Question: need help will rate your answer 1. A firm is expected to have a high growth rate in the next 3 years and a stable

need help will rate your answer

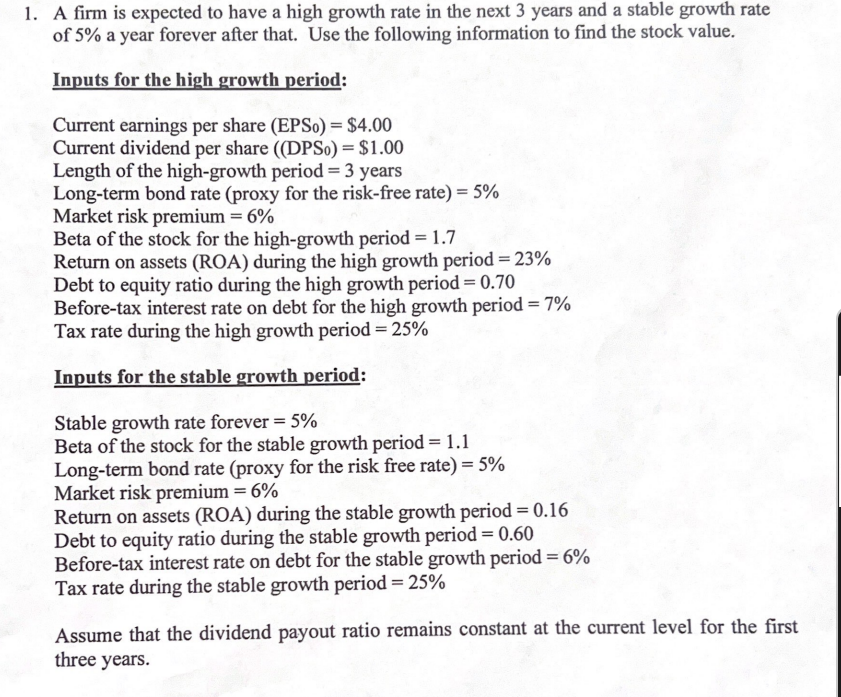

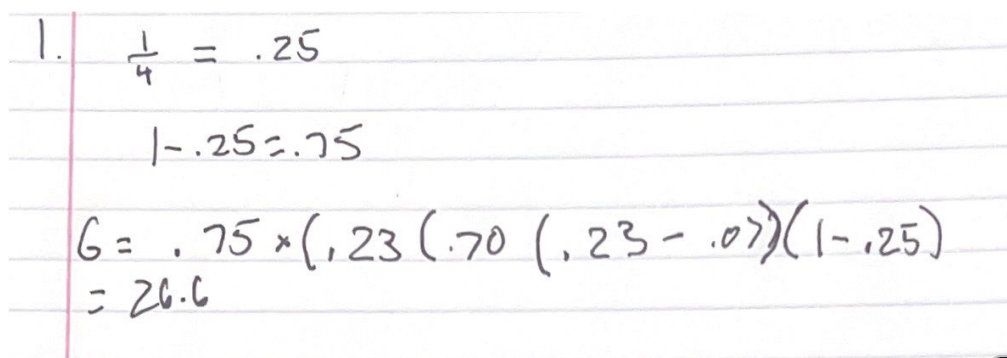

1. A firm is expected to have a high growth rate in the next 3 years and a stable growth rate of 5% a year forever after that. Use the following information to find the stock value. Inputs for the high growth period: Current earnings per share (EPS0)=$4.00 Current dividend per share ((DPS)=$1.00 Length of the high-growth period =3 years Long-term bond rate (proxy for the risk-free rate) =5% Market risk premium =6% Beta of the stock for the high-growth period =1.7 Return on assets (ROA) during the high growth period =23% Debt to equity ratio during the high growth period =0.70 Before-tax interest rate on debt for the high growth period =7% Tax rate during the high growth period =25% Inputs for the stable growth period: Stable growth rate forever =5% Beta of the stock for the stable growth period =1.1 Long-term bond rate (proxy for the risk free rate) =5% Market risk premium =6% Return on assets (ROA) during the stable growth period =0.16 Debt to equity ratio during the stable growth period =0.60 Before-tax interest rate on debt for the stable growth period =6% Tax rate during the stable growth period =25% Assume that the dividend payout ratio remains constant at the current level for the first three years. 1. A firm is expected to have a high growth rate in the next 3 years and a stable growth rate of 5% a year forever after that. Use the following information to find the stock value. Inputs for the high growth period: Current earnings per share (EPS0)=$4.00 Current dividend per share ((DPS)=$1.00 Length of the high-growth period =3 years Long-term bond rate (proxy for the risk-free rate) =5% Market risk premium =6% Beta of the stock for the high-growth period =1.7 Return on assets (ROA) during the high growth period =23% Debt to equity ratio during the high growth period =0.70 Before-tax interest rate on debt for the high growth period =7% Tax rate during the high growth period =25% Inputs for the stable growth period: Stable growth rate forever =5% Beta of the stock for the stable growth period =1.1 Long-term bond rate (proxy for the risk free rate) =5% Market risk premium =6% Return on assets (ROA) during the stable growth period =0.16 Debt to equity ratio during the stable growth period =0.60 Before-tax interest rate on debt for the stable growth period =6% Tax rate during the stable growth period =25% Assume that the dividend payout ratio remains constant at the current level for the first three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts