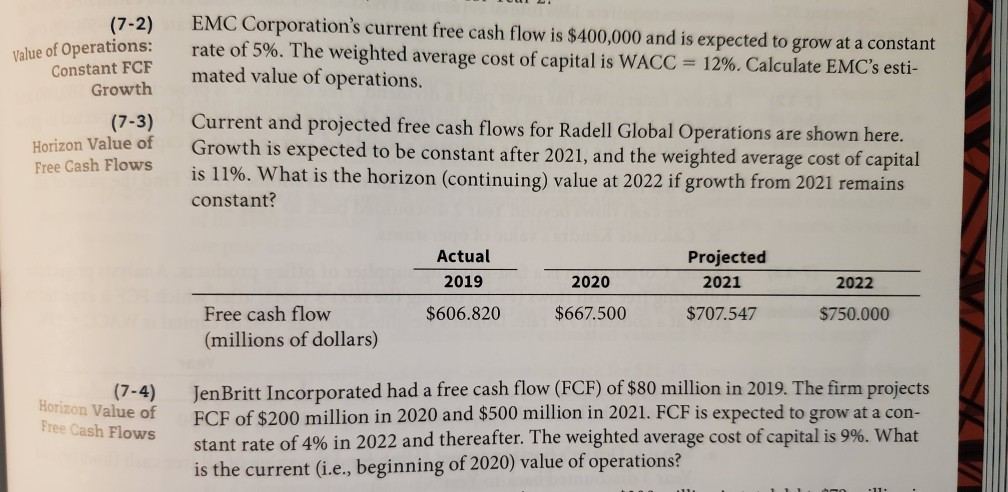

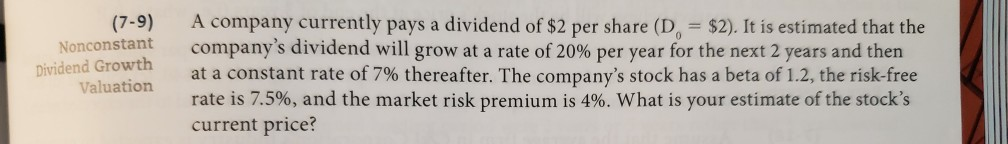

EMC Corporation's current free cash flow is $400,000 and is expected to grow at a constant rate of 5%. The weighted average cost of capital is WACC = 12%. Calculate EMC's esti- mated value of operations. Value of Operations: Constant FCF Growth (7-3) Horizon Value of Free Cash Flows Current and projected free cash flows for Radell Global Operations are shown here. Growth is expected to be constant after 2021, and the weighted average cost of capital is 11%. What is the horizon (continuing) value at 2022 if growth from 2021 remains constant? Actual 2019 2020 Projected 2021 $707.547 2022 $606.820 $667.500 $750.000 Free cash flow (millions of dollars) (7-4) Horizon Value of Free Cash Flows Jen Britt Incorporated had a free cash flow (FCF) of $80 million in 2019. The firm projects FCF of $200 million in 2020 and $500 million in 2021. FCF is expected to grow at a con- stant rate of 4% in 2022 and thereafter. The weighted average cost of capital is 9%. What is the current (i.e., beginning of 2020) value of operations? (7-9) Nonconstant Dividend Growth Valuation A company currently pays a dividend of $2 per share (D = $2). It is estimated that the company's dividend will grow at a rate of 20% per year for the next 2 years and then at a constant rate of 7% thereafter. The company's stock has a beta of 1.2, the risk-free rate is 7.5%, and the market risk premium is 4%. What is your estimate of the stock's current price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts