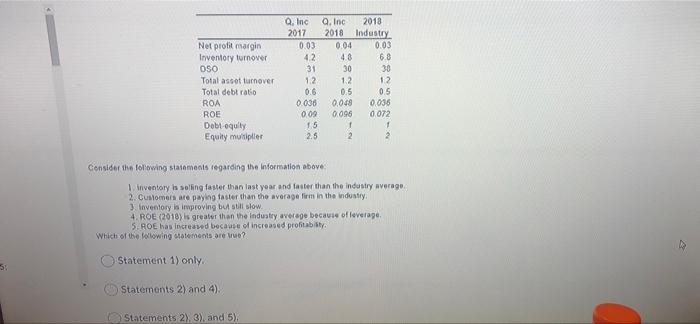

Question: need help with 3 and 4 Net profit margin Inventory turnover OSO Total asset turnover Total debt ratio ROA ROE Dobloquity Equity multiplier Q. Inc

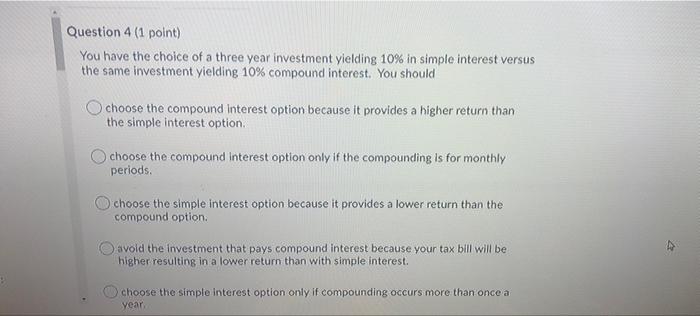

Net profit margin Inventory turnover OSO Total asset turnover Total debt ratio ROA ROE Dobloquity Equity multiplier Q. Inc 2017 0.03 42 31 1.2 0.6 0.036 0.09 1.5 2.5 a. Inc 2018 2018 Industry 0.04 0.03 48 6.8 30 30 1.2 12 0.5 0.5 0.048 0.036 0.096 0.072 1 1 2 2 Consider the following statements regarding the information above Inventory has selling faster than last year and faster than the industry average 2. Customers are paying faster than the average firm in the industry 3. Inventory is irwproving but still slow. 4. ROE (2018) is greater than the Industry average because of leverage 5. ROE has increased because of increased profitability Which of the following sements are ? Statement 1) only 5: Statements 2) and 4). Statements 2), 3), and 5), Question 4 (1 point) You have the choice of a three year investment yielding 10% in simple interest versus the same investment yielding 10% compound interest. You should choose the compound interest option because it provides a higher return than the simple interest option choose the compound Interest option only if the compounding is for monthly periods choose the simple interest option because it provides a lower return than the compound option avoid the investment that pays compound interest because your tax bill will be higher resulting in a lower return than with simple interest. choose the simple interest option only if compounding occurs more than once a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts