Question: need help with 22 and 23 Question 22 (3.5 points) Saved You are considering buying common stock in Grow On, Inc. You have projected that

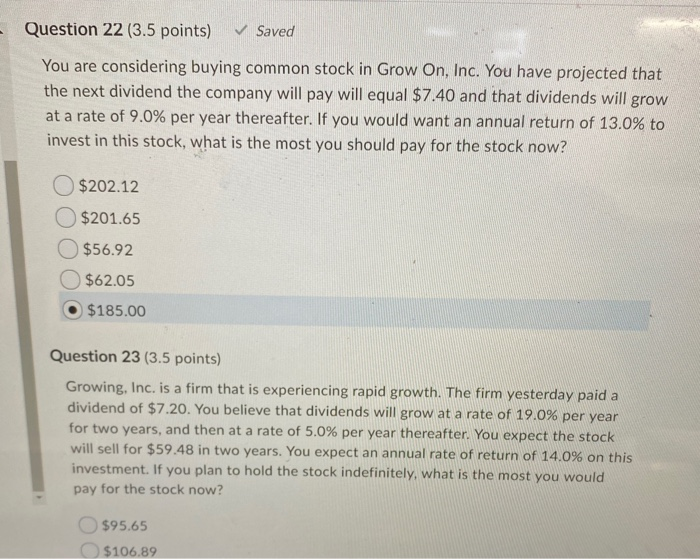

Question 22 (3.5 points) Saved You are considering buying common stock in Grow On, Inc. You have projected that the next dividend the company will pay will equal $7.40 and that dividends will grow at a rate of 9.0% per year thereafter. If you would want an annual return of 13.0% to invest in this stock, what is the most you should pay for the stock now? $202.12 $201.65 $56.92 $62.05 $185.00 Question 23 (3.5 points) Growing, Inc. is a firm that is experiencing rapid growth. The firm yesterday paid a dividend of $7.20. You believe that dividends will grow at a rate of 19.0% per year for two years, and then at a rate of 5.0% per year thereafter. You expect the stock will sell for $59.48 in two years. You expect an annual rate of return of 14.0% on this investment. If you plan to hold the stock indefinitely, what is the most you would pay for the stock now? $95.65 $106.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts