Question: need help with 1,2, and 3 Question 1 (1 point) Assume that the real risk-free rate is 2% and the average annual expected inflation rate

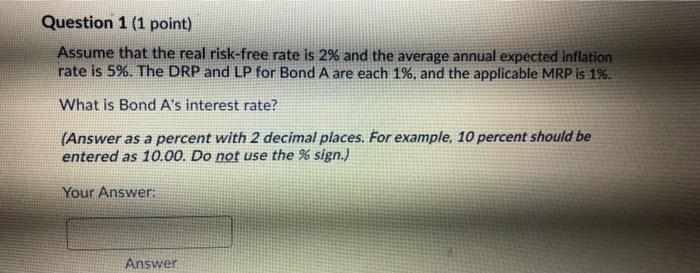

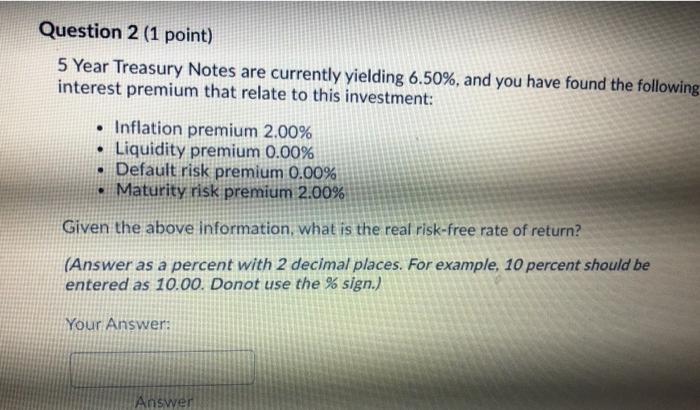

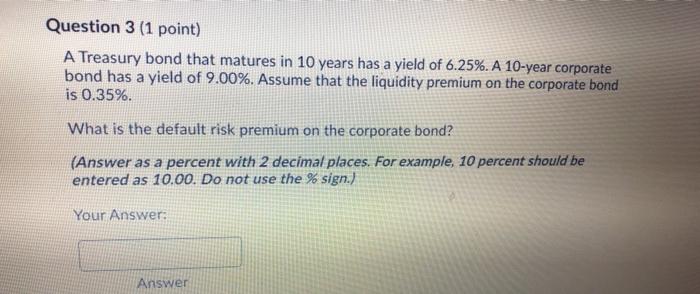

Question 1 (1 point) Assume that the real risk-free rate is 2% and the average annual expected inflation rate is 5%. The DRP and LP for Bond A are each 1%, and the applicable MRP is 1%. What is Bond A's interest rate? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your Answer: Answer Question 2 (1 point) 5 Year Treasury Notes are currently yielding 6.50%, and you have found the following interest premium that relate to this investment: Inflation premium 2.00% Liquidity premium 0.00% Default risk premium 0.00% Maturity risk premium 2.00% . Given the above information, what is the real risk-free rate of return? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Donot use the % sign.) Your Answer: Answer Question 3 (1 point) A Treasury bond that matures in 10 years has a yield of 6.25%. A 10-year corporate bond has a yield of 9.00%. Assume that the liquidity premium on the corporate bond is 0.35%. What is the default risk premium on the corporate bond? (Answer as a percent with 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts