Question: Need help with 1-5! Problem 13-18 (Static) Relevant Cost Analysis in a Variety of Situations [LO13-2, LO13-3, LO13-4] Andretti Company has a single product called

![a Variety of Situations [LO13-2, LO13-3, LO13-4] Andretti Company has a single](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671639c424378_827671639c3ae3cd.jpg)

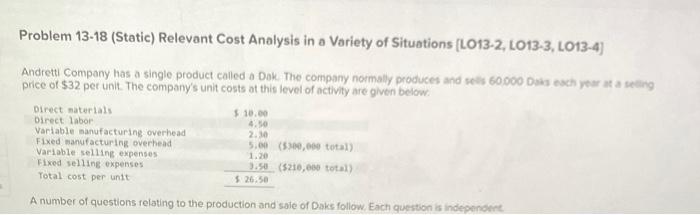

Problem 13-18 (Static) Relevant Cost Analysis in a Variety of Situations [LO13-2, LO13-3, LO13-4] Andretti Company has a single product called a Dak. The company normally produces and scits 600000 Dabs esch year at a seting price of $32 per unit. The company's unit costs at this level of activity are given below. A number of questions relating to the production and saie of Daks follow. Each question is independere. Required: 1.a. Assume that Andretti Company has sufficient capocity to produce 90000 Daks each yetr withost ary increase in fined manufacturing overhead costs. The company could increase its unit sales by 25% above the presert fobob unts esch yeur if it aieve willing to increase the fixed seling expenses by 380,000 . What is the financial sdvartage fdisadvartegef of investing an adasisanat $80.000 in fixed selling expenses? 1-b. Would the additional investment be justified? 2. Assume again that Andrett Company has sufficient capacity to produce 90,000 Doks oach year A custoner in as forey marsef wants to purchase 20.000 Daks. If Andretti accepts this order it would have to pyy import duties on the Daks of 51>0 per unit ard an additional $9.000 for permits and licenses. The only seling costs that would be ascocinted with the order would be 51 as per unt thipping cost. What is the break-even price per unit on this order? figure that is relevant for seting a minimurt selling price? 4. Due to a strike in its suppiler's plant. Andretu Company is unable to purchave more maseral tse the productsen of Duks. The st se is expected to last for two months. Andreti Company has enough matenai an hand to operute at 30/ of normal kwitu for the two-mont period. As an alternative. Andreti could close its plant down entirely for the two money. if the plant were closed theed ehan ofaching overhead costs would continue at 60% of theit normal level during the two-month period and the fired seting expentes wosks be reduced by 20% during the two-month period. a. How much totol contibution margin wis Andretti forgo if it closes the plant for two monthe? b. How much totat fixed cost will the company avold if it closes the plant for fwo monthe? c. What is the financial advantage (disadvantage) of closing the plant for the two-mort period? d. Should Andretti close the plant for two months? accepts this offer, the facilises that it uses to produce Daks would be idle, howevec fired manitacturn. reduced by 75%. Becouse the outside manufacturer would pay for all shipping costa, the varatie seiting expe thirds of their prese manufacturen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts