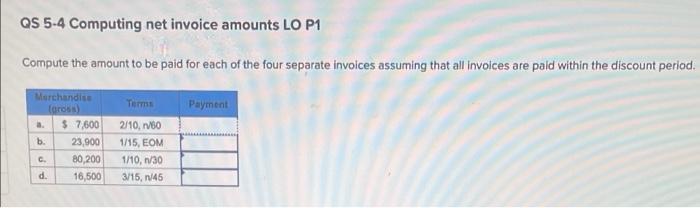

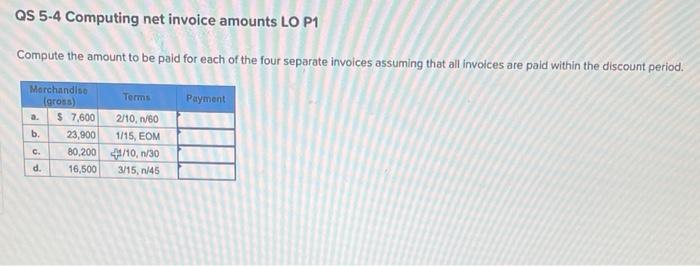

Question: need help what are the answers? QS 5-4 Computing net invoice amounts LO P1 Compute the amount to be paid for each of the four

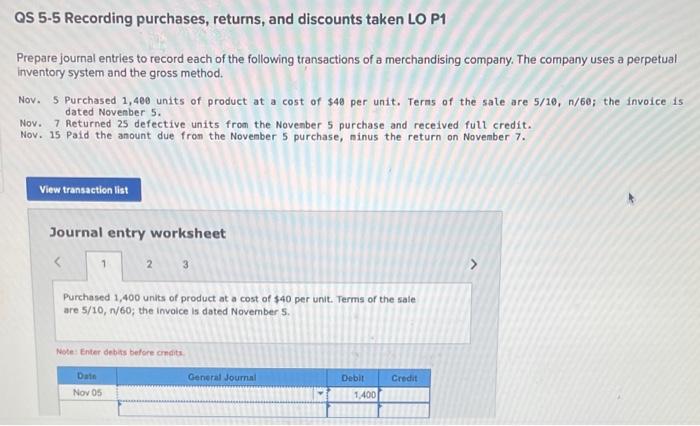

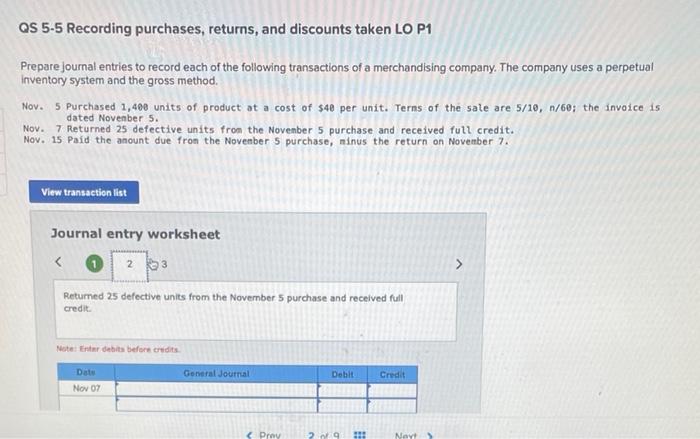

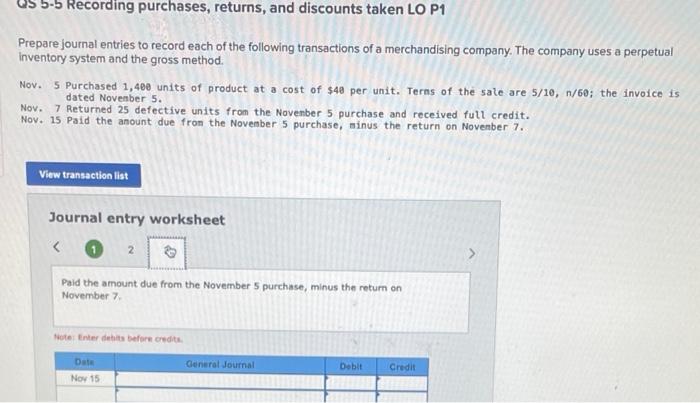

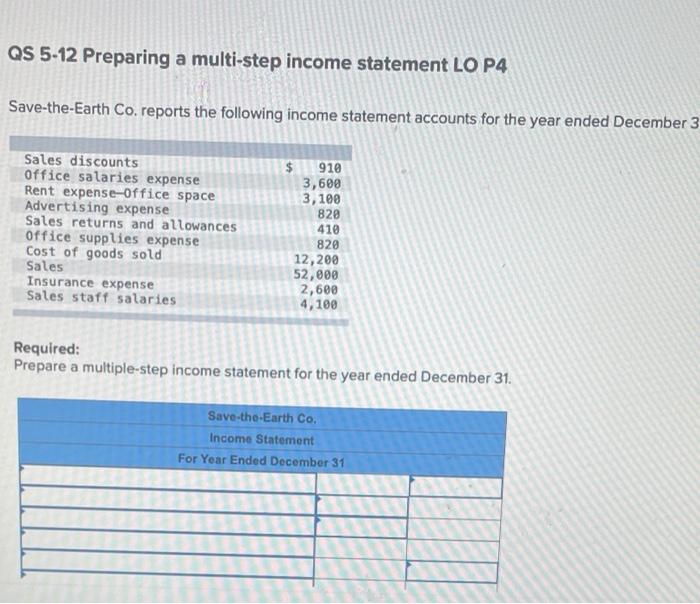

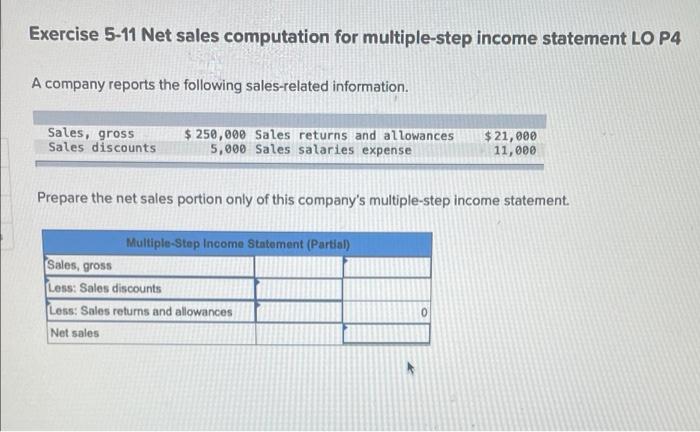

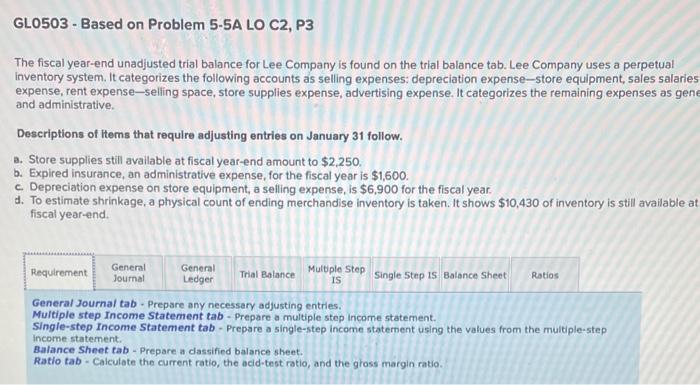

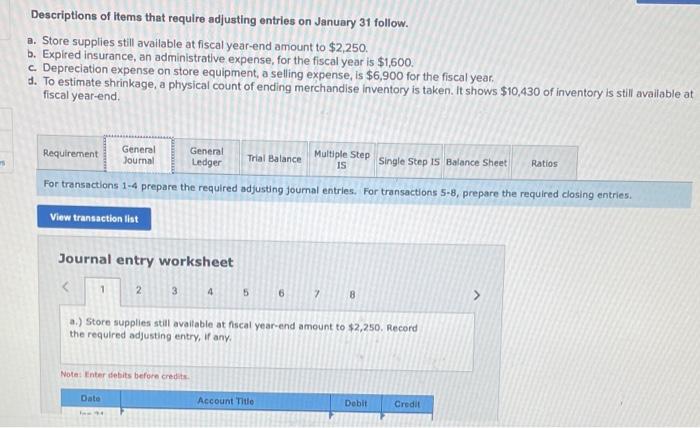

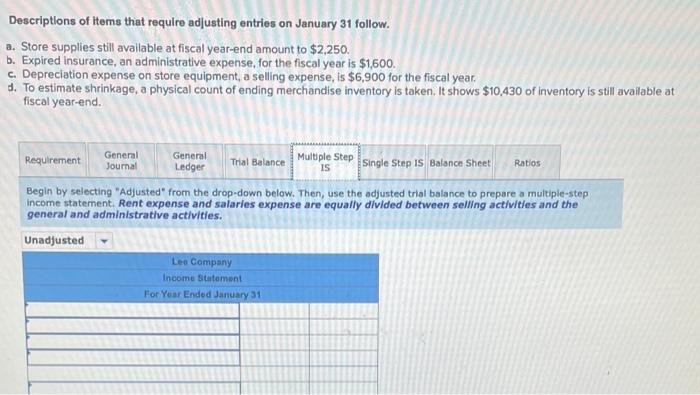

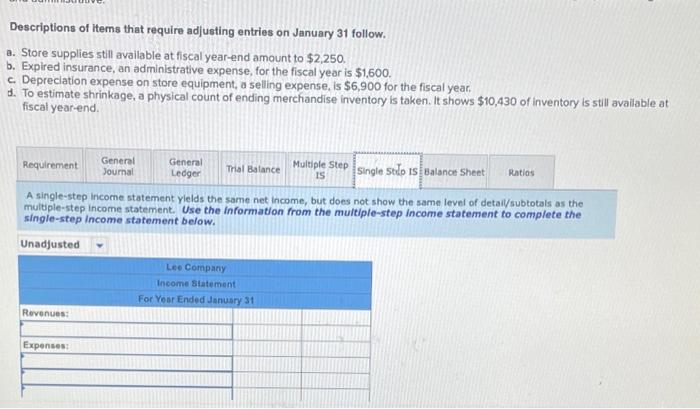

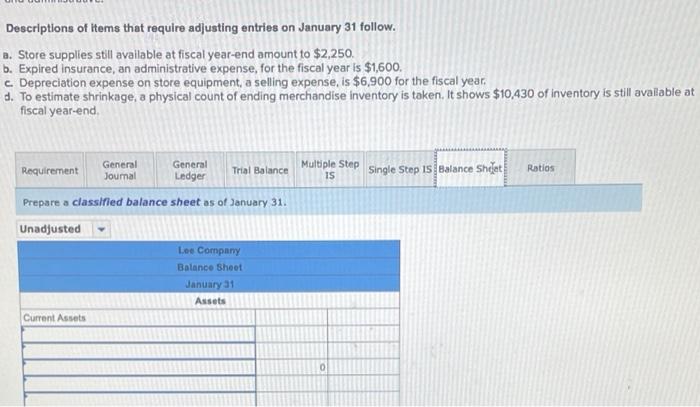

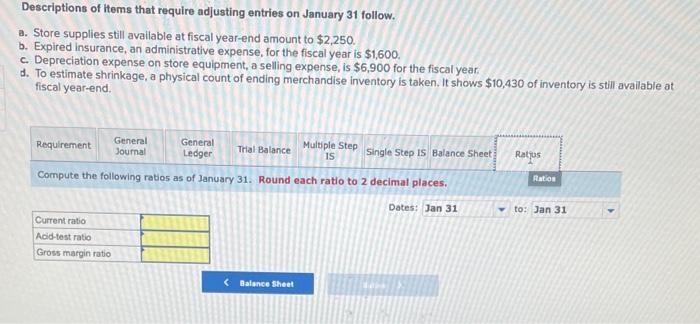

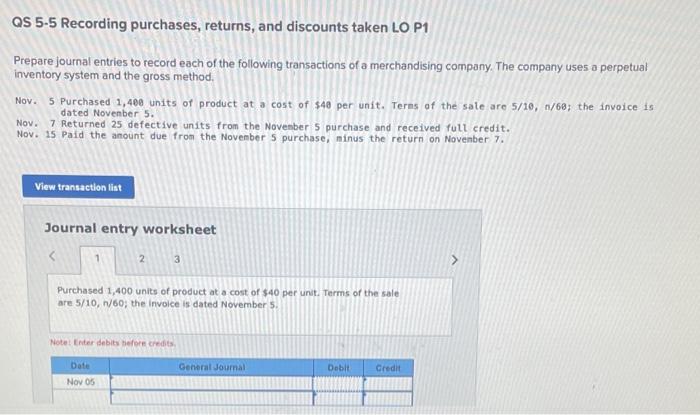

QS 5-4 Computing net invoice amounts LO P1 Compute the amount to be paid for each of the four separate invoices assuming that all involces are paid within the discount period Terms Payment Merchandise (oros) $ 7,600 b. 23,900 80,200 d. 16,500 2/10, 1060 1/15, EOM 1/10, 1/30 3/15, 1/45 G. QS 5-5 Recording purchases, returns, and discounts taken LO P1 Prepare journal entries to record each of the following transactions of a merchandising company. The company uses a perpetual inventory system and the gross method. Nov. 5 Purchased 1,400 units of product at a cost of $40 per unit. Terns of the sale are 5/10, 1/60; the invoice is dated November 5. Nov. 7 Returned 25 defective units from the November 5 purchase and received full credit. Nov. 15 Paid the anount due from the November 5 purchase, ninus the return on November 7. View transaction list Journal entry worksheet 2 3 Purchased 1,400 units of product at a cost of $40 per unit. Terms of the sale are 5/10, 1/60; the involce is dated November s. Note: Enter debits before credits General Journal Debit Credit Dain Nov 05 1.400 QS 5-5 Recording purchases, returns, and discounts taken LO P1 Prepare journal entries to record each of the following transactions of a merchandising company. The company uses a perpetual Inventory system and the gross method. Nov. 5 Purchased 1,400 units of product at a cost of $40 per unit. Terns of the sale are 5/10, 1/60: the invoice is dated November 5. Nov. 7 Returned 25 defective units from the November 5 purchase and received full credit. Nov. 15 Paid the anount due fron the November 5 purchase, minus the return on November 7. View transaction list Journal entry worksheet 23 > Returned 25 defective units from the November 5 purchase and received full credit Note: Enter debit before credits General Journal Debit Date Nov 07 Credit a.) Store supplies still available at fiscal year-end amount to $2,250. Record the required adjusting entry, if any. Nota: Enter debits before credits Date Account Title Dobit Credit Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,250. b. Expired insurance, an administrative expense, for the fiscal year is $1,600. c. Depreciation expense on store equipment , a selling expense, is $6,900 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,430 of Inventory is still available at fiscal year-end. Requirement General General Multiple Step Journal Ledger Trial Balance Ratios IS Single Step Is Balance Sheet Begin by selecting "Adjusted from the drop-down below. Then, use the adjusted trial balance to prepare a multiple-step income statement. Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities. Unadjusted Les Company Income Statement For Your Ended January 31 Descriptions of Items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,250. b. Expired insurance, an administrative expense, for the fiscal year is $1.600. c Depreciation expense on store equipment, a seling expense, is $6,900 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,430 of inventory is still avallable at fiscal year-end Requirement General Journal General Ledger Trial Balance Multiple Step single sedo is Balance Sheet IS Ratios A single-step Income statement yields the same net income, but does not show the same level of detail/subtotals as the multiple-step Income statement. Use the information from the multiple-step Income statement to complete the single-step Income statement below. Unadjusted Lee Company Income Statement For Year Ended January 31 Revenues: Expenses: Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,250. b. Expired insurance, an administrative expense, for the fiscal year is $1,600, c Depreciation expense on store equipment, a selling expense, is $6,900 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,430 of inventory is still available at fiscal year-end Multiple Step 1S Single Step Is Balance Sheet Ratios General General Requirement Trial Balance Journal Ledger Prepare a classified balance sheet as of January 31. Unadjusted Lee Company Balance Sheet January 31 Assets Current Assets 0 Descriptions of items that require adjusting entries on January 31 follow. a. Store supplies still available at fiscal year-end amount to $2,250. b. Expired insurance, an administrative expense, for the fiscal year is $1,600 c Depreciation expense on store equipment, a selling expense, is $6,900 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,430 of inventory is still available at fiscal year-end Requirement General Journal General Ledger Trial Balance Multiple Step IS Single Step Is Balance Sheet Ratus Ratios Compute the following ratios as of January 31. Round each ratio to 2 decimal places. Dates: Jan 31 Current ratio Add-test ratio Gross margin ratio to: Jan 31 Purchased 1,400 units of product at a cost of $40 per unit. Terms of the sale are 5/10, V60, the invoice is dated November 5. Note Enter debits before credits Date General Journal Dobit Credit Nov 05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts