Question: need help wit part B CALCULATOR STANDARD VIEW Problem 14-01A a-c (Part Level Submission) (Video) On January 1, 2020, Blossom Corporation had the following stockholders'

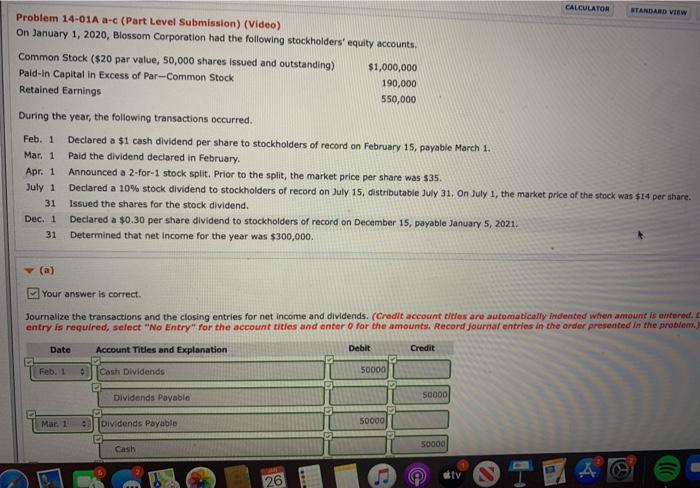

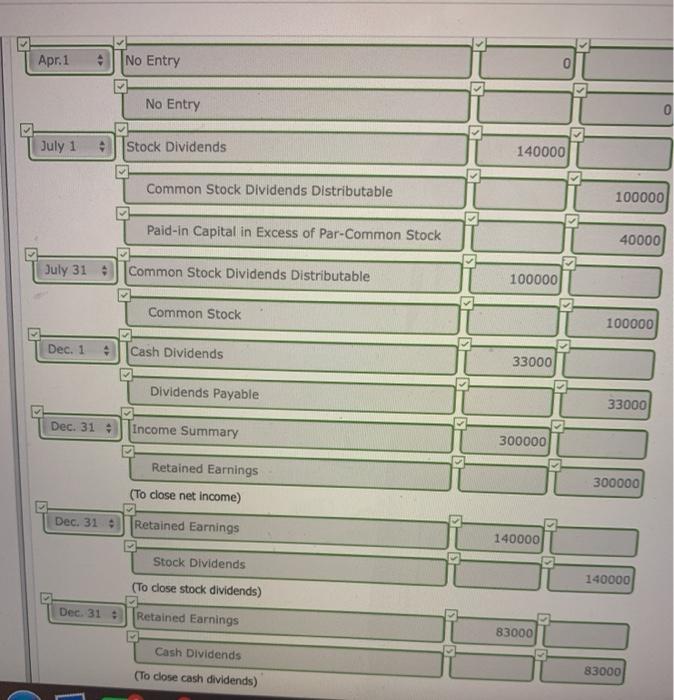

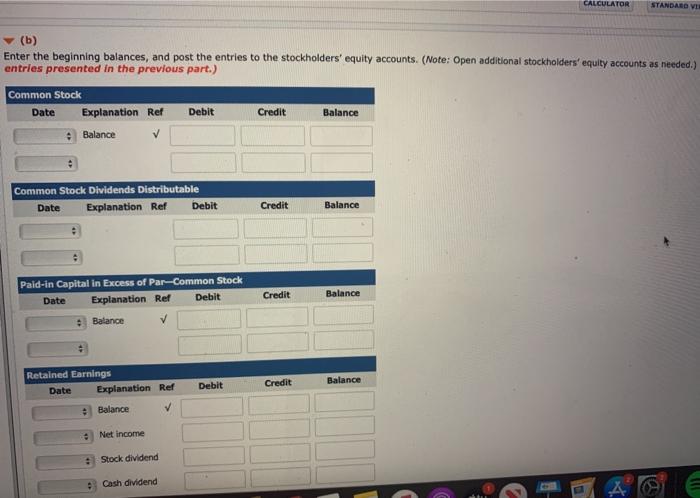

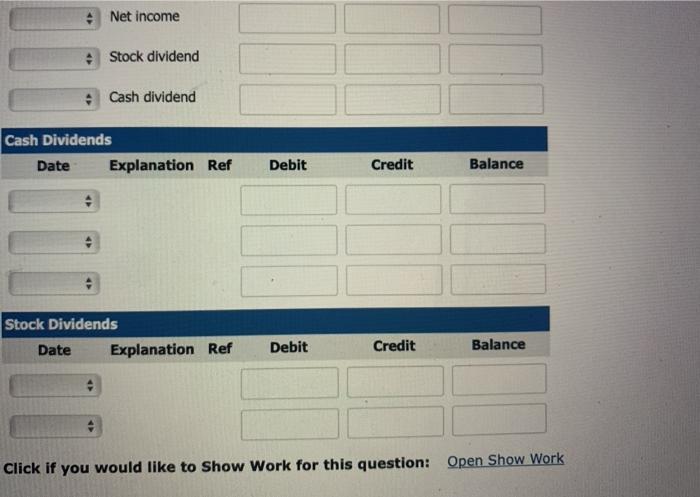

CALCULATOR STANDARD VIEW Problem 14-01A a-c (Part Level Submission) (Video) On January 1, 2020, Blossom Corporation had the following stockholders' equity accounts Common Stock ($20 par value, 50,000 shares issued and outstanding) $1,000,000 Paid-in Capital in Excess of Par--Common Stock 190,000 Retained Earnings 550,000 During the year, the following transactions occurred. Feb. 1 Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. Mar. 1 Paid the dividend declared in February Apr. 1 Announced a 2-for-1 stock split. Prior to the split, the market price per share was $35. July 1 Declared a 10% stock dividend to stockholders of record on July 15, distributable July 31, on July 1, the market price of the stock was $14 per share. Issued the shares for the stock dividend. Declared a $0,30 per share dividend to stockholders of record on December 15, payable January 5, 2021. 31 Determined that net income for the year was $300,000. 31 Dec. 1 (a) Your answer is correct. Journalize the transactions and the closing entries for net income and dividends. (Credit account titles are automatically indented when amount is entered. entry is required, select "No Entry for the account titles and enter o for the amounts. Record Journal entries in the order presented in the problem. Date Account Titles and Explanation Debit Credit Feb. 1 Cash Dividends 50000 50000 Dividends Payable Mar. 1 Dividends Payable 50000 50000 Cash 1 tv 26 Apr. 1 No Entry No Entry 0 July 1 + Stock Dividends 140000 Common Stock Dividends Distributable 100000 Paid-in Capital in Excess of Par-Common Stock 40000 July 31 Common Stock Dividends Distributable 100000 Common Stock 100000 Dec. 1 Cash Dividends 33000 > Dividends Payable 33000 Dec. 31 Income Summary 300000 Retained Earnings 300000 (To close net income) Dec. 31 Retained Earnings 140000 Stock Dividends (To close stock dividends) 140000 Dec. 31 Retained Earnings 83000 Cash Dividends (To close cash dividends) 83000 CALCULATOR STANDARD VII (b) Enter the beginning balances, and post the entries to the stockholders' equity accounts. (Note: Open additional stockholders' equity accounts as needed.) entries presented in the previous part.) Common Stock Date Explanation Ref Debit Credit Balance Balance Common Stock Dividends Distributable Date Explanation Ref Debit Credit Balance Credit Balance Pald-in Capital in Excess of Par-Common Stock Date Explanation Ref Debit Balance Retained Earnings Explanation Ref Debit Credit Balance Date Balance Net income Stock dividend Cash dividend Net income Stock dividend Cash dividend Cash Dividends Date Explanation Ref Debit Credit Balance Stock Dividends Date Explanation Ref Debit Credit Balance Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts