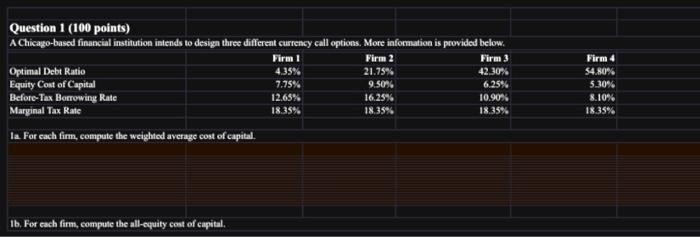

Question: need help with 1b Question 1 (100 points) A Chicago-based financial institution intends to design three different currency call options. More information is provided below.

Question 1 (100 points) A Chicago-based financial institution intends to design three different currency call options. More information is provided below. \begin{tabular}{|l|c|c|c|c|} \hline & Firm 1 & Firm 2 & Firm 3 3 & Firm 4 \\ \hline Optimal Debt Ratio & 4.35% & 21.75% & 42.30% & 54.80% \\ \hline Equity Coat of Capital & 7.75% & 9.50% & 6.25% & 5.0% \\ \hline Before-Tax Berrowing Rate & 12.65% & 16.25% & 10.90% & 10% \\ \hline Marginal Tax Rate & 18.35% & 18.35% & 18.35% & 18.35% \end{tabular} la For cach fim, compute the weighted average cost of capital. Ib. For each firm, compule the all-equity cest of capital, Question 1 (100 points) A Chicago-based financial institution intends to design three different currency call options. More information is provided below. \begin{tabular}{|l|c|c|c|c|} \hline & Firm 1 & Firm 2 & Firm 3 3 & Firm 4 \\ \hline Optimal Debt Ratio & 4.35% & 21.75% & 42.30% & 54.80% \\ \hline Equity Coat of Capital & 7.75% & 9.50% & 6.25% & 5.0% \\ \hline Before-Tax Berrowing Rate & 12.65% & 16.25% & 10.90% & 10% \\ \hline Marginal Tax Rate & 18.35% & 18.35% & 18.35% & 18.35% \end{tabular} la For cach fim, compute the weighted average cost of capital. Ib. For each firm, compule the all-equity cest of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts