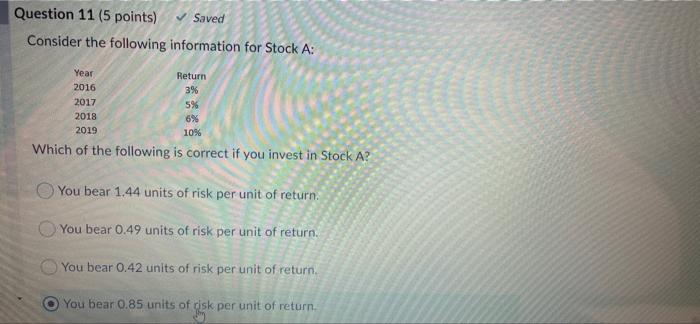

Question: need help with 11 and 12 Saved Question 11 (5 points) Consider the following information for Stock A: Year 2016 2017 2018 2019 Return 3%

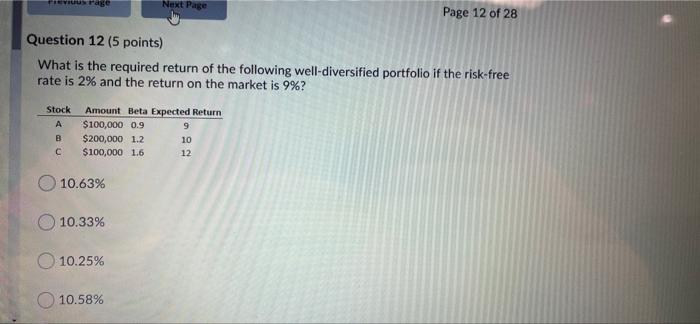

Saved Question 11 (5 points) Consider the following information for Stock A: Year 2016 2017 2018 2019 Return 3% 5% 6% 10% Which of the following is correct if you invest in Stock A? You bear 1.44 units of risk per unit of return. You bear 0.49 units of risk per unit of return. You bear 0.42 units of risk per unit of return You bear 0.85 units of gisk per unit of return Tied Next Page Page 12 of 28 Question 12 (5 points) What is the required return of the following well-diversified portfolio if the risk-free rate is 2% and the return on the market is 9%? Stock B Amount Beta Expected Return $100,000 0.9 9 $200,000 1.2 10 $100,000 1.6 12 10.63% 10.33% 10.25% 10.58%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts