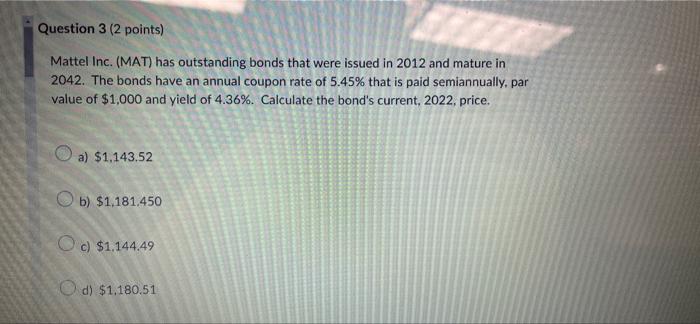

Question: need help with 3 and 5 Question 3 (2 points) Mattel Inc. (MAT) has outstanding bonds that were issued in 2012 and mature in 2042.

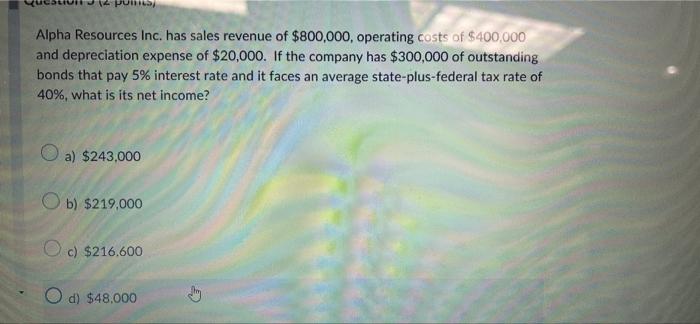

Question 3 (2 points) Mattel Inc. (MAT) has outstanding bonds that were issued in 2012 and mature in 2042. The bonds have an annual coupon rate of 5.45% that is paid semiannually, par value of $1,000 and yield of 4.36%. Calculate the bond's current, 2022, price, a) $1,143.52 Ob) $1,181,450 O c) $1,144.49 d) $1,180.51 Alpha Resources Inc. has sales revenue of $800,000, operating costs of $400,000 and depreciation expense of $20,000. If the company has $300,000 of outstanding bonds that pay 5% interest rate and it faces an average state-plus-federal tax rate of 40%, what is its net income? a) $243,000 Ob) $219.000 Oc) $216.600 O d) $48.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts