Question: need help with 24 and 25 Question 24 (3.5 points) Costly Corporation plans a new issue of bonds with a par value of $1000, a

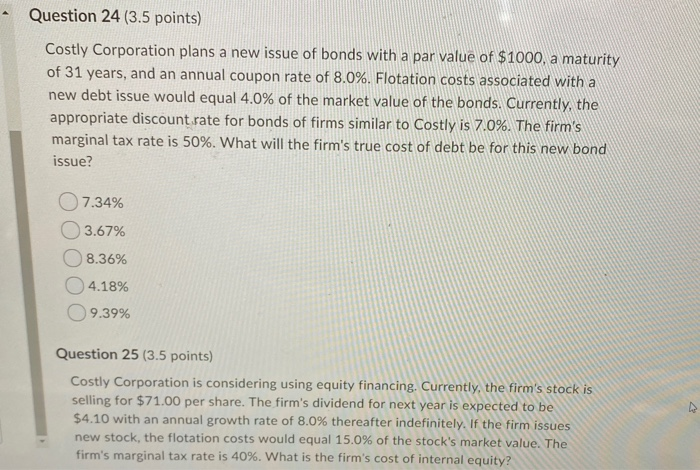

Question 24 (3.5 points) Costly Corporation plans a new issue of bonds with a par value of $1000, a maturity of 31 years, and an annual coupon rate of 8.0%. Flotation costs associated with a new debt issue would equal 4.0% of the market value of the bonds. Currently, the appropriate discount.rate for bonds of firms similar to Costly is 7.0%. The firm's marginal tax rate is 50%. What will the firm's true cost of debt be for this new bond issue? O7.34% O 3.67% 8.36% 4.18% O.39% Question 25 (3.5 points) Costly Corporation is considering using equity financing. Currently, the firm's stock is selling for $71.00 per share. The firm's dividend for next year is expected to be $4.10 with an annual growth rate of 8.0% thereafter indefinitely. If the firm issues new stock, the flotation costs would equal 15.0% of the stock's market value, The firm's marginal tax rate is 40%. What is the firm's cost of internal equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts