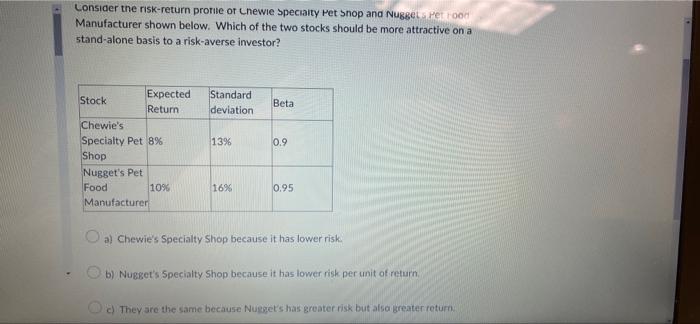

Question: need help with 13 and 15 Consider the risk-return profile of Chewie Specialty Pet Shop and Nugget Petro Manufacturer shown below. Which of the two

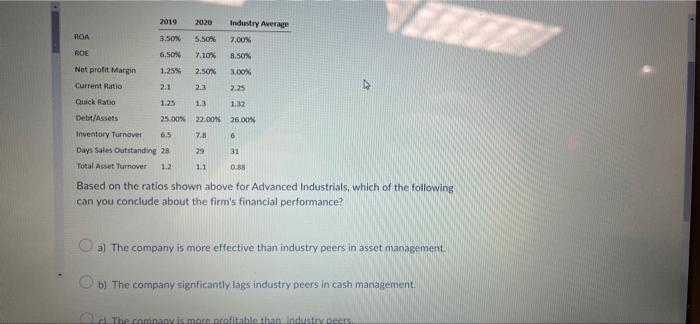

Consider the risk-return profile of Chewie Specialty Pet Shop and Nugget Petro Manufacturer shown below. Which of the two stocks should be more attractive on a stand-alone basis to a risk-averse investor? Standard deviation Beta 13% 0.9 Stock Expected Return Chewie's Specialty Pet 8% Shop Nugget's Pet Food 1096 Manufacturer 16% 0.95 O a) Chewie's Specialty Shop because it has lower risk. b) Nugget's Specialty Shop because it has lower risk per unit of return They are the same because Nugget's has greater risk but also greater return 2019 2020 ROA 5.50N 3.50% 6.50% Industry Average 7.00% 8.50% ROE 7.10 Net profit Margin 1.25% 3.00% 2.50N 2.3 Current Ratio 2.1 2.25 Quick Ratio 1.25 1.3 1.12 12.00 Debt/Assets 25.00% 22.0026,00% Inventory Turnover 65 7.8 6 Days Sales Outstanding 28 29 31 Total Asset Turnover 12 1.1 0.83 Based on the ratios shown above for Advanced Industrials, which of the following can you conclude about the firm's financial performance? O a) The company is more effective than industry peers in asset management. b) The company signficantly lags industry peers in cash management. The company is more profitable than Industry eers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts